QUALCOMM Incorporated (NASDAQ:QCOM) will release earnings results for the second quarter, after the closing bell on Wednesday, April 30.

Analysts expect the Santa Monica, California-based company to report quarterly earnings at 4 cents per share, up from 3 cents per share in the year-ago period. Qualcomm projects to report quarterly revenue at $1.35 billion, compared to $1.19 billion a year earlier, according to data from Benzinga Pro.

Qualcomm, earlier during the month, expanded its generative AI capabilities with the acquisition of VinAI Division.

Qualcommshares fell 0.5% to close at $146.88 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

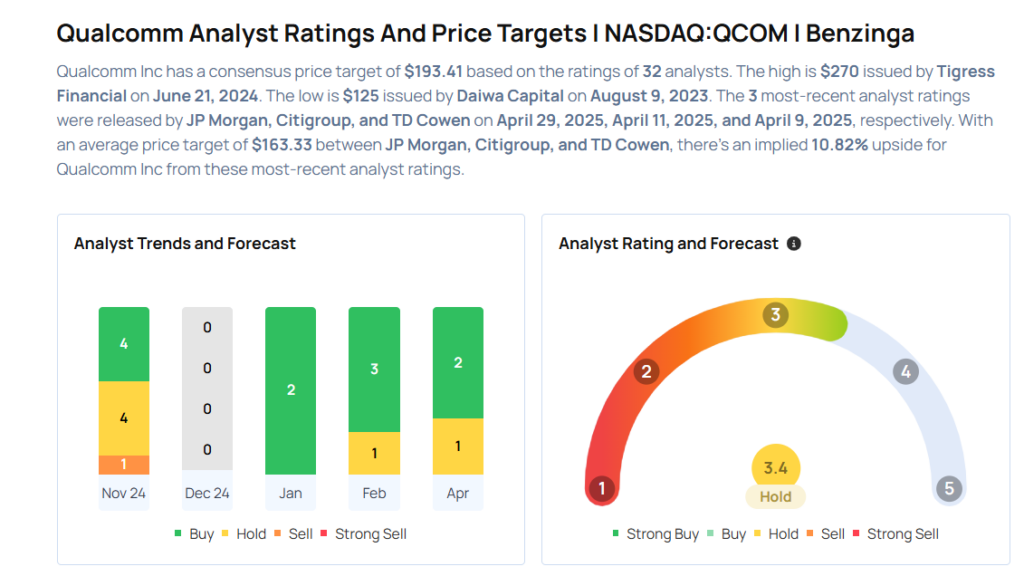

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Samik Chatterjee reinstated an Overweight rating with a price target of $185 on April 29, 2025. This analyst has an accuracy rate of 69%.

- Citigroup analyst Christopher Danely maintained a Neutral rating and slashed the price target from $185 to $145 on April 11, 2025. This analyst has an accuracy rate of 77%.

- Evercore ISI Group analyst Mark Lipacis maintained an In-Line rating and slashed the price target from $199 to $179 on Feb. 6, 2025. This analyst has an accuracy rate of 71%.

- Piper Sandler analyst Harsh Kumar maintained an Overweight rating and cut the price target from $205 to $190 on Feb. 6, 2025. This analyst has an accuracy rate of 79%.

- Rosenblatt analyst Kevin Cassidy maintained a Buy rating with a price target of $250 on Feb. 6, 2025. This analyst has an accuracy rate of 66%.

Considering buying QCOM stock? Here’s what analysts think:

Read This Next:

- Top 3 Industrials Stocks Which Could Rescue Your Portfolio In Q2

Photo via Shutterstock