Meta Platforms, Inc. (NASDAQ:META) will release earnings results for the first quarter, after the closing bell on Wednesday, April 30.

Analysts expect the Menlo Park, California-based company to report quarterly earnings at $5.22 per share, up from $4.71 per share in the year-ago period. Meta projects to report quarterly revenue at $41.36 billion, compared to $36.45 billion a year earlier, according to data from Benzinga Pro.

The social media and technology company has beaten analyst estimates for revenue in 10 straight quarters.

Meta shares gained 0.9% to close at $554.44 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Stifel analyst Mark Kelley maintained a Buy rating and cut the price target from $740 to $628 on April 23, 2025. This analyst has an accuracy rate of 83%.

- Needham analyst Laura Martin reiterated an Underperform rating on April 23, 2025. This analyst has an accuracy rate of 70%.

- Truist Securities analyst Youssef Squali maintained a Buy rating and cut the price target from $770 to $700 on April 17, 2025. This analyst has an accuracy rate of 78%.

- Cantor Fitzgerald analyst Deepak Mathivanan maintained an Overweight rating and cut the price target from $790 to $624 on April 16, 2025. This analyst has an accuracy rate of 78%.

- Wedbush analyst Meta Marshall maintained an Outperform rating and cut the price target from $770 to $680 on April 15, 2025. This analyst has an accuracy rate of 74%.

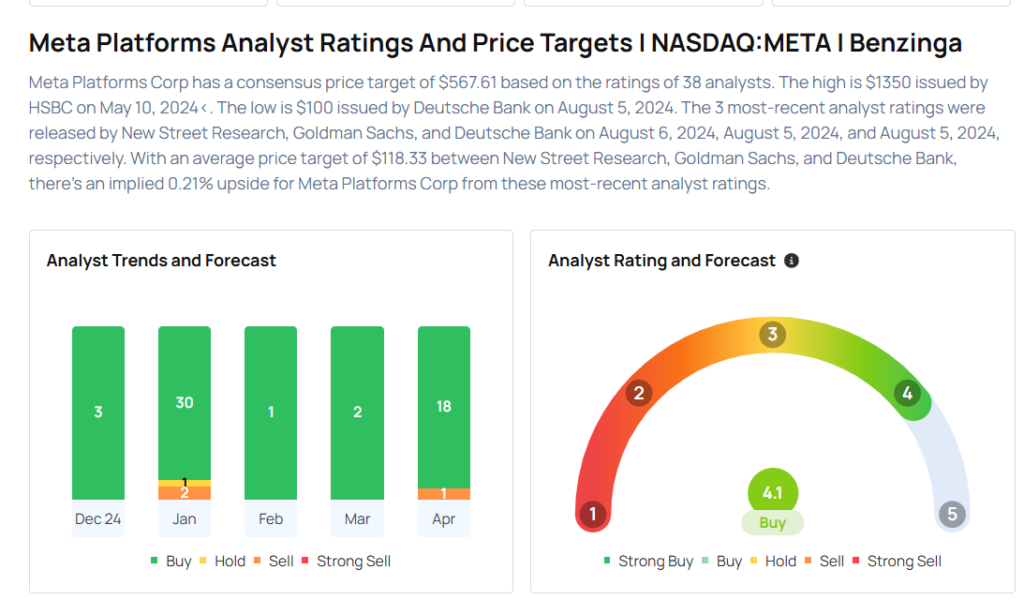

Considering buying META stock? Here’s what analysts think:

Read This Next:

- Top 3 Industrials Stocks Which Could Rescue Your Portfolio In Q2

Photo via Shutterstock