ON Semiconductor Corporation (NASDAQ:ON) will release its fourth-quarter financial results before the opening bell on Monday, Feb. 10.

Analysts expect the Scottsdale, Arizona-based company to report quarterly earnings at 97 cents per share, down from $1.25 per share in the year-ago period. ON Semiconductor projects quarterly revenue of $1.76 billion, compared to $2.02 billion a year earlier, according to data from Benzinga Pro.

On Dec. 17, 2024, ON Semiconductor and tier-one automotive supplier Denso Corp (OTC:DNZOF) (OTC:DNZOY) announced that they are strengthening their long-term relationship to support the procurement of autonomous driving (AD) and advanced driver assistance systems (ADAS) technologies..

ON Semiconductor shares gained 1.4% to close at $52.44 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

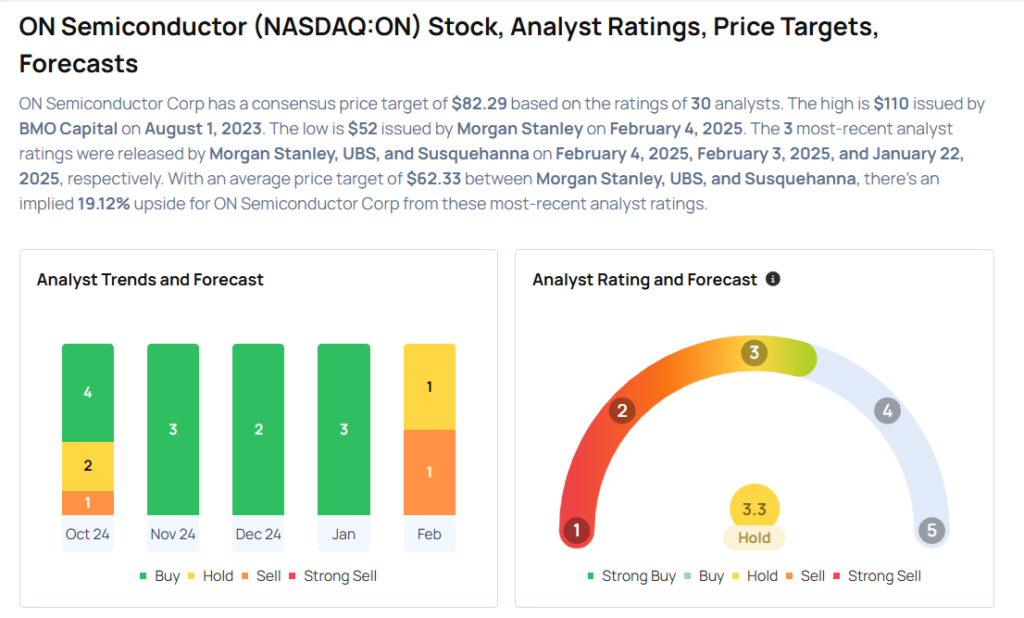

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Joseph Moore maintained an Underweight rating and cut the price target from $64 to $52 on Feb. 4, 2025. This analyst has an accuracy rate of 71%.

- UBS analyst Pradeep Ramani maintained a Neutral rating and cut the price target from $72 to $65 on Feb. 3, 2025. This analyst has an accuracy rate of 65%.

- Susquehanna analyst Christopher Rolland maintained a Positive rating and lowered the price target from $80 to $70 on Jan. 22, 2025. This analyst has an accuracy rate of 75%.

- Keybanc analyst John Vinh maintained an Overweight rating and cut the price target from $90 to $70 on Jan. 14, 2025. This analyst has an accuracy rate of 73%.

- Goldman Sachs analyst Toshiya Hari maintained a Buy rating and slashed the price target from $92 to $77 on Jan. 10, 2025. This analyst has an accuracy rate of 81%.

Considering buying ON stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says Don’t Buy This Financial Stock At This Level: ‘Let It Come In’