Exploring Three High Growth Tech Stocks In Europe

The European market has recently experienced significant declines, with the pan-European STOXX Europe 600 Index dropping 8.44% amid heightened trade tensions and economic uncertainty stemming from new U.S. tariffs. In this challenging environment, identifying high growth tech stocks in Europe requires a focus on companies that demonstrate resilience through innovation and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 20.52% | 36.58% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Yubico | 20.94% | 26.69% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.52% | ★★★★★★ |

| Xbrane Biopharma | 33.71% | 82.67% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.68% | 36.76% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Click here to see the full list of 238 stocks from our European High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

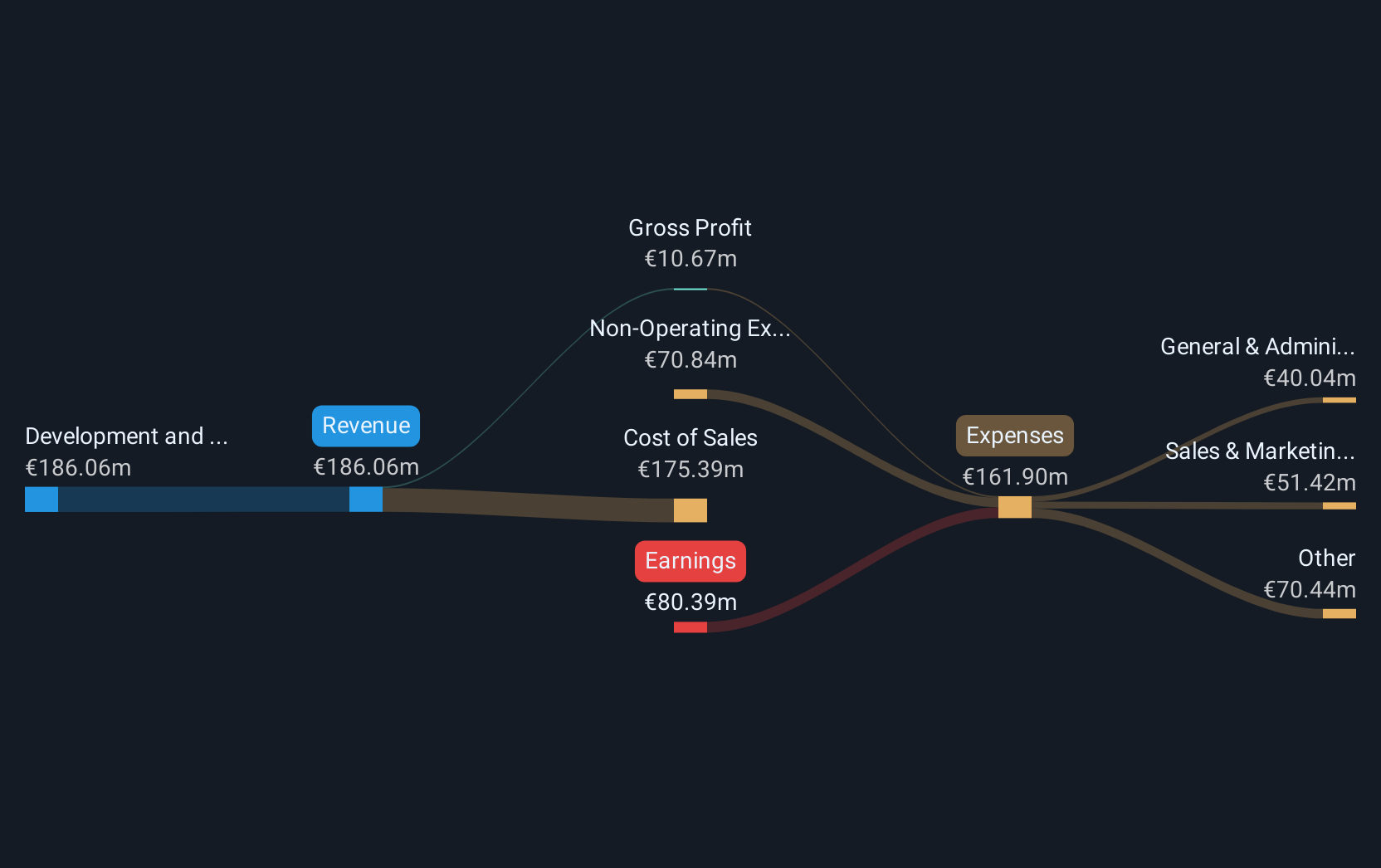

Pharming Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pharming Group N.V. is a biopharmaceutical company focused on developing and commercializing protein replacement therapies and precision medicines for rare diseases across the United States, Europe, and internationally, with a market cap of €484.22 million.

Operations: Pharming Group specializes in developing and commercializing therapies for rare diseases, focusing on protein replacement and precision medicines. The company operates across the United States, Europe, and other international markets.

Pharming Group has demonstrated resilience and strategic foresight in the biotech sector, particularly with its recent advancements in clinical trials. The initiation of a Phase II trial for leniolisib addresses a critical unmet need in CVID patients, potentially impacting mortality rates significantly. Financially, the company reported a notable increase in sales from $245.32 million to $297.2 million year-over-year and anticipates further growth with revenue projections between $315 million and $335 million for 2025. This growth trajectory is supported by robust R&D investments aimed at expanding its product pipeline and enhancing drug efficacy, ensuring Pharming remains at the forefront of biotechnological innovation despite its current unprofitability.

- Take a closer look at Pharming Group's potential here in our health report.

Assess Pharming Group's past performance with our detailed historical performance reports.

Believe

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Believe S.A. offers digital music services to independent labels and local artists across various regions including France, Germany, the rest of Europe, the Americas, Asia, Oceania, and the Pacific with a market cap of approximately €1.50 billion.

