3 Promising Penny Stocks With Market Caps Larger Than US$60M

As the year draws to a close, global markets have experienced mixed signals, with U.S. consumer confidence dropping while major stock indexes saw moderate gains during a holiday-shortened week. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated moniker—continue to present intriguing opportunities. By focusing on those with robust financial foundations and potential for growth, investors can uncover value in these lesser-known equities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.055 | £774.25M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$44.38B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.65M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.39M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,837 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CM Energy Tech (SEHK:206)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CM Energy Tech Co., Ltd. is an investment holding company involved in the design, manufacture, installation, and commissioning of land and offshore rigs globally, with a market cap of HK$518.95 million.

Operations: The company's revenue is primarily derived from equipment manufacturing and packages at $121.13 million, followed by assets management and engineering services at $58.19 million, and supply chain and integration services at $31.45 million.

Market Cap: HK$518.95M

CM Energy Tech Co., Ltd. presents a mixed picture for investors interested in penny stocks. The company has demonstrated significant earnings growth over the past five years, becoming profitable with an average annual increase of 34.7%. Despite this, it faced negative earnings growth last year and maintains a low Return on Equity at 5.4%. Being debt-free is a positive aspect, providing financial stability, while its Price-To-Earnings ratio of 9.3x suggests it may be undervalued compared to the Hong Kong market average of 10x. The management team is experienced; however, recent volatility in share price could concern potential investors.

- Unlock comprehensive insights into our analysis of CM Energy Tech stock in this financial health report.

- Gain insights into CM Energy Tech's past trends and performance with our report on the company's historical track record.

Honbridge Holdings (SEHK:8137)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Honbridge Holdings Limited is an investment holding company involved in the research, development, production, and sale of lithium batteries across China, Hong Kong, Brazil, France, and internationally with a market cap of HK$5.55 billion.

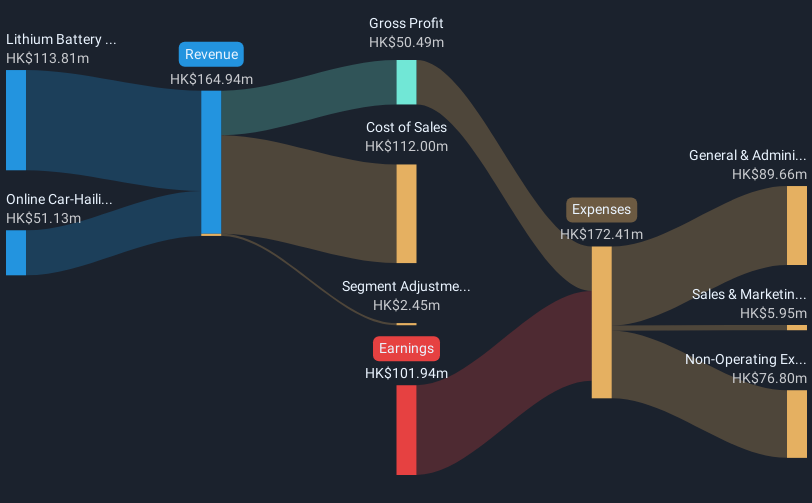

Operations: The company generates revenue through its lithium battery production segment, which accounts for HK$113.81 million, and its online car-hailing and related services, contributing HK$51.13 million.

