Atlassian Corp (NASDAQ:TEAM) posted upbeat fiscal third-quarter results but issued weak sales guidance for the fourth quarter on Thursday.

Atlassian reported third-quarter revenue of $1.36 billion, beating analyst estimates of $1.35 billion. The collaboration and productivity software provider reported third-quarter adjusted earnings of 97 cents per share, beating analyst estimates of 87 cents per share.

"Our long-term investments in building a world-class Cloud platform have enabled us to advance the Atlassian System of Work and bring Rovo's powerful AI capabilities to the center," said Mike Cannon-Brookes, co-founder and CEO of Atlassian.

Atlassian said it expects fourth-quarter revenue to be in the range of $1.35 billion to $1.36 billion versus estimates of $1.42 billion. The company anticipates cloud revenue growth of 23% and data center growth of 16.5% on a year-over-year basis in the fourth quarter. Marketplace and other revenue is expected to be approximately flat.

Atlassian also guided for full-year 2025 revenue of $5.19 billion versus estimates of $5.18 billion, according to Benzinga Pro.

Atlassian shares fell 7.2% to trade at $212.42 on Friday.

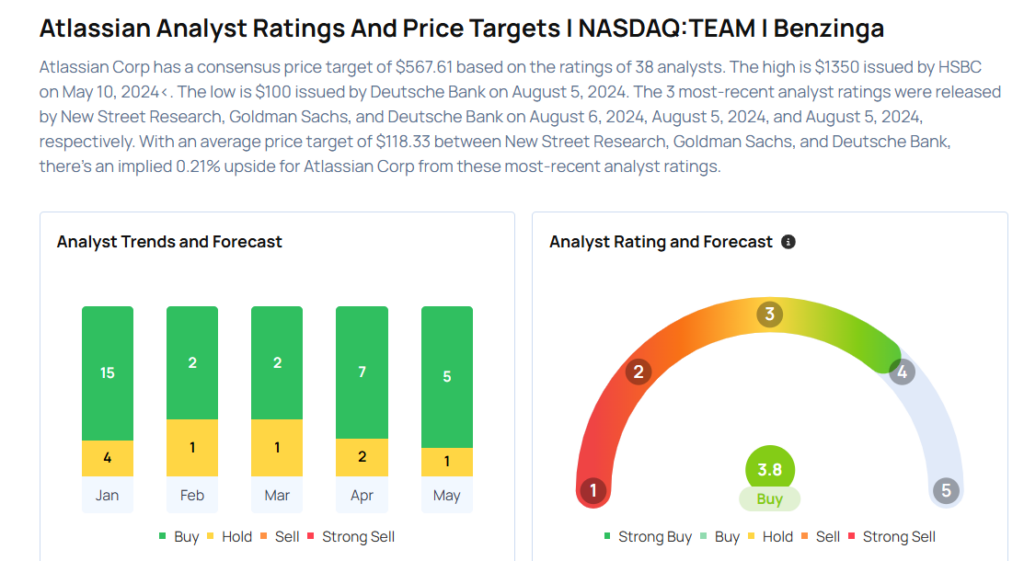

These analysts made changes to their price targets on Atlassian following earnings announcement.

- Piper Sandler analyst Rob Owens reiterated Atlassian with an Overweight rating and lowered the price target from $365 to $300.

- Macquarie analyst Steve Koenig maintained the stock with an Outperform rating and lowered the price target from $270 to $250.

- Canaccord Genuity analyst David Hynes maintained Atlassian with a Buy and cut the price target from $300 to $255.

- Raymond James analyst Adam Tindle reiterated Atlassian with an Outperform rating and lowered the price target from $330 to $300.

- Stephens & Co. analyst Brett Huff maintained the stock with an Equal-Weight rating and lowered the price target from $255 to $221.

- Wells Fargo analyst Michael Turrin maintained Atlassian with an Overweight rating and lowered the price target from $330 to $315.

Considering buying TEAM stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From Tyson Foods Stock Ahead Of Q2 Earnings

Photo via Shutterstock