Operations: The company's revenue primarily comes from Premium Solutions, generating €924.24 million, while Automated Solutions contribute €64.59 million.

Believe S.A. is shaping up as a compelling narrative in the European tech landscape, especially with its robust revenue uptick of 13% year-over-year to EUR 988.83 million in 2024, outpacing the broader French market's growth of 5.8%. Despite reporting a net loss, the reduction from EUR 5.48 million to EUR 3.05 million signals improving operational efficiency and cost management. The firm's commitment to innovation is evident from its forecasted earnings growth at an impressive rate of over 50% annually, positioning it for profitability within three years. This trajectory is underpinned by strategic R&D investments which are set to enhance product offerings and market competitiveness in a rapidly evolving digital music distribution sector.

- Navigate through the intricacies of Believe with our comprehensive health report here.

Understand Believe's track record by examining our Past report.

Valneva

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Valneva SE is a specialty vaccine company focused on developing, manufacturing, and commercializing vaccines for infectious diseases with unmet needs, with a market cap of €453.74 million.

Operations: Valneva SE primarily generates revenue through the development and commercialization of prophylactic vaccines for infectious diseases, with reported revenues of €169.58 million.

Valneva's recent strides in the biotech sector underscore its potential within the high-growth tech landscape in Europe, particularly with its pioneering single-dose chikungunya vaccine, IXCHIQ®. The European Commission's approval and subsequent label extension applications mark significant milestones, potentially broadening market reach and reinforcing Valneva’s commitment to addressing global health challenges. Despite a net loss of EUR 12.25 million in 2024, a substantial improvement from previous years, the company is poised for recovery with projected revenue growth to EUR 180-190 million by 2025. This growth trajectory is bolstered by strategic R&D investments which accounted for a notable portion of expenses yet are critical for long-term sustainability and competitiveness in the vaccine development arena.

- Unlock comprehensive insights into our analysis of Valneva stock in this health report.

Explore historical data to track Valneva's performance over time in our Past section.

Taking Advantage

- Embark on your investment journey to our 238 European High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:PHARM ENXTPA:BLV and ENXTPA:VLA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10