Air Products & Chemicals Inc Reports Q2 Adjusted EPS of $2.69, Exceeding Estimates; Revenue at $2.9 Billion, Slightly Below Expectations

On May 1, 2025, Air Products & Chemicals Inc (APD, Financial) released its 8-K filing for the fiscal 2025 second quarter. The company reported a GAAP loss per share of $7.77 and a net loss of $1.7 billion, primarily due to a $2.3 billion after-tax charge related to strategic business and asset actions. Adjusted earnings per share (EPS) came in at $2.69, missing the analyst estimate of $0.22. Air Products, a leading global industrial gas supplier, operates in 50 countries and is the largest supplier of hydrogen and helium worldwide.

Company Overview

Founded in 1940, Air Products & Chemicals Inc (APD, Financial) has established itself as a major player in the industrial gas sector, serving diverse industries such as chemicals, energy, healthcare, metals, and electronics. The company reported $12.1 billion in revenue for fiscal 2024, underscoring its significant market presence.

Performance and Challenges

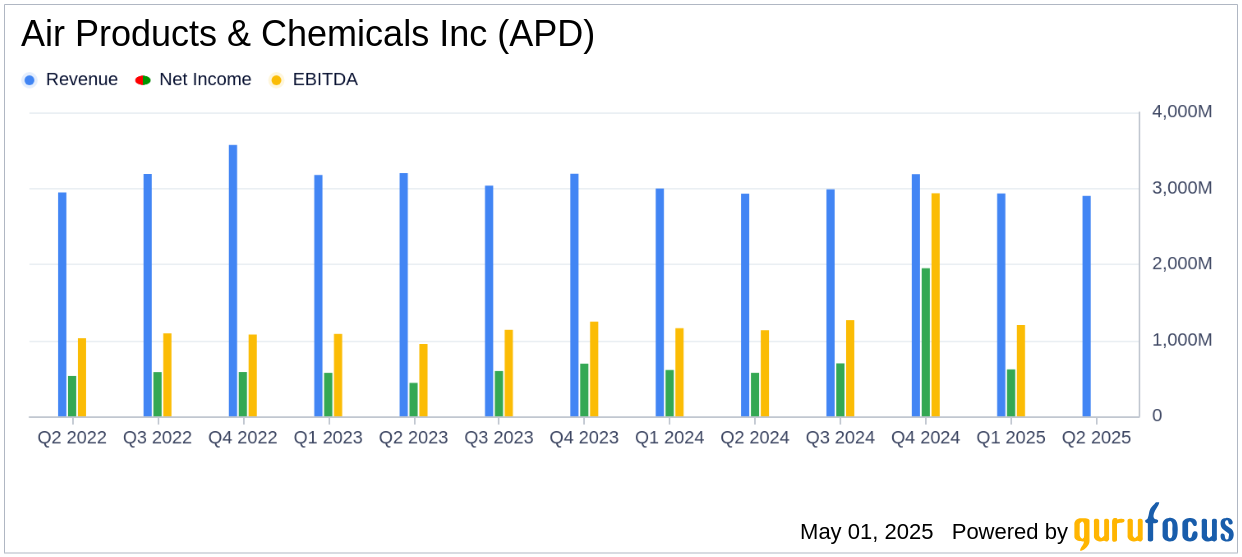

The fiscal 2025 second quarter results reflect a challenging period for Air Products & Chemicals Inc (APD, Financial), marked by strategic exits from several U.S. projects and a global cost reduction plan. These actions resulted in substantial charges, impacting the company's financial performance. The adjusted EPS of $2.69, although a non-GAAP measure, highlights the underlying business performance excluding these strategic charges. However, it still represents a 6% decrease from the prior year, driven by lower volumes and higher costs.

Financial Achievements and Industry Importance

Despite the challenges, Air Products & Chemicals Inc (APD, Financial) achieved an adjusted EBITDA of $1.2 billion, albeit a 3% decline from the previous year. The company's ability to maintain a strong EBITDA is crucial in the chemicals industry, where operational efficiency and cost management are key to sustaining profitability. The increase in quarterly dividends to $1.79 per share, marking the 43rd consecutive year of dividend increases, underscores the company's commitment to returning value to shareholders.

Key Financial Metrics

Second quarter sales were $2.9 billion, flat compared to the previous year. The sales performance was influenced by a 4% higher energy cost pass-through and a 1% increase in pricing, offset by a 3% decline in volumes and a 2% unfavorable currency impact. The company's balance sheet shows total assets of $38.9 billion, with a notable decrease in cash and cash items from $2.98 billion to $1.49 billion, reflecting significant cash outflows for strategic actions and investments.

| Metric | Q2 FY25 | Q2 FY24 |

|---|---|---|

| Sales | $2,916.2 million | $2,930.2 million |

| Net Income (Loss) | ($1,737.5 million) | $580.9 million |

| Adjusted EPS | $2.69 | $2.57 |

Segment Performance

In the Americas, sales increased by 3% to $1.3 billion, driven by higher energy cost pass-through and pricing. However, operating income decreased by 2% due to higher maintenance costs. In Asia, sales slightly decreased by 1% to $774 million, with operating income down by 6% due to lower helium pricing and currency impacts. Europe saw a 9% increase in sales to $727 million, but operating income fell by 3% due to higher costs and unfavorable business mix.

Analysis and Outlook

The strategic decisions taken by Air Products & Chemicals Inc (APD, Financial) to exit certain projects and implement cost reduction measures are aimed at streamlining operations and focusing on high-value projects. While these actions have led to significant charges in the short term, they are expected to position the company for long-term growth. The revised full-year adjusted EPS guidance of $11.85 to $12.15 reflects management's confidence in the company's underlying business performance.

Explore the complete 8-K earnings release (here) from Air Products & Chemicals Inc for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10