Fintech giant PayPal Holdings Inc. (NASDAQ:PYPL) said Tuesday it was committed to boosting cryptocurrency adoption, with a particular emphasis on its PayPal USD (CRYPTO: PYUSD) stablecoin.

What Happened: During the company’s first-quarter earnings call, CEO Alex Chriss said PayPal was “making strides” and “moving quickly” to bring the benefits of cryptocurrency and stablecoins to its user base.

“Last week, we introduced the ability to earn rewards for holding PYUSD. This will increase the adoption and use of digital currencies for everyday commerce, from sending money internationally to making purchases and more,” Chriss stated.

Regarding PYUSD, the top executive said PayPal has been strengthening its ties with cryptocurrency industry giants such as Coinbase Global Inc. (NASDAQ:COIN) to facilitate easier access and usage.

Moreover, the company’s strategic move to add PYUSD to the Solana blockchain is seen as an attempt to expand its crypto-related services. This move is in line with the rising dominance of stablecoins in the global financial system, as highlighted by tech investor Chamath Palihapitiya. He noted that the weekly transaction volumes of stablecoins have surpassed that of Visa Inc.

See Also: SEC Zooms In On Nayib Bukele-Led El Salvador’s Crypto Regulation Model

Why It Matters: PayPal has strategically invested in digital assets, particularly stablecoins, to capitalize on their growing importance in the global financial system.

Last year, it launched PYUSD, a dollar-backed cryptocurrency, on the Solana (CRYPTO: SOL) blockchain. As of this writing, the stablecoin had a market capitalization of $880 million, making it the sixth-largest overall.

Additionally, PayPal allows customers to buy and sell cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), as well as use them for online purchases.

The company reported its first-quarter financials on Tuesday, beating earnings predictions but falling short of revenue expectations.

Price Action: Shares of PayPal dipped 0.24% in after-hours trading after closing up 2.14% at $66.32 during Tuesday's regular trading session, according to data from Benzinga Pro. Year-to-date, the stock has lost over 22% of its value.

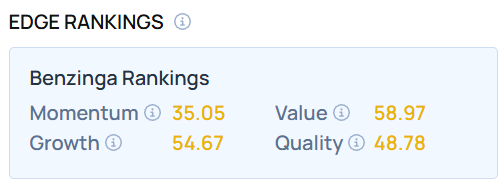

PayPal recorded a moderate reading on some of its key indicators, including momentum, growth, and quality. Check out the Benzinga Edge Stock Rankings to see how rival fintech firms stack up.

Photo Courtesy: Michael Vi on Shutterstock.com

Read Next:

- Trump-Affiliated World Liberty Financial Defies Ethics Concerns, Raises $550 Million