Solana Open Interest Nears $5 Billion, but Price ATH Remains Elusive

- Solana nears $245 resistance, with Futures Open Interest at $4.7 billion signaling strong trader confidence despite overbought RSI.

- Technical challenges emerge, as RSI suggests overbought conditions, risking a pullback to $221 if SOL fails to breach resistance.

- Flipping $245 into support could drive Solana to a new all-time high above $260, reinforcing its bullish trajectory.

Solana’s price rally has brought it close to forming a new all-time high, stirring optimism among traders and investors. The altcoin’s upward momentum reflects heightened market activity, but challenges remain as Solana struggles to breach critical resistance levels.

Despite these hurdles, SOL enthusiasts remain bullish about the asset’s long-term potential.

Solana Is Struggling

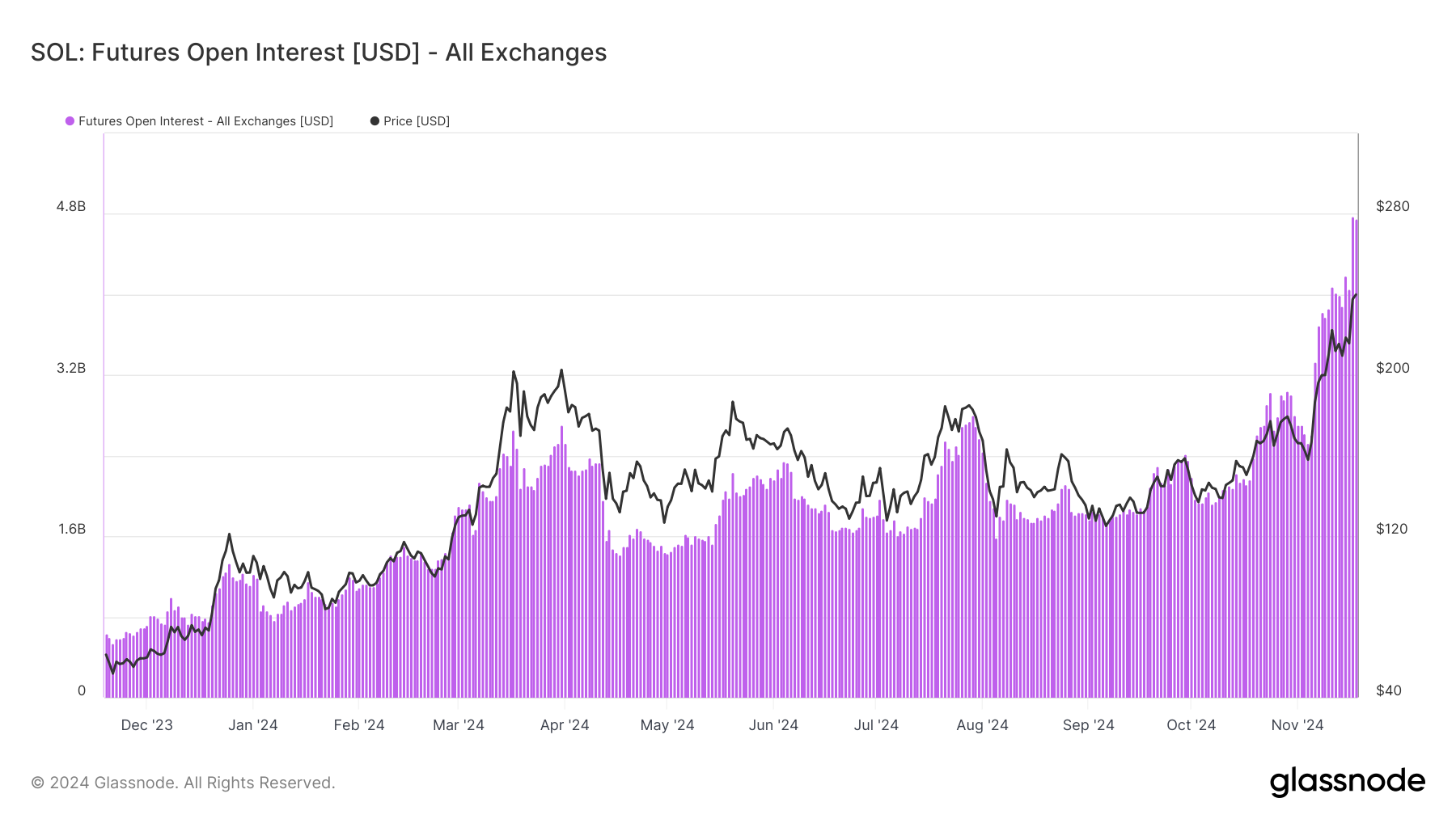

Solana traders exhibit strong optimism, with the asset’s Futures Open Interest (OI) reaching a record $4.7 billion. This surge highlights increasing confidence among traders as they pour significant capital into SOL amid its ongoing rally. With OI nearing $5 billion, Solana is experiencing a notable rise in market participation, reflecting heightened anticipation for further gains.

However, this growing OI highlights a divergence between expectations and current price movement. While traders are heavily investing, Solana’s price has yet to break past critical resistance levels. This contrast between open interest and price action raises questions about whether the bullish momentum can sustain itself or lead to a correction.

From a technical perspective, Solana’s Relative Strength Index (RSI) indicates overbought conditions, sitting well above the neutral range. Historically, such RSI levels have triggered price corrections, suggesting SOL may face short-term headwinds. A dip in price could materialize as traders adjust positions and secure profits, pulling the asset away from its all-time high ambitions.

Despite this, Solana’s macro momentum remains strong, driven by broader market cues and increased adoption. These factors contribute to the asset’s resilience, but the overbought conditions warrant caution. Investors will need to monitor whether Solana can maintain its upward trajectory or succumb to market pressures.

SOL Price Prediction: Continuing the Rise

Solana’s price is trading just below the $245 resistance level, which serves as the final barrier to a new ATH beyond $260. Breaching this critical level would confirm the continuation of SOL’s rally, allowing the asset to set new milestones.

However, mixed signals from market sentiment and technical indicators suggest potential difficulties in overcoming $245. A failure to break through could send Solana down to $221 or lower, testing investor confidence.

But if the broader market cues remain positive and $245 is flipped into support, Solana would have a chance at forming a new ATH beyond $260, invalidating the bearish thesis

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10