Telegram Meme Coin DOGS Leaves 99% Holders Underwater

- On-chain data shows that only 1% of DOGS addresses are holding the Telegram meme coin in profits.

- The volume has also decreased significantly, with several supply walls suggesting another decline.

- DOGS price is likely to drop to $0.00061 as volatility around the token continues to hit low levels.

The hype around the Telegram-linked meme coin DOGS has taken a sharp turn, as nearly 99% of its holders are now in losses just about 60 days after its listing.

Once a token of high expectations, DOGS has been hit by relentless selling pressure, leaving early investors deep underwater. With mounting concerns over its future, the meme coin now faces a crucial test. Can it recover, or is it heading towards further decline?

Interest in Telegram’s Flagship Meme Coin Plunges

DOGS, which launched on August 26 with the distribution of approximately 40 billion tokens to around 17 million Telegram users, had an initial price of $0.0017. However, since then, the meme coin has plummeted by 56%.

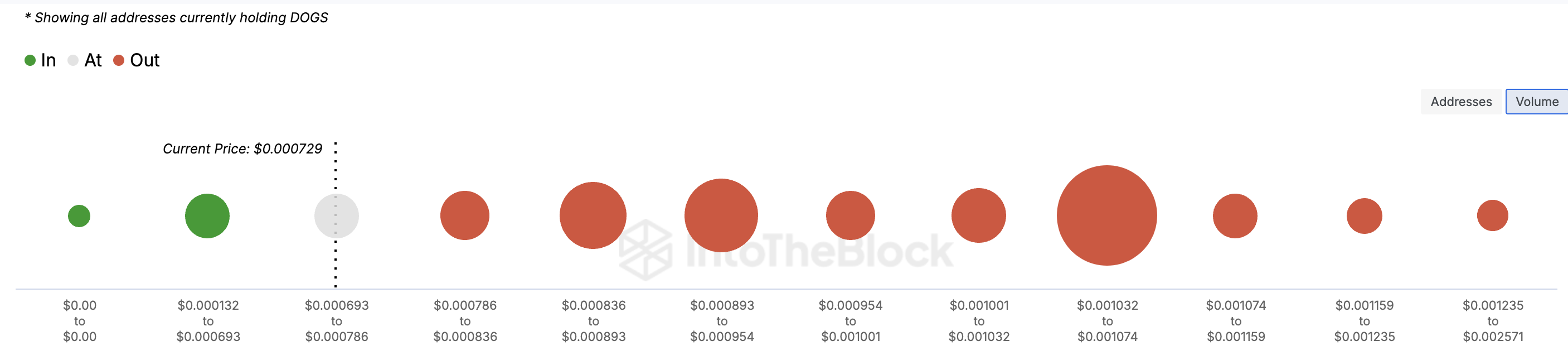

According to the Global In/Out of Money (GIOM) indicator, nearly 99% of DOGS holders are at a loss, with billions of addresses that purchased DOGS between $0.00079 and $0.0013 currently holding the token at a loss.

Apart from highlighting the on-chain cost basis, the GIOM also reveals whether a token is facing resistance or support. A large cluster of addresses or tokens within a price range signals significant support or resistance. Presently, the large number of DOGS holders out of the money indicates that the price may struggle to rise and could potentially fall again.

Read more: What Are Telegram Bot Coins?

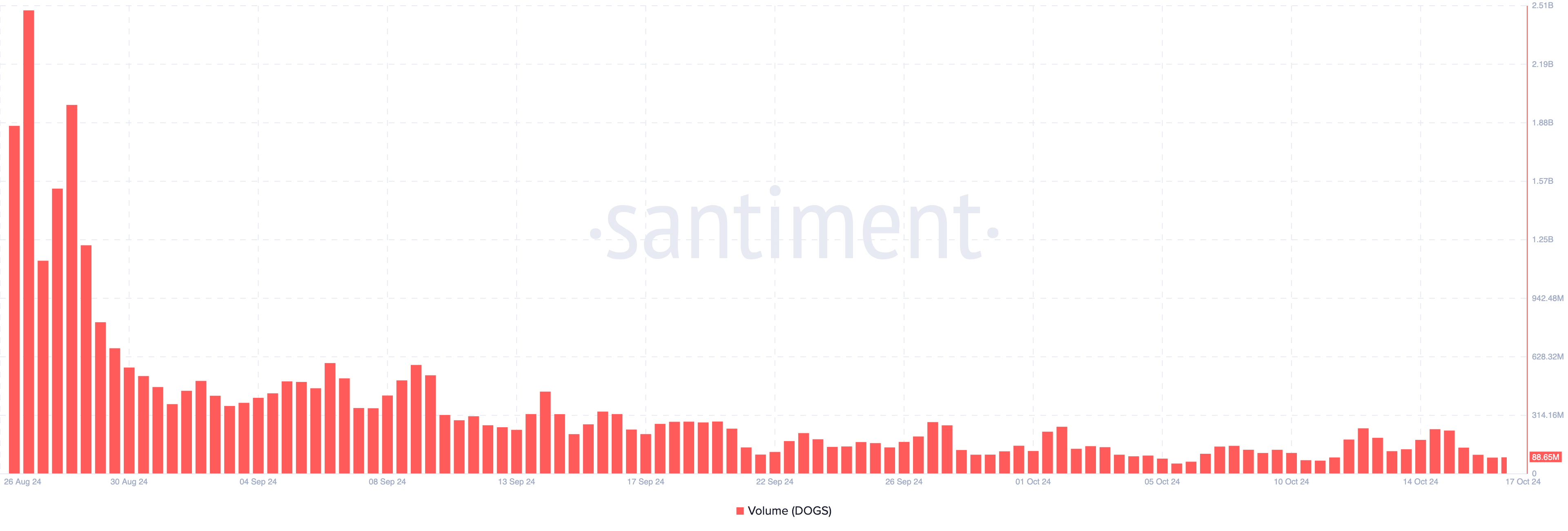

Another reason DOGS’ price could fall again is its volume. Around the time the meme coin launched, the volume was over $2 billion, indicating that the market was highly interested in it.

As of this writing, the token’s trading volume has dropped to $88.65 million, a significant decline from earlier levels. This drop in volume suggests reduced buying and selling activity, which may make it difficult for the meme coin to rebound from its current lows.

With lower market activity, price recovery could be a challenge as fewer traders are interacting with the token.

DOGS Price Prediction: Lower Lows

Based on the daily chart, the Bollinger Bands (BB) around DOGS have contracted. This suggests that volatility is currently low, and the price may remain range-bound without experiencing significant price swings.

When the bands expand, it typically indicates high volatility and the potential for more dramatic price movements. However, with the BB contracting, it seems the market is expecting stability or muted price action in the short term for DOGS.

Read more: Top 7 Telegram Tap-to-Earn Games to Play in 2024

Considering DOGS’ current movement, the meme coin’s price is likely to drop below $0.00061. However, if investors step in and buy the dip in large volumes, the trend could reverse. In that scenario, the meme coin’s value might rise to $0.00081 or potentially even as high as $0.0010.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10