Kinder Morgan, Inc. (NYSE:KMI) will release earnings results for the first quarter, after the closing bell on Wednesday, April 16.

Analysts expect the Houston, Texas-based company to report quarterly earnings at 36 cents per share, up from 34 cents per share in the year-ago period. Kinder Morgan projects to report quarterly revenue at $4.03 billion, compared to $3.84 billion a year earlier, according to data from Benzinga Pro.

On Jan. 22, Kinder Morgan reported quarterly earnings of 32 cents per share, which missed the analyst consensus estimate of 33 cents.

Kinder Morgan shares gained 1.6% to close at $27.22 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

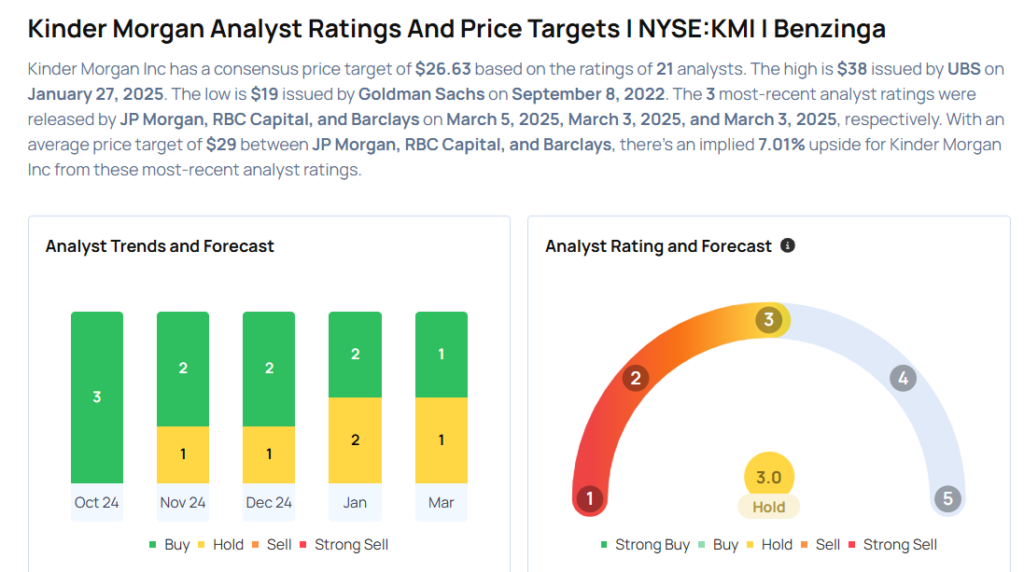

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Jeremy Tonet maintained a Neutral rating and raised the price target from $28 to $29 on March 5, 2025. This analyst has an accuracy rate of 63%.

- Barclays analyst Theresa Chen upgraded the stock from Equal-Weight to Overweight with a price target of $31 on March 3, 2025. This analyst has an accuracy rate of 74%.

- Citigroup analyst Spiro Dounis maintained a Neutral rating and raised the price target from $25 to $28 on Jan. 29, 2025. This analyst has an accuracy rate of 76%.

- Wells Fargo analyst Michael Blum maintained an Overweight rating and raised the price target from $30 to $33 on Jan. 23, 2025. This analyst has an accuracy rate of 64%.

- Goldman Sachs analyst John Mackay maintained a Buy rating and increased the price target from $26 to $29 on Nov. 26, 2024. This analyst has an accuracy rate of 73%.

Considering buying KMI stock? Here’s what analysts think:

Read This Next:

- Jim Cramer: Planet Fitness Is Doing Better Than Expected, Says No To This Industrial Stock

Photo via Shutterstock