Market Cap: HK$5.55B

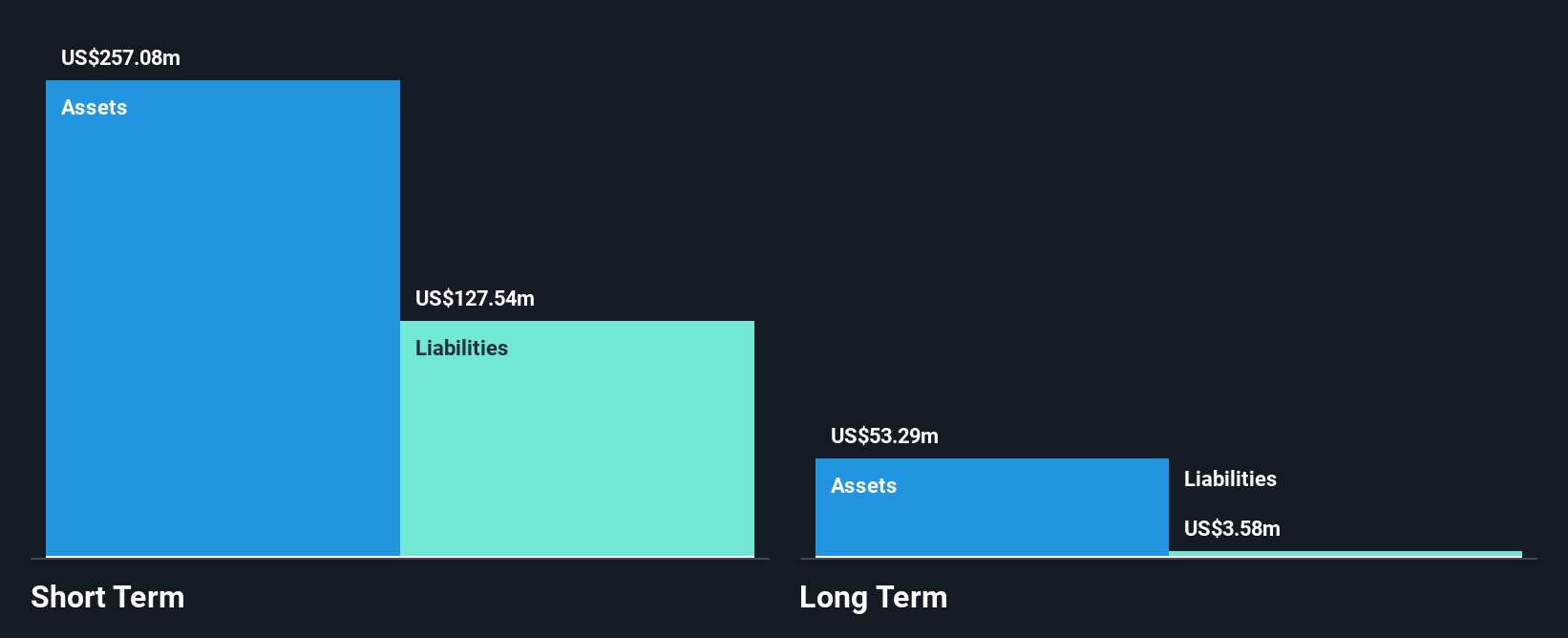

Honbridge Holdings Limited, involved in lithium battery production, faces challenges typical of penny stocks. Despite having more cash than debt and a stable cash runway exceeding three years, the company remains unprofitable with negative Return on Equity. Recent executive changes introduced industry veterans from Geely Holding, potentially strengthening strategic direction. However, earnings have declined significantly over the past five years. The company's short-term assets cover its immediate liabilities but fall short against long-term obligations. Additionally, Honbridge's share price has been highly volatile recently. A substantial equity offering aims to raise HK$376 million at HK$0.08 per share to support operations and growth initiatives.

- Get an in-depth perspective on Honbridge Holdings' performance by reading our balance sheet health report here.

- Gain insights into Honbridge Holdings' historical outcomes by reviewing our past performance report.

Tianjin TEDA Biomedical Engineering (SEHK:8189)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tianjin TEDA Biomedical Engineering Company Limited, along with its subsidiaries, focuses on the research, development, manufacture, and sale of biological compound fertilizer products in China and has a market cap of HK$520.99 million.

Operations: The company's revenue is primarily derived from its Fertiliser Products segment, which generated CN¥427.18 million, while the Elderly Care and Health Care Services segment reported a negative revenue of CN¥3.53 million.

Market Cap: HK$520.99M

Tianjin TEDA Biomedical Engineering, though unprofitable, has managed to reduce its losses by 41.6% annually over the past five years. The company’s cash runway is stable for over three years based on current free cash flow, but its debt-to-equity ratio has surged significantly from 16.6% to 167.1% in five years. Recent executive changes saw Ms. Liu Jinyu appointed as Chairman of the Supervisory Committee following Ms. Yang Chunyan's resignation, which does not impact regulatory compliance or operations. Despite high volatility in share price and significant insider selling recently, short-term assets exceed long-term liabilities but fall short of covering immediate obligations.

- Dive into the specifics of Tianjin TEDA Biomedical Engineering here with our thorough balance sheet health report.

- Understand Tianjin TEDA Biomedical Engineering's track record by examining our performance history report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 5,837 companies within our Penny Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honbridge Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10