Pudgy Penguins (PENGU) Price Targets New Highs After 30% Surge

- Pudgy Penguins (PENGU) price surges 30% in 24 hours, driven by bullish momentum and strong investor confidence.

- RSI at 64.4 and CMF at 0.18 hit all-time highs, reflecting strong buying pressure and market enthusiasm.

- Key levels at $0.039 and $0.045 signal potential upside, while $0.030 acts as critical support in case of correction.

Pudgy Penguins (PENGU) price has surged approximately 30% in the last 24 hours, rebounding sharply after reaching its lowest level on December 20.

This dramatic recovery has been accompanied by bullish momentum, as key indicators like RSI and CMF hit all-time highs, reflecting strong buying pressure and renewed investor confidence.

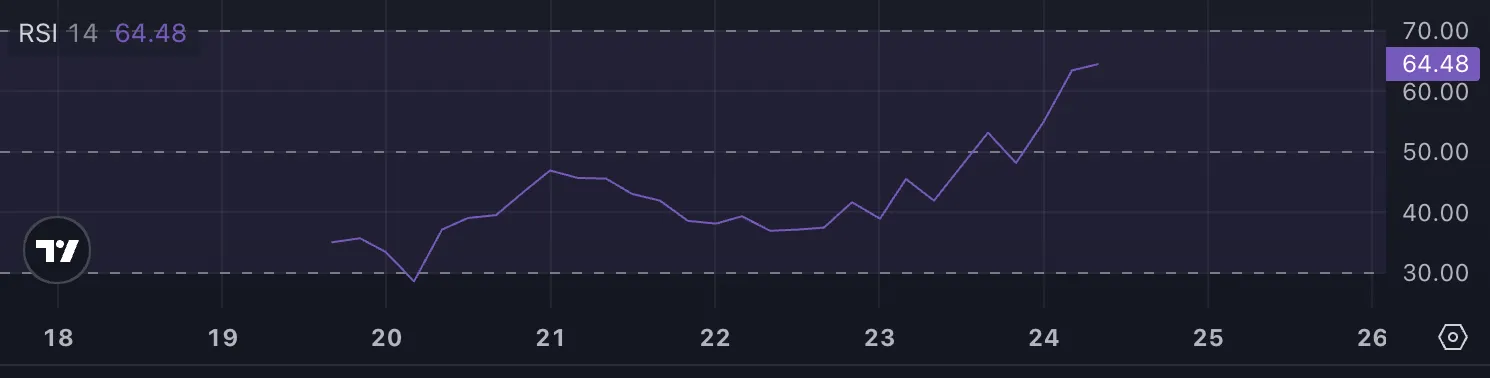

PENGU RSI Is At an All-Time High

PENGU Relative Strength Index (RSI) currently stands at 64.4, the highest value since its launch. This elevated RSI indicates strong buying momentum, suggesting that the token has been experiencing significant upward pressure.

While it is not yet in overbought territory, which is typically considered an RSI above 70, this level reflects increasing market enthusiasm and potential bullish sentiment.

RSI, a popular momentum indicator, measures the speed and magnitude of price movements on a scale from 0 to 100. Values above 70 suggest an overbought condition that could lead to a price correction, while values below 30 indicate an oversold condition, often preceding a rebound.

With PENGU RSI at 64.4, it is nearing the overbought zone, signaling that its price may continue climbing in the short term if buying momentum persists. This would make PENGU one of the best-performing altcoins in the last few days.

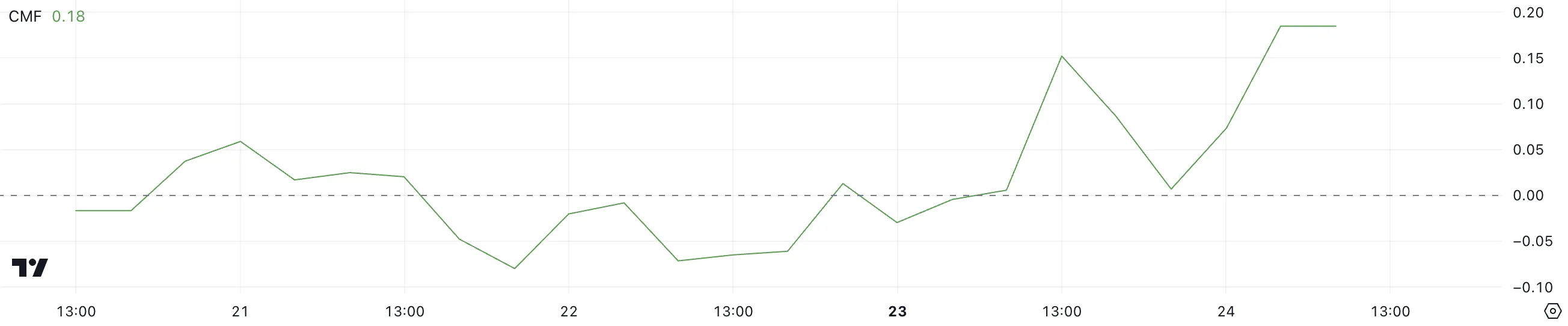

PENGU CMF Has Jumped In The Last Day

PENGU’s Chaikin Money Flow (CMF) is currently at 0.18, a significant increase from 0.01 just a day ago, marking its highest level since the token’s launch. This sharp rise indicates a substantial inflow of capital, reflecting strong buying pressure and growing investor confidence in the altcoin.

A CMF at this level suggests that buyers are dominating the market, which could support continued price increases in the short term.

CMF is a volume-weighted indicator that measures the accumulation or distribution of an asset over a given period, ranging between -1 and +1. Positive values indicate accumulation and buying pressure, while negative values suggest distribution and selling pressure.

With PENGU’s CMF at 0.18, the current market sentiment is decisively bullish, implying that the token could maintain upward momentum if the inflows persist. However, such elevated levels could also lead to a period of consolidation as traders lock in profits, making it crucial to monitor whether the buying trend sustains or begins to wane.

PENGU Price Prediction: Can PENGU Reach $0.045 In December?

If the uptrend persists, PENGU could approach a new all-time high of around $0.039.

Breaking through this resistance could pave the way for further gains, with potential targets at $0.040 and $0.045, representing an approximate 20% upside.

However, if the RSI enters the overbought zone, signaling excessive buying pressure, a price correction could follow. In such a case, PENGU price might test $0.030 as its first key level.

If this support fails, PENGU price could decline further to $0.0229, marking a strong correction.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10