European investors rotated out of investment grade (IG) credit ETFs and into high yield during October in what has been described as a “risk-on” move.

As the below chart shows, investors pulled $1.9bn from IG bond ETFs during the month, while pouring $2.1bn into high yield funds.

Chart 1: Fixed income ETF flows by category, October 2024

Source: Vanguard, ETFbook

The bulk of the flows came in the European credit space, with European high yield ETFs attracting net inflows of €1.6bn over the month, according to Refinitiv Lipper data.

The data provider found that European IG ETFs suffered net outflows of €1.2bn in October, while US IG ETFs lost €300m.

The rotation into high yield can be viewed as a “risk-on” move by European investors, according to Detlef Glow, head of EMEA research at Refinitiv Lipper.

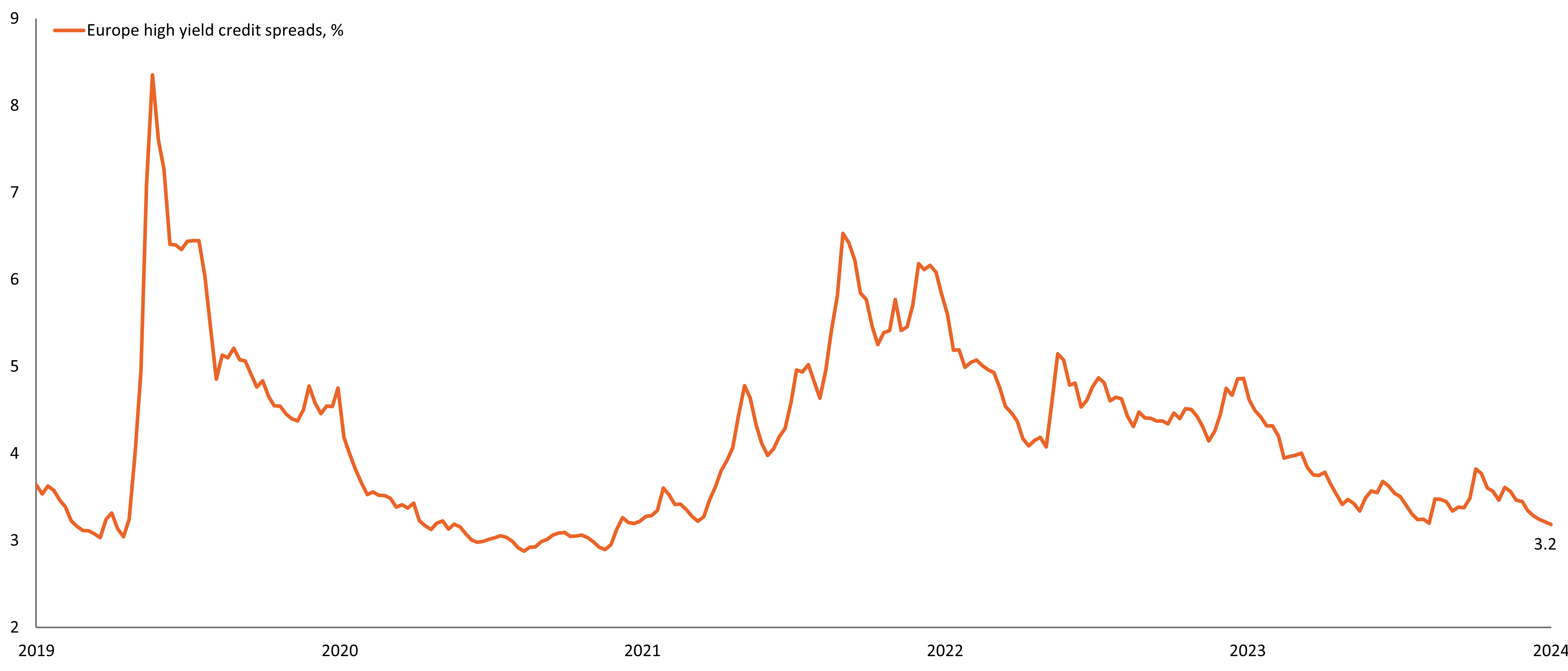

European high yield credit spreads have now fallen to their lowest level since 2021, indicating that investors are increasingly sanguine about the prospects of the European economy.

Chart 2: European high yield credit spreads, 2019 to present

Source: FRED database, ICE BofA Euro High Yield Index Option-Adjusted Spread

Indeed, the Eurozone economy grew 0.4% in the third quarter, outpacing economists’ expectations of a 0.2% expansion.

Germany, in particular, has proved more resilient than anticipated. After a 0.3% contraction in Q2, economists had tipped the country to enter a recession but third quarter growth of 0.2% allayed those fears.