I'd invest $10,000 in these ASX dividend shares to keep growing my wealth as rates fall

Do you know that Mariah Carey meme? The one where the web searches for 'All I want for Christmas' begin to tick up, foreshadowing the approaching bombardment of the festive mainstay. Well, the inverse of that might be about to play out in interest rates, and I think ASX dividend shares are the antidote.

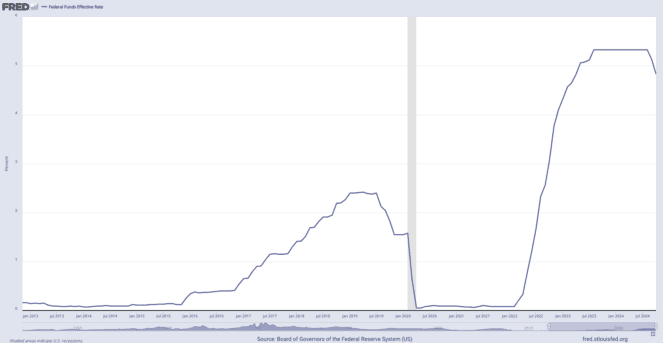

As the United States Federal funds rate above shows, the US Fed is chipping away at the country's benchmark rate as inflation subsides. Last week, the targeted overnight borrowing rate in the US was lowered another 25 basis points to a range of 4.50% to 4.75%.

Australia is a bit of a different beast. Our local cash rate is yet to budge from its recent high of 4.35%, and the Reserve Bank of Australia governor Michele Bullock is showing no indication of a need to hastily cut.

However, with our local inflation rate now in the target band of 2.0% to 3.0% — hitting 2.8% in the September quarter — the impetus for lowering rates soon is building.

Avoiding wealth derailment with ASX dividend shares

Low interest rates can be a blight on aspirational savers.

I know first-hand the drudgery of diligently stowing away cash while trying to save for a house. Savings accounts or term deposits growing at 3.5% or less is painfully slow. If a knife is taken to the cash rate, many hopeful homeowners will be relegated to a pace that makes their goals almost unobtainable.

To keep my wealth on track for a house deposit, I'd take $10,000 of my savings out of cash and deploy it into three ASX dividend shares. But not just any three dividend-paying companies; I'd want durable businesses offering a dividend yield of around 5% or greater.

With these conditions in mind, I filtered through hundreds of companies to arrive at my top three. Here's which ASX dividend shares I've selected, what they're trailing yield is, and how much I would invest in each:

- ANZ Group Holdings Ltd (ASX: ANZ) — 5.1% yield — $3,000 invested

- APA Group (ASX: APA) — 8.4% yield — $3,500 invested

- Super Retail Group Ltd (ASX: SUL) — 8% inc. special dividend, 4.7% without — $3,500 invested

Even without Super Retail Group's special dividend, these three ASX dividend shares would achieve a combined 6.1% yield on $10,000 invested, assuming the trailing yield is indicative of future years (which isn't guaranteed).

Remember that the capital invested in shares can also increase in value. On the other hand, savings accounts and term deposits rely solely on the interest earned.

Time matters

Now, there is an important downside to investing in the pursuit of saving for something.

Volatility.

The market ebbs and flows, up and down. Occasionally, it hits like a tsunami. If Murphy's Law is anything to go by, those sudden slumps will arrive at the most inconvenient times.

It's important to know that ASX dividend shares may not be the best option if there is an upcoming deadline when the money will be needed. In those scenarios, it can be worth sacrificing the theoretical higher return for greater security.

However, if I were just beginning my home-saving journey and expecting to purchase sometime in the next five to ten years, I would be comfortable turning to a few ASX dividend shares to expedite the process.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10