Spotify Technology (NYSE:SPOT) reported downbeat first-quarter 2025 financial results on Tuesday.

Spotify reported quarterly earnings of $1.13 per share, which missed the analyst consensus estimate of $2.33. The company reported quarterly sales of $4.41 billion (4.19 billion euros), up by 15% year-on-year, which beat the analyst consensus estimate of $4.20 billion.

Spotify clocked monthly average user (MAU) net additions of 3 million quarter-over-quarter to 678 million, which is in line with the guidance.

Spotify said it expects fiscal second-quarter 2025 revenue of $4.52 billion (4.3 billion euros) versus an analyst consensus estimate of $4.39 billion and total MAUs of 689 million.

Spotify shares fell 3.5% to close at $576.94 on Tuesday.

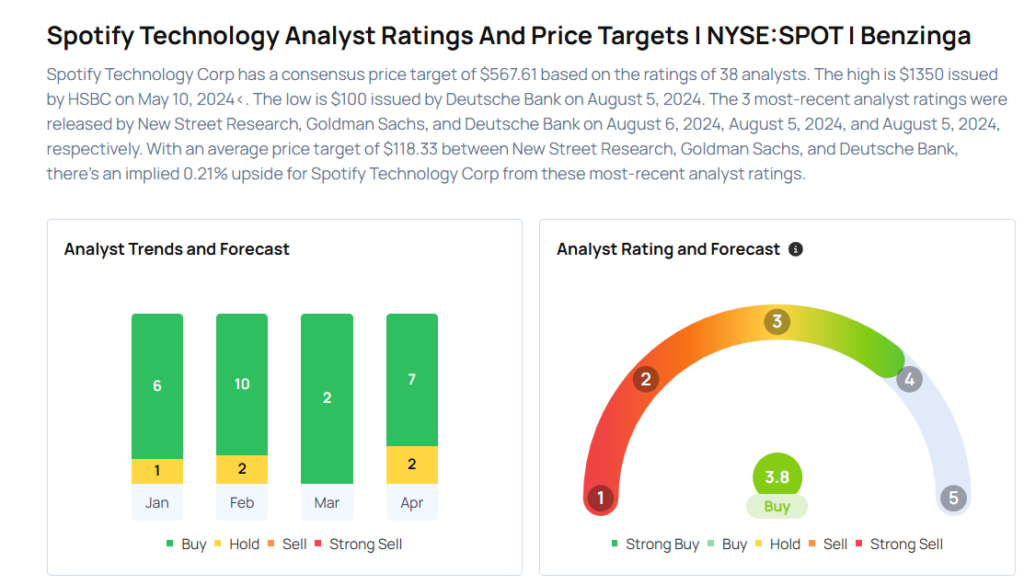

These analysts made changes to their price targets on Spotify following earnings announcement.

- Rosenblatt analyst Barton Crockett maintained Spotify Technology with a Neutral rating and lowered the price target from $658 to $657.

- Evercore ISI Group analyst Mark Mahaney maintained the stock with an Outperform rating and lowered the price target from $700 to $650.

Considering buying SPOT stock? Here’s what analysts think:

Read This Next:

- Top 3 Industrials Stocks Which Could Rescue Your Portfolio In Q2

Photo via Shutterstock