Honeywell International Inc. (NASDAQ:HON) reported better-than-expected first-quarter financial results and raised its FY25 adjusted EPS guidance on Tuesday.

Revenue grew 8% year-over-year (Y/Y, organic: +4% Y/Y) to $9.82 billion, beating the consensus of $9.59 billion. Adjusted EPS was $2.51 (+7% Y/Y), beating the consensus of $2.21.

Honeywell declared a quarterly dividend per share of $1.13, payable on June 6, 2025, out of surplus to holders of record as of business on May 16, 2025.

For FY25, Honeywell revised its adjusted EPS guidance to $10.20-$10.50, from $10.10-$10.50 earlier (vs. consensus of $10.29) and sales guidance to $39.60 billion-$40.50 billion (from the prior $39.60 billion-$40.60 billion) compared to street view of $40.27 billion.

Honeywell anticipates second-quarter adjusted EPS of $2.60-$2.70, (vs. consensus of $2.56) and sales of $9.80 billion-$10.10 billion, slightly below the street view of $10.17 billion.

"Despite the volatile macroeconomic backdrop, we maintained segment margin consistent with last year, which is a testament to the value delivered by our Accelerator operating system," said Honeywell chairman and CEO Vimal Kapur.

Honeywell shares fell 0.9% to trade at $209.65 on Wednesday.

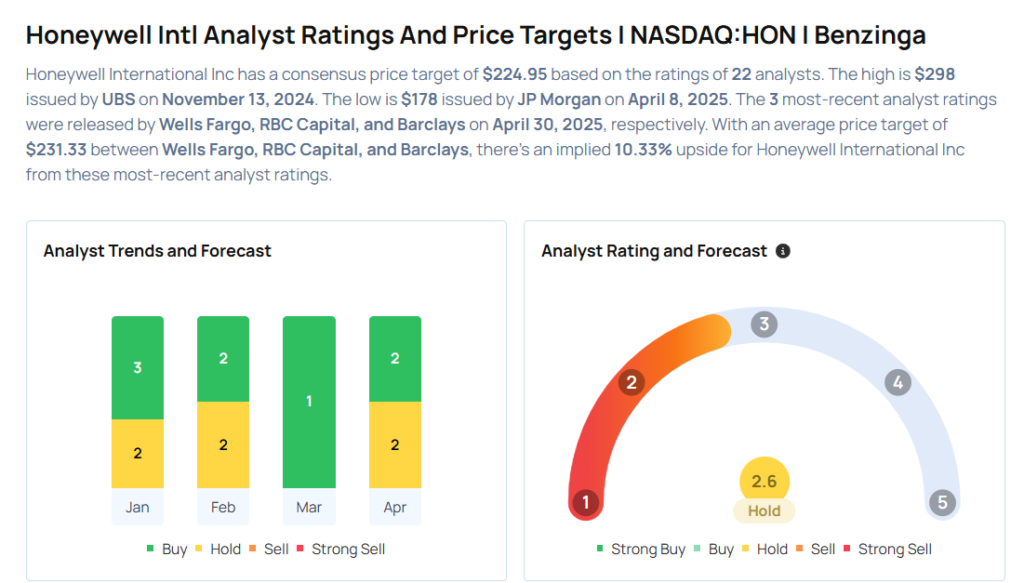

These analysts made changes to their price targets on Honeywell following earnings announcement.

- Barclays analyst Julian Mitchell maintained Honeywell Intl with an Overweight rating and lowered the price target from $247 to $243.

- RBC Capital analyst Deane Dray maintained Honeywell with a Sector Perform rating and raised the price target from $211 to $226.

- Wells Fargo analyst Joseph O’Dea maintained the stock with an Equal-Weight rating and raised the price target from $205 to $225.

Considering buying HON stock? Here’s what analysts think:

Read This Next:

- Top 3 Industrials Stocks Which Could Rescue Your Portfolio In Q2

Photo via Shutterstock