With EPS Growth And More, Boltek Holdings (HKG:8601) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Boltek Holdings (HKG:8601). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Boltek Holdings with the means to add long-term value to shareholders.

View our latest analysis for Boltek Holdings

Boltek Holdings' Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Boltek Holdings' EPS skyrocketed from HK$0.023 to HK$0.034, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 46%.

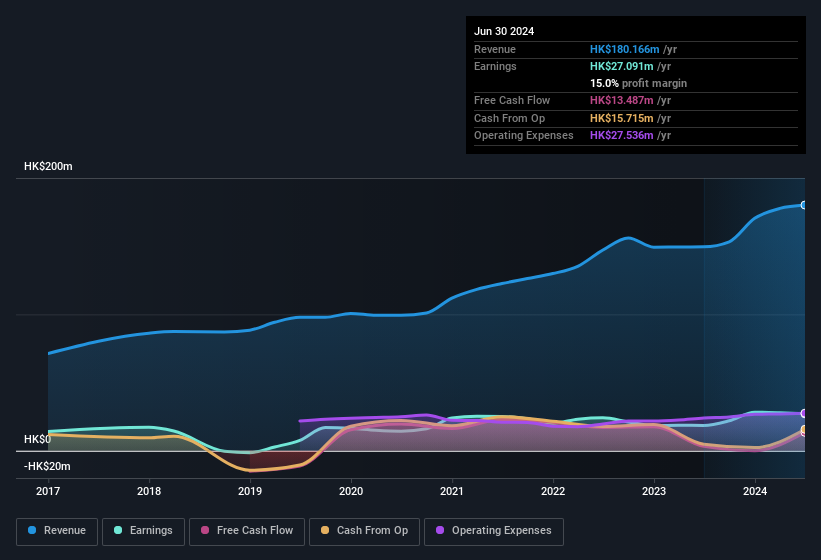

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Boltek Holdings shareholders is that EBIT margins have grown from 8.8% to 16% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Boltek Holdings is no giant, with a market capitalisation of HK$276m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Boltek Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for Boltek Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. In one fell swoop, Executive Director Pak Hung Ng, spent HK$2.4m, at a price of HK$0.28 per share. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Boltek Holdings insiders own more than a third of the company. To be exact, company insiders hold 78% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at HK$215m at the current share price. That's nothing to sneeze at!

Should You Add Boltek Holdings To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Boltek Holdings' strong EPS growth. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. So it's fair to say that this stock may well deserve a spot on your watchlist. We should say that we've discovered 2 warning signs for Boltek Holdings (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

The good news is that Boltek Holdings is not the only stock with insider buying. Here's a list of small cap, undervalued companies in HK with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Boltek Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10