These Were the 2 Worst-Performing Stocks in the S&P 500 in March 2025

-

Close to 20% of S&P 500 stocks finished March down by at least 10%.

-

Delta lowered both its revenue and earnings-per-share guidance.

-

United said its government-related booking declined by around 50%.

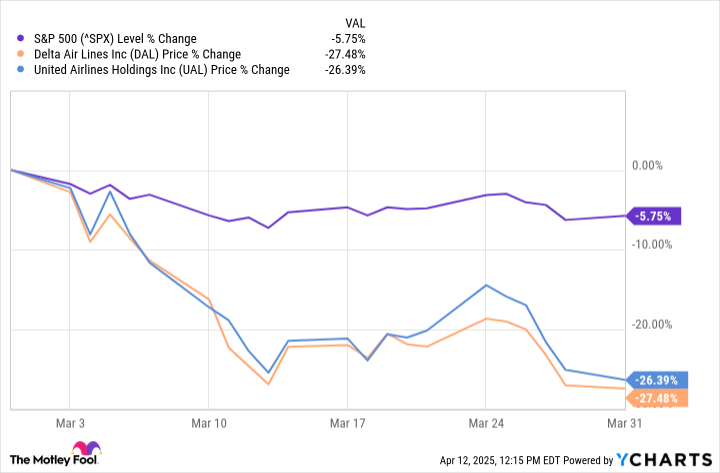

March wasn't the best month for the S&P 500, with the index dropping 5.8%. It was a tough month all around, as 98 of the S&P 500 stocks finished the month down at least 10%, but two especially had a bad month: Delta Air Lines (DAL -0.29%) and United Airlines (UAL 0.36%). Delta and United were the S&P 500's worst-performing stocks in March, falling 27.5% and 26.4%, respectively.

^SPX data by YCharts

Why did both airlines have such a bad March?

Broader economic uncertainty took its toll on both companies, but there were also industry-specific problems that caused the stock price drops. Delta lowered its revenue growth guidance from 6%-8% down to 5% (at the higher end). It also cut its earnings-per-share (EPS) guidance from $0.70 to $1 down to $0.30 to $0.50.

United also lowered its guidance as it projects its revenue will take a hit. It noted a slowdown in corporate and government travel, especially as the federal government focuses on reducing its spending. United says government-related booking decreased by half.

As new tariff plans go into effect and concerns about inflation and a potential recession ramp up, both companies could face some near-term troubles as consumers, companies, and governments cut back on travel. It will take time to see how it all plays out, but investors should expect volatility to continue along with potential drops.

As of market closing on April 11, Delta's and United's stocks are down 30.8% and 31.3% for the year, respectively.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10