Commvault Systems, Inc. (NASDAQ:CVLT) reported upbeat fourth-quarter financial results and issued FY26 revenue guidance above estimates.

CommVault Systems reported quarterly earnings of $1.03 per share which beat the analyst consensus estimate of 93 cents per share. The company reported quarterly sales of $275.04 million which beat the analyst consensus estimate of $262.43 million.

“It was a record-breaking year at Commvault,” said Sanjay Mirchandani, President and CEO. “Commvault surpassed all key metrics, ended the year with over 12,000 subscription customers, and is firmly positioned as a growth company with subscription revenue up 45% in Q4. We continue to deliver cloud-first innovations that solve a hard problem for customers – strengthening their cyber resilience.”

CommVault said it sees FY2026 sales of $1.130 billion to $1.140 billion, versus estimates of $1.10 billion.

Commvault shares fell 1.3% to trade at $166.52 on Wednesday.

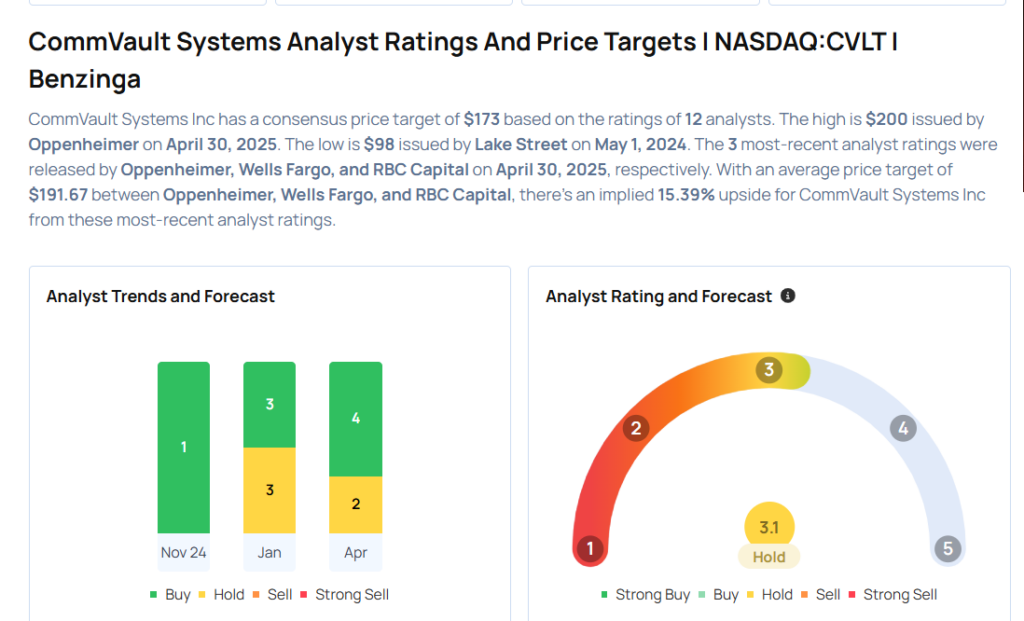

These analysts made changes to their price targets on Commvault following earnings announcement.

- RBC Capital analyst Brad Erickson maintained CommVault Systems with a Sector Perform and raised the price target from $175 to $185.

- Wells Fargo analyst Aaron Rakers maintained the stock with an Overweight rating and raised the price target from $180 to $190..

- Oppenheimer analyst Param Singh maintained CommVault Systems with an Outperform rating and raised the price target from $180 to $200.

Considering buying CVLT stock? Here’s what analysts think:

Read This Next:

- Top 3 Industrials Stocks Which Could Rescue Your Portfolio In Q2

Photo via Shutterstock