Olin Corporation (NYSE:OLN) reported upbeat results for its fourth quarter, after the closing bell on Thursday.

The company posted quarterly earnings of 9 cents per share which beat the analyst consensus estimate of a loss of 3 cents per share. The company reported quarterly sales of $1.671 billion which beat the analyst consensus estimate of $1.549 billion.

Ken Lane, President, and Chief Executive Officer, said, “While we expect challenging industry conditions to continue into 2025, we will stay focused on optimizing our core businesses through our value-first commercial approach as well as controlling our costs as we described during our Investor Day in December. We remain confident in our ability to generate higher trough-level earnings and cash flow despite the difficult environment.”

Olin shares fell 5.1% to trade at $27.81 on Monday.

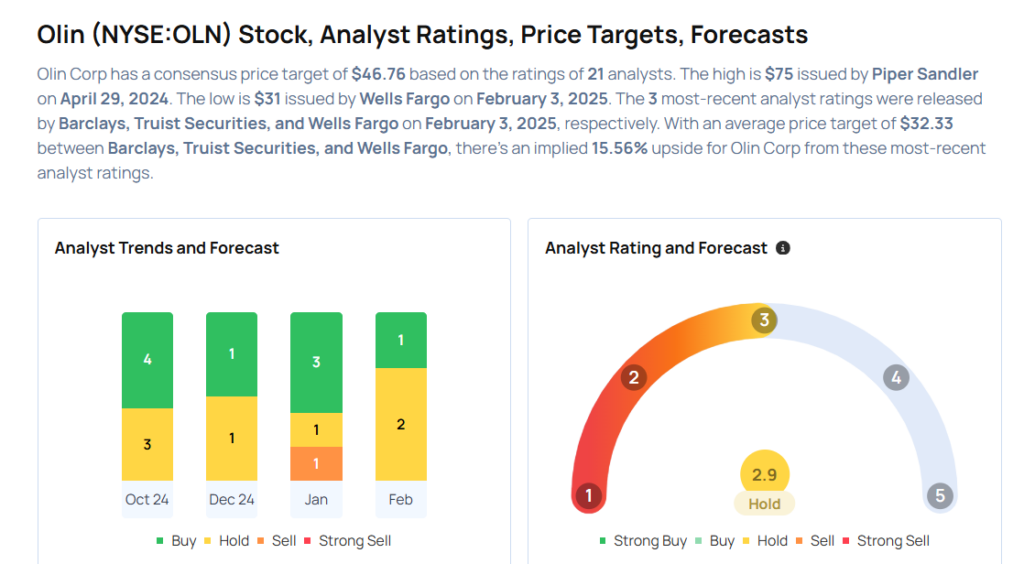

These analysts made changes to their price targets on Olin following earnings announcement.

- Keybanc analyst Aleksey Yefremov maintained Olin with an Overweight and lowered the price target from $50 to $40.

- Wells Fargo analyst Michael Sison maintained Olin with an Equal-Weight and lowered the price target from $40 to $31.

- Truist Securities analyst Peter Osterland maintained the stock with a Hold and cut the price target from $38 to $32.

- Barclays analyst Michael Leithead maintained the stock with an Equal-Weight and slashed the price target from $43 to $34.

Considering buying OLN stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Energy Stocks Delivering High-Dividend Yields