Visa Inc. (NYSE:V) will release earnings results for the second quarter, after the closing bell on Tuesday, April 29.

Analysts expect the San Francisco, California-based company to report quarterly earnings at $2.68 per share, up from $2.51 per share in the year-ago period. Visa projects to report quarterly revenue at $9.55 billion, compared to $8.78 billion a year earlier, according to data from Benzinga Pro.

Visa has reportedly proposed a $100 million payment to Apple Inc. (NASDAQ:AAPL) to secure the Apple Card network. This move comes amid fierce competition among the country's leading payment networks.

Visa shares gained 0.7% to close at $337.51 on Monday.

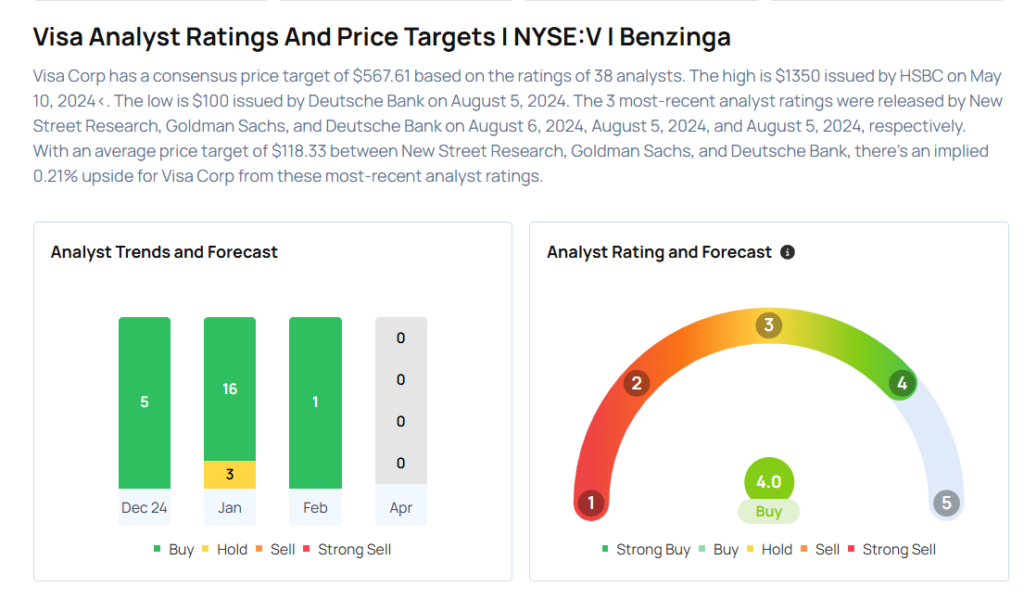

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Barclays analyst Ramsey El-Assal maintained an Overweight rating and raised the price target from $361 to $396 on Feb. 3, 2025. This analyst has an accuracy rate of 65%.

- BMO Capital analyst Rufus Hone maintained an Outperform rating and increased the price target from $350 to $370 on Jan. 31, 2025. This analyst has an accuracy rate of 72%.

- Mizuho analyst Dan Dolev maintained a Neutral rating and boosted the price target from $304 to $359 on Jan. 31, 2025. This analyst has an accuracy rate of 66%.

- JP Morgan analyst Tien-Tsin Huang maintained an Overweight rating and increased the price target from $340 to $375 on Jan. 31, 2025. This analyst has an accuracy rate of 65%.

- Goldman Sachs analyst Matthew O'Neill maintained a Buy rating and raised the price target from $346 to $384 on Jan. 31, 2025. This analyst has an accuracy rate of 63%.

Considering buying Visa stock? Here’s what analysts think:

Read This Next:

- Top 2 Industrials Stocks That May Fall Off A Cliff This Quarter

Photo via Shutterstock