F5, Inc. (NASDAQ:FFIV) will release earnings results for its first quarter, after the closing bell on Tuesday, Jan. 28, 2025.

Analysts expect the Seattle, Washington-based company to report quarterly earnings at $3.38 per share, down from $3.43 per share in the year-ago period. F5 projects to report revenue of $716.48 million for the recent quarter, compared to $692.6 million a year earlier, according to data from Benzinga Pro.

On Oct. 28, 2024, F5 reported better-than-expected fourth-quarter financial results and approved an additional $1 billion buyback program.

F5 shares fell 3.7% to close at $263.01 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

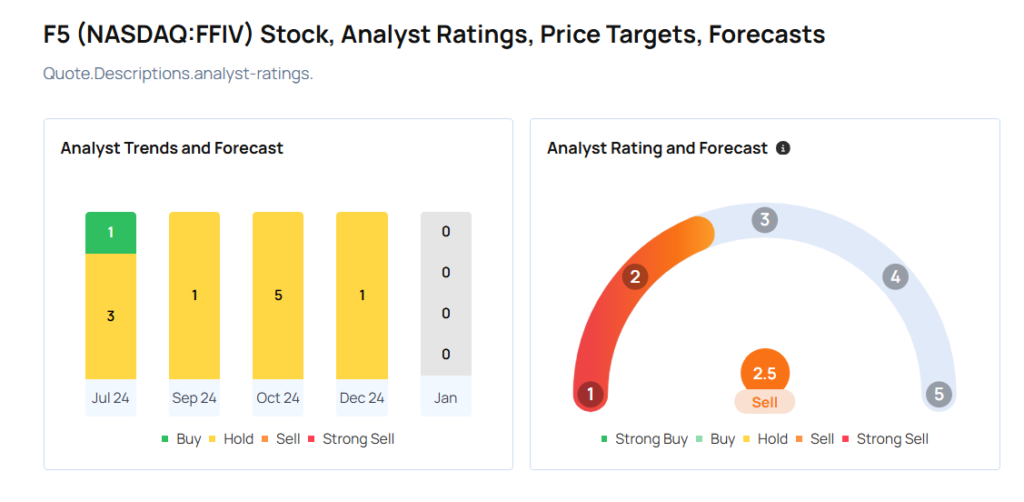

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Evercore ISI Group analyst Amit Daryanani maintained an In-Line rating and raised the price target from $240 to $270 on Jan. 17, 2025. This analyst has an accuracy rate of 80%.

- RBC Capital analyst Matthew Hedberg maintained a Sector Perform rating and raised the price target from $240 to $260 on Jan. 3, 2025. This analyst has an accuracy rate of 74%.

- Morgan Stanley analyst Meta Marshall maintained an Equal-Weight rating and boosted the price target from $230 to $262 on Dec. 17, 2024. This analyst has an accuracy rate of 76%.

- Goldman Sachs analyst Michael Ng maintained a Neutral rating and raised the price target from $212 to $241 on Oct. 29, 2024. This analyst has an accuracy rate of 74%.

- JP Morgan analyst Samik Chatterjee maintained a Neutral rating and raised the price target from $225 to $250 on Oct. 29, 2024. This analyst has an accuracy rate of 72%.

Considering buying FFIV stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Is Worried About This Consumer Cyclical Stock: 7% Yield? ‘Something May Be Wrong Here’