The China IPO market has collapsed

ronniechua

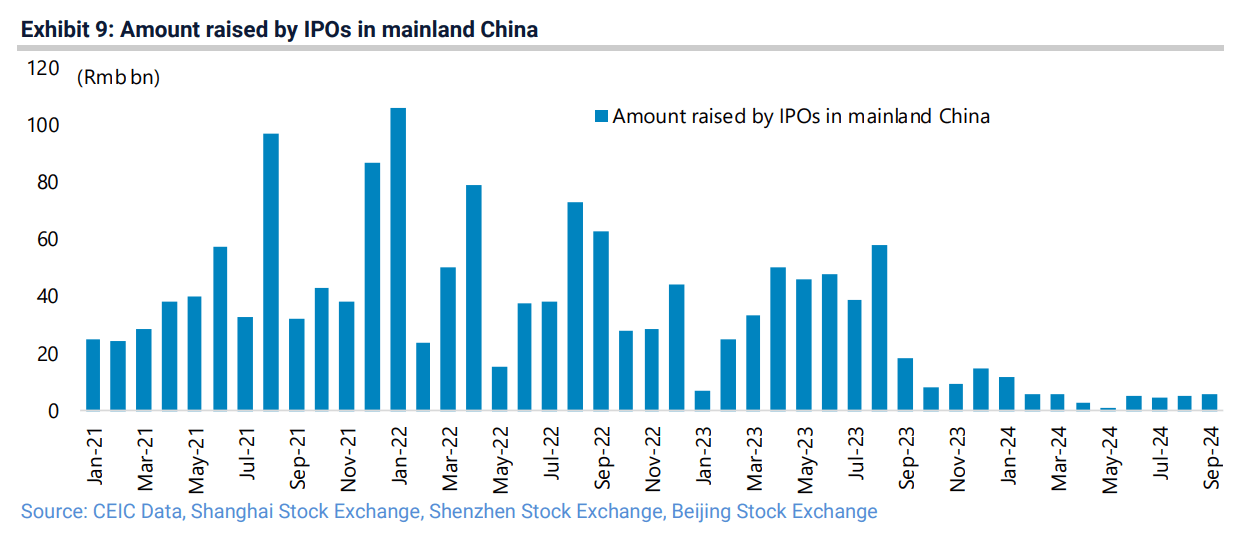

IPOs raised in mainland China have collapsed by 85% year-over-year to CNY 48B in the first nine months of the year.

Christopher Wood, global head of Equity Strategy at Jefferies, said in a note that the ongoing collapse in IPO activity in China is causing "a dramatic change in the supply and demand dynamics for Chinese equities."

IPO activity in China plummeted due to the prolonged regulatory scrutiny for the country’s economic policy.

Funds raised via the Shanghai Stock Exchange (SHCOMP) and the Shenzhen Stock Exchange fell to $4B from January through June, down from $29.8B in the same period in 2023, according to S&P Global Market Intelligence data.

Results for the 2024 first half were less than the second half of last year, which raised $15.89B – the lowest half-year result since the first six months of 2020, when $20B were raised, S&P Global Market Intelligence data showed.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10