Clear Secure (NYSE:YOU) Reports US$770M Sales and Leadership Changes with New President and CFO

Clear Secure (NYSE:YOU) reported significant financial achievements and executive changes that might have influenced its share price movement of 0.50% over the past week. The company revealed robust annual and fourth-quarter results, with sales and net income both sharply rising. Concurrently, Clear Secure announced executive transitions, with Ken Cornick stepping into an advisory role, and Michael Barkin and Jen Hsu assuming leadership positions. Despite general market volatility and concerns over new tariffs impacting investor confidence, the information security company's share price edged up, diverging from the broader market decline of 3.6%. The company's strategic business expansions, such as the opening of its first non-airport location in Puerto Rico, added to its positive outlook. These factors, against a backdrop of mixed results from major tech companies, positioned Clear Secure's shares to perform slightly better amidst a challenging market week.

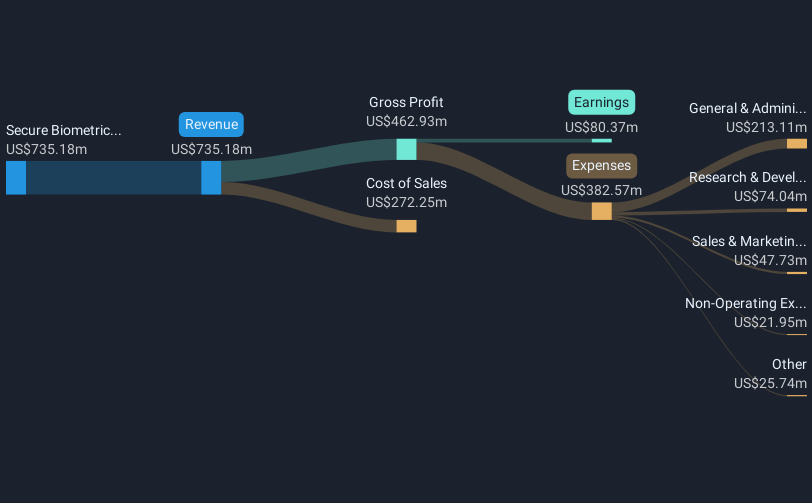

Click to explore a detailed breakdown of our findings on Clear Secure.

Over the past year, Clear Secure's total shareholder return was 22.98%, significantly outperforming the US market's return of 16.7% and the software industry’s 6.7% return. Several factors may have influenced this strong performance. Clear Secure saw a very large earnings growth, significantly outpacing the broader software industry's earnings growth. Additionally, the company has deemed good value due to its Price-To-Earnings ratio of 12.4x compared to the industry average of 36.6x.

In terms of capital allocation, Clear Secure executed a buyback program, repurchasing approximately 19.11% of its shares. Furthermore, shareholder returns were enhanced by both a quarterly and a special dividend, contributing to positive investor sentiment. The opening of a new enrollment location in Puerto Rico, Clear Secure's first non-airport site, highlights its efforts in business expansion. These measures collectively supported Clear Secure’s strong total return performance over the period.

- Learn how Clear Secure's intrinsic value compares to its market price with our detailed valuation report.

- Discover the key vulnerabilities in Clear Secure's business with our detailed risk assessment.

- Already own Clear Secure? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10