Magnificent 7 Earnings: What to Expect (AMZN, AAPL, META and MSFT)

The tech giants are back in focus as earnings season kicks into high gear. Microsoft (MSFT), Meta Platforms (META), Apple (AAPL), and Amazon (AMZN), four pillars of the “Magnificent 7,” are set to report results this week, and the stakes couldn’t be higher. These companies collectively represent trillions of dollars in market cap and serve as bellwethers for everything from AI adoption to e-commerce, ad and cloud spending.

After a volatile few weeks marked by shifting macro narratives, concerns about tariffs, inflation, and geopolitical uncertainty, investors are eager for clarity. Will the Magnificent 7 deliver strong enough numbers to reassure the market?

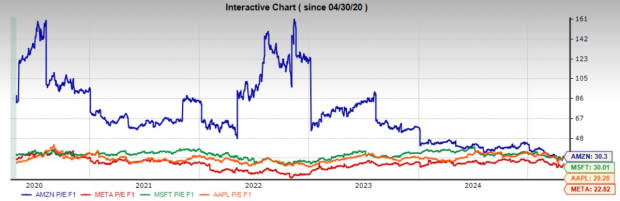

This group of elite stocks has been a weak spot in the market this year, with all but Meta Platforms underperforming the S&P 500. However, after the recent pullbacks, valuations have become more attractive and despite the drawdowns, these companies still boast impressive earnings growth forecasts. Is it time to start acquiring shares of big tech stocks?

Meta Platforms and Microsoft report Wednesday after the market close, while Amazon and Apple report on Thursday afternoon.

Image Source: Zacks Investment Research

Magnificent 7 Earnings Forecasts and Beats

At the moment, each of these stocks holds a Zacks Rank #3 (Hold), reflecting mixed earnings estimate revisions heading into their upcoming reports. Given the heightened market uncertainty and macro exposure of these companies, it’s not surprising that analysts are offering a wide range of forecasts.

Historically, these companies have taken a conservative approach to forward guidance, allowing room to outperform Wall Street expectations. This strategy has served them well — Amazon, for example, has delivered an average earnings beat of 25.4% over the last four quarters.

However, this quarter presents a noticeable shift. Three of the four names currently have a negative Earnings ESP (Expected Surprise Prediction), suggesting that downside surprises are more likely. Amazon has an ESP of -2.67%, Microsoft -0.51%, and Apple -0.85%. Meta Platforms stands out with a positive ESP of +3.0%, indicating a potential beat.

Despite the near-term uncertainty, long-term earnings growth expectations remain impressive, especially for companies of this size. Amazon is projected to grow earnings at an annual rate of 22.3% over the next three to five years. Meta follows at 17.6%, with Microsoft at 14.4%, and Apple, the slowest of the group, still expected to deliver a respectable 12.8% annual earnings growth.

Tariff Implications for Quarterly Earnings at MSFT, AMZN, AAPL and META

While it’s unlikely that the latest round of tariff policy has yet to materially affect the top or bottom lines of Microsoft, Amazon, Apple, or Meta this quarter, management commentary will be closely watched. Investors will be looking for any signs that escalating trade tensions could impact forward-looking guidance, particularly around AI infrastructure spending and consumer demand.

Apple and Amazon face the most direct exposure to tariffs. Apple’s hardware supply chain remains heavily dependent on China, and any disruptions or rising costs could pressure margins. For Amazon, tariffs may hit resellers and imported goods on its marketplace platform, potentially complicating inventory costs and pricing strategies.

Microsoft and Meta, on the other hand, are more likely to feel the secondary effects of tariffs through a broader economic slowdown. A pullback in enterprise spending, slower advertising budgets, or delays in AI-related capex could weigh on both companies’ growth trajectories.

If management teams begin to lower guidance or signal caution about the second half of the year, it may be a sign that the ripple effects of protectionist policy are starting to show. At a time when the market is watching AI capex plans and global consumer demand, any hint of hesitation could move stocks sharply.

Ultimately, while the numbers this quarter may hold up, it’s the tone and forward-looking commentary from executives that will shape the market’s reaction.

Do MSFT, AAPL, META and AMZN Shares Trade at a Discount?

After a sharp run-up in 2023 and 2024, the recent pullback across large-cap tech has compressed valuations. All four companies, Microsoft, Apple, Meta, and Amazon, are now trading below their respective five-year median forward earnings multiples. This reset comes at a time when broader market uncertainty is creating opportunities for investors willing to look past short-term volatility.

Among the group, Meta Platforms appears to offer the most compelling valuation on a relative basis. It currently trades at just 22.8x forward earnings, well below its historical norm, despite strong earnings momentum and improving monetization across its platforms. Amazon also stands out, as not only is it trading the furthest below its five-year average multiple, but it also boasts the highest long-term earnings growth forecast of the group, at over 22% annually.

This combination of compressed valuation and robust earnings potential makes Meta and Amazon especially attractive right now. Microsoft and Apple, while more expensive in absolute terms, also offer improved entry points after their recent declines.

Image Source: Zacks Investment Research

What Can Investors Expect from Upcoming Magnificent 7 Earnings?

This week’s earnings from Microsoft, Apple, Meta, and Amazon will provide critical insight into the health of both the tech sector and the broader economy. While short-term expectations have moderated, long-term growth stories remain intact, especially for Meta and Amazon, which now offer compelling combinations of valuation and momentum.

Tariff risks and macro uncertainty may weigh on commentary, but investors should focus on guidance, AI-related capital plans, and signals around enterprise and consumer demand. In a market searching for leadership, strong reports from these names could reignite momentum in big tech, and possibly the broader indices.

For long-term investors, the pullback may be presenting an opportunity to selectively accumulate shares of the Magnificent 7 before the next leg higher.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10