Williams-Sonoma, Inc. (NYSE:WSM) released upbeat results for its fourth quarter on Wednesday.

Williams-Sonoma reported quarterly earnings of $3.28 per share which beat the analyst consensus estimate of $2.93 per share. The company reported quarterly sales of $2.46 billion which beat the analyst consensus estimate of $2.35 billion.

"This success was fueled by the strength of our operating model, our standout seasonal offerings, our impactful collaborations, and a strong improvement in both retail and online furniture sales. On the full year, our comp ran down 1.6%. We delivered a record annual operating margin of 17.9% with full-year earnings per share of $8.50," stated Laura Alber, President and Chief Executive Officer.

The company said it sees 2025 net revenue to range from -1.5% to +1.5%, comps from flat to +3.0%, and operating margin between 17.4% and 17.8%, including a 20bps impact from the prior year's extra week.

Williams-Sonoma shares fell 3.5% to close at $166.27 on Wednesday.

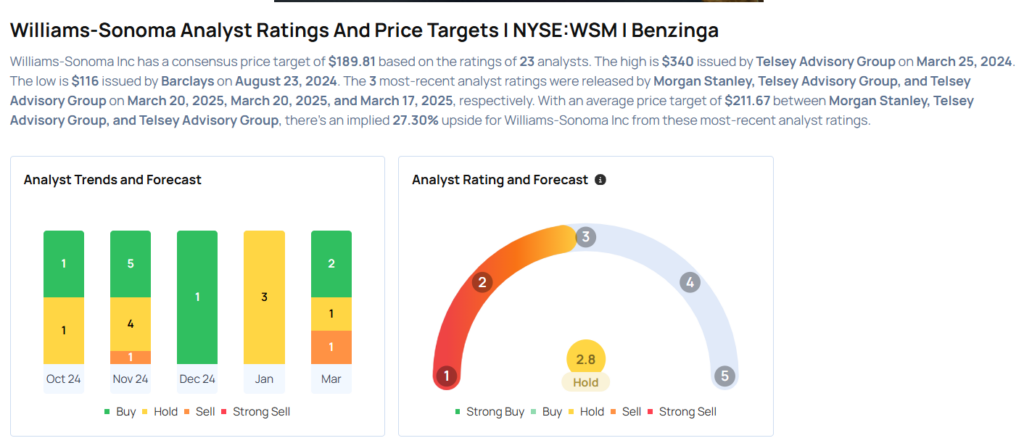

These analysts made changes to their price targets on Williams-Sonoma following earnings announcement.

- Telsey Advisory Group analyst Cristina Fernandez maintained Williams-Sonoma with an Outperform rating and lowered the price target from $230 to $220.

- Morgan Stanley analyst Simeon Gutman maintained Williams-Sonoma with an Equal-Weight rating and cut the price target from $195 to $185.

Considering buying WSM stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says TJX Is ‘Terrific,’ Recommends Buying These Stocks