Fading Altcoin Dominance Threatens XRP Price as DEX Volume Shrinks By $58 Million

- XRP's dominance falters as the Altcoin Season Index drops to 47 from 78, reflecting a shift to neutral sentiment.

- XRP DEX volume plummeted by $58M to $2.66M, signaling declining demand and potential continued price pressure.

- A death cross on the 4-hour chart points to a decline toward $1.75. Bullish sentiment could reverse the trend to $2.90.

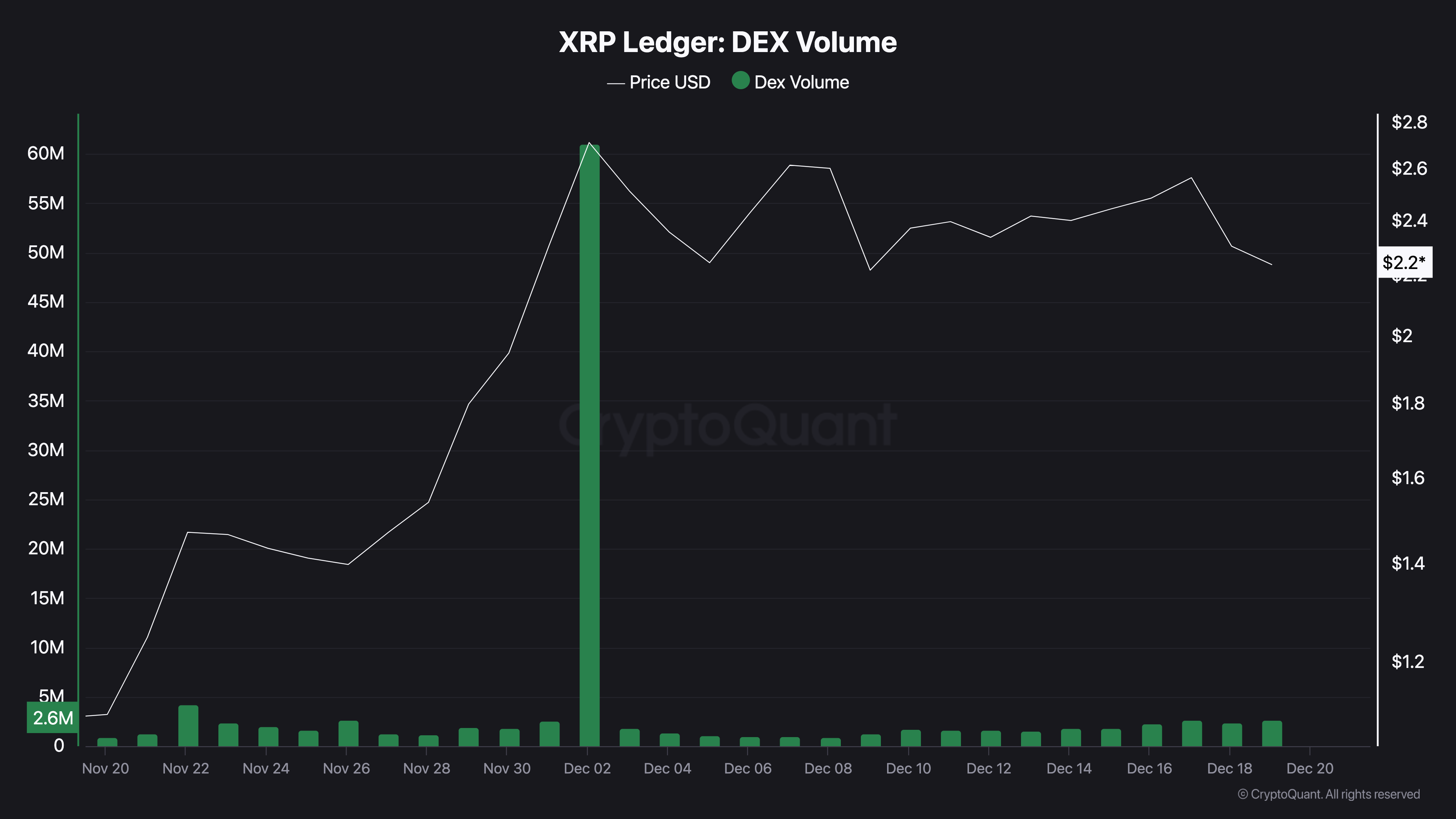

On December 2, XRP’s price climbed to a six-year high of $2.72, making it one of the altcoins that have outperformed Bitcoin (BTC) this quarter. This development also happened around the same time the XRP DEX volume jumped to $61 million, with speculation that the token could lead altcoin season.

While it attempted to hold the gains at some point, the last 24 hours have changed things, with the XRP price now trading at $2.21. Here is why the altcoin could find it challenging to reach a new high before 2024 closes.

