Abbott Laboratories (NYSE:ABT) reported better-than-expected first-quarter adjusted EPS results on Wednesday.

Abbott Laboratories reported first-quarter sales of $10.36 billion, up 7.2% year over year, almost in line with the consensus of $10.40 billion. The U.S. MedTech giant reported adjusted EPS of $1.09, beating the consensus of $1.07 and the management guidance of $1.05-$1.09.

"Once again, Abbott's diversified business model delivered top-tier sales and EPS growth," said Robert Ford, chairman and CEO of Abbott. "It is this diversification and execution that allows Abbott to navigate through periods of uncertainty and continually deliver sustainable growth."

Abbott Laboratories expects second quarter 2025 adjusted EPS of $1.23-$1.27 versus consensus of $1.25.

Abbott Laboratories shares gained 0.9% to trade at $130.81 on Thursday.

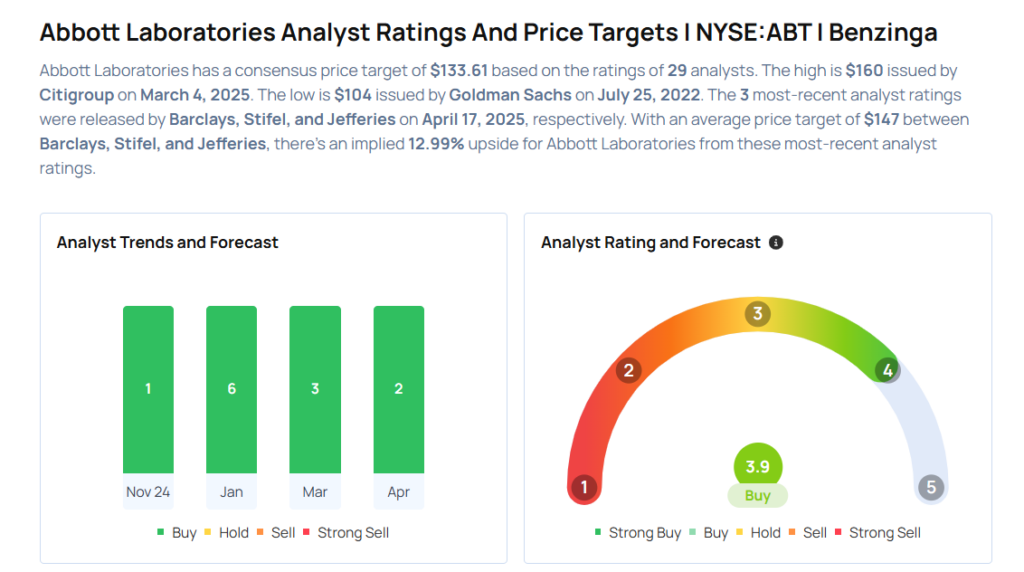

These analysts made changes to their price targets on Abbott Laboratories following earnings announcement.

- Jefferies analyst Matthew Taylor maintained Abbott Laboratories with a Hold and raised the price target from $135 to $137.

- Stifel analyst Rick Wise maintained the stock with a Buy and raised the price target from $135 to $145.

- Barclays analyst Matt Miksic maintained Abbott Laboratories with an Overweight and raised the price target from $158 to $159.

Considering buying ABT stock? Here’s what analysts think:

Read This Next:

- Netflix Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call