Arm Holdings PLC – ADR (NASDAQ:ARM) reported better-than-expected fourth-quarter earnings, but issued FY26 guidance below estimates.

Arm Holdings reported quarterly earnings of 55 cents per share, which beat the analyst consensus estimate of 52 cents. Quarterly revenue came in at $1.24 billion, which beat the consensus estimate of $1.23 billion.

“Arm delivered record-breaking results for both the fourth quarter and the full fiscal year ending 2025. We surpassed $1 billion in revenue for the first time in Q4, driven by increased deployment of our CSS platforms across AI data center, cloud compute and mobile. As AI growth from the cloud to the edge creates demand for more energy-efficient compute, Arm will enable AI everywhere," said Rene Haas, CEO of Arm Holdings.

Arm said it sees fiscal 2026 EPS in a range of $1.56 to $1.64, versus the $2.03 estimate, and revenue in a range of $3.94 billion to $4.04 billion, versus the $4.91 billion analyst estimate.

Arm Holdings shares fell 5.6% to trade at $117.09 on Thursday.

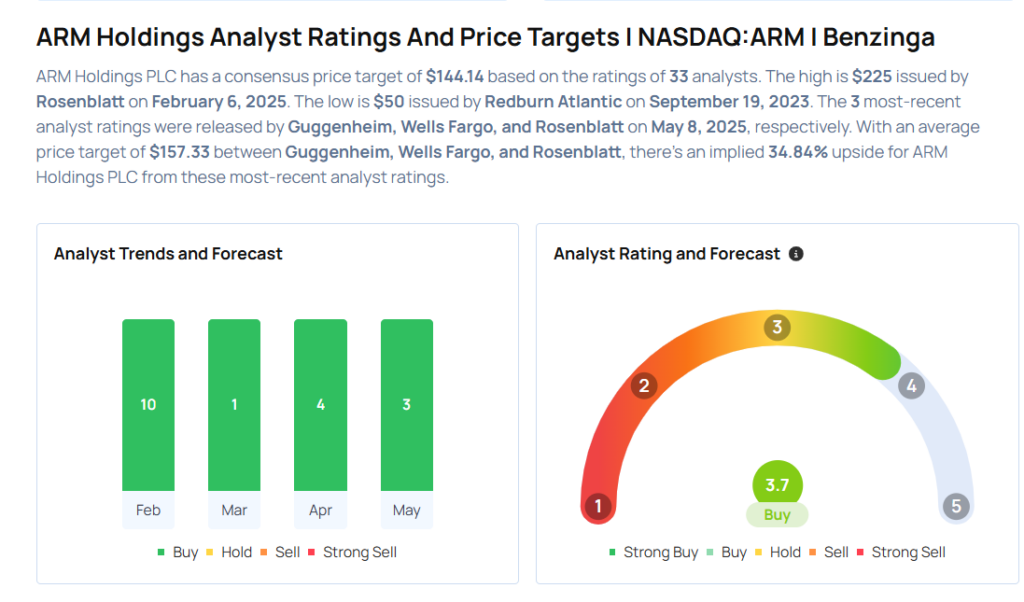

These analysts made changes to their price targets on Arm Holdings following earnings announcement.

- Guggenheim analyst John Difucci maintained ARM with a Buy and lowered the price target from $180 to $147.

- Wells Fargo analyst Joe Quatrochi maintained the stock with an Overweight rating and lowered the price target from $150 to $145.

- Rosenblatt analyst Kevin Cassidy maintained ARM Holdings with a Buy and lowered the price target from $203 to $180.

Considering buying ARM stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From McKesson Stock Ahead Of Q4 Earnings

Photo via Shutterstock