Ethereum Finally Shows Signs of Life as Retail Sentiment Improves

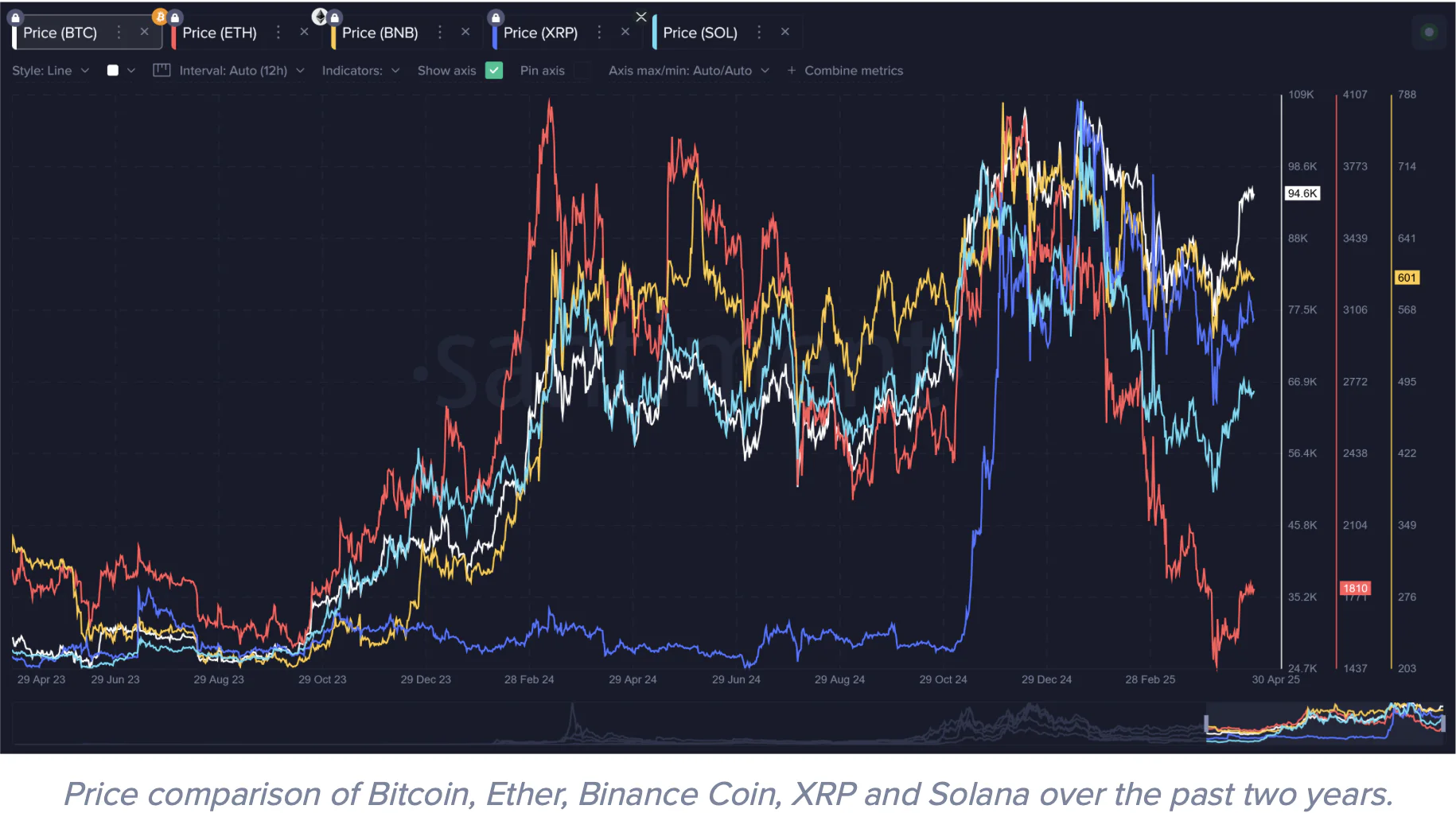

Long overshadowed by Bitcoin (BTC), Solana (SOL), XRP, and Binance Coin (BNB), Ether has seen its market relevance shrink, particularly in social conversations. Since March 2024, ETH has struggled to keep pace with other top-cap assets — as shown in comparative performance charts, where ETH (in red) lags behind.

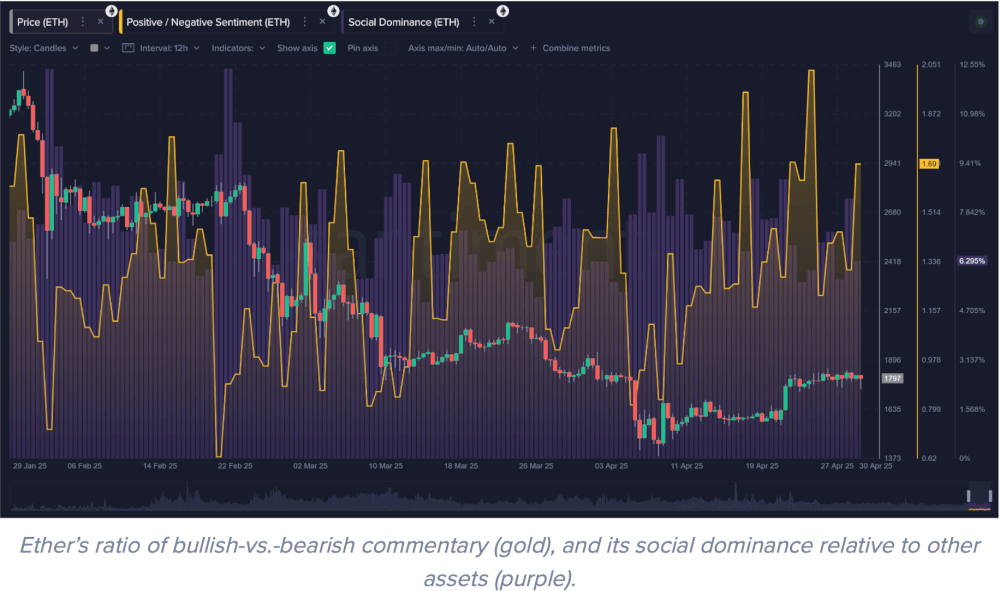

During the 2022–2023 cycle, Ethereum averaged about 10% of all top 100 asset discussions. Fast forward to 2025, and that number has declined to around 6–7%, marking a significant shift in market attention.

Sentiment Flips Bullish as Vitalik Speaks Out

Despite the slump, ETH sentiment is now turning a corner. After bottoming out earlier this month, bullish social media commentary on Ether has begun to outweigh bearish takes, signaling a cautious return of investor confidence.

Data from Santiment illustrates:

- Gold line = Bullish vs. bearish sentiment for Ethereum

- Purple bars = Ethereum’s share of crypto-related discussions

The post Ethereum Finally Shows Signs of Life as Retail Sentiment Improves appeared first on Coindoo.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10