DEX Trades on the Ledger Slide Amid Altcoin Season Pullback

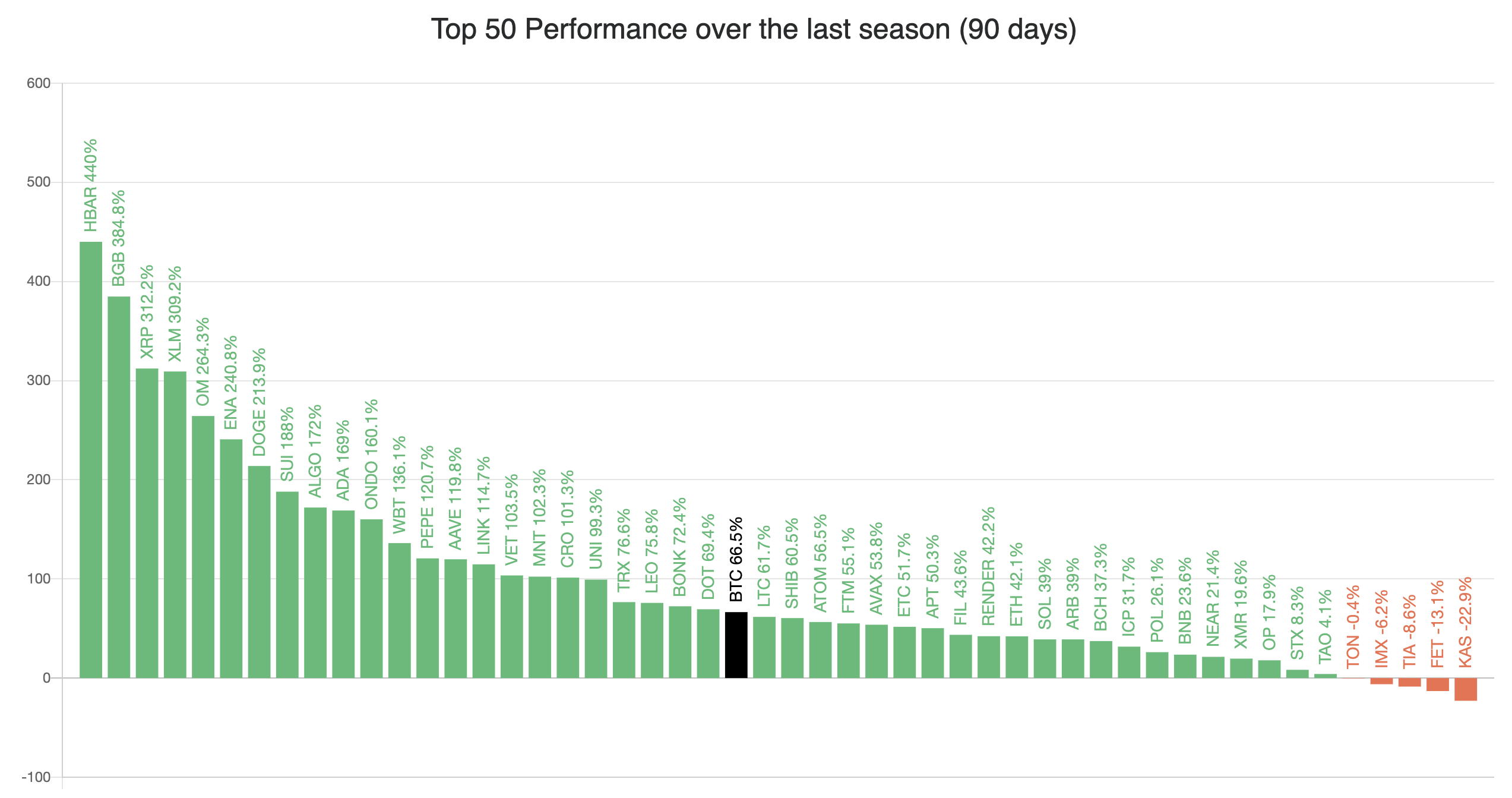

Over the past 90 days, XRP’s price surged by 282%, indicating a remarkable performance among altcoins. However, the token’s current momentum has faltered, with a 6.09% decline recorded in the last 24 hours.

The Altcoin Season Index, which confirms an altcoin season if 75% of the top 50 non-BTC coins outperform Bitcoin, highlighted XRP as one of the leading contributors alongside Hedera (HBAR) and Bitget Token (BGB) during this period. As a result, the index recently peaked at 78, suggesting an undeniable altcoin season.

However, with the recent price declines across multiple altcoins, including XRP, the Altcoin Season Index has fallen to 47, reflecting a shift toward neutral sentiment. Should this momentum continue to fade, then XRP price risks falling below $2.

The XRP DEX volume is another indicator that supports this extended decline. The DEX volume measures the value of the cryptocurrency traded on the XRP Ledger (XRPL) over a period of time.

For those unfamiliar, the XRPL is the project’s decentralized public blockchain used to facilitate the trading of XRP and quick settlements of different currencies. When the DEX volume rises, it suggests increasing demand for the token. On the flip side, a dwindling DEX volume indicates otherwise.

As mentioned above, the XRP DEX volume climbed to $61.01 million on December 2. Today, it is down to $2.66 million, indicating that the value of the token traded dropped by approximately $58 million. If sustained, XRP price might face sustained downward pressure.

XRP Price Prediction: No All-Time High in Sight

On the 4-hour XRP/USD chart, the altcoin has faced a death cross. A death cross occurs when the longer Exponential Moving Average (EMA) slides below the shorter one and is a bearish sign.

The opposite is called a golden cross which involves a crossover of the longer EMA above the shorter one. As seen below, the 50 EMA (yellow) has risen above the 20 EMA (blue) as the price has also dropped below these indicators.

Should this trend continue, XRP’s value could decline to $1.75. However, if sentiment turns bullish and the EMAs form a golden cross, the trend might reverse. If that happens, the XRP price might rally to $2.90.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10