Verisk Analytics (VRSK) Q1 2025 Earnings: EPS of $1.65 Beats Estimate, Revenue Hits $753 Million Surpassing Expectations

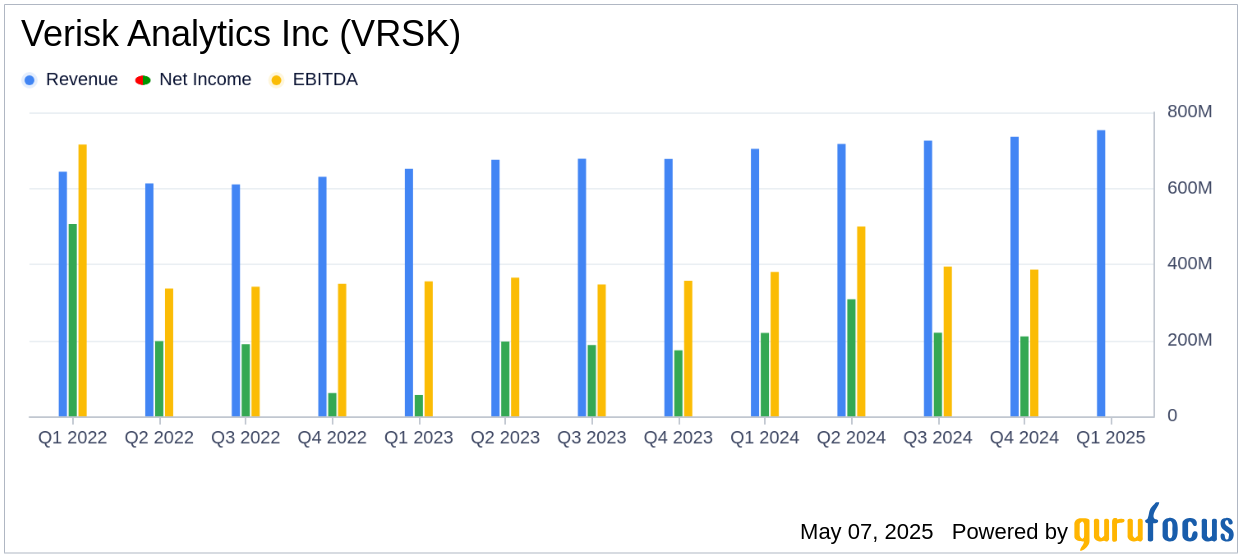

On May 7, 2025, Verisk Analytics Inc (VRSK, Financial) released its 8-K filing for the first quarter of 2025, showcasing a robust financial performance that exceeded analyst expectations. Verisk, a leading provider of data analytics and technology solutions for the insurance industry, reported a revenue of $753 million, marking a 7.0% increase from the previous year and surpassing the estimated revenue of $749.81 million. The company's net income rose by 5.9% to $232 million, while diluted GAAP earnings per share (EPS) increased by 8.6% to $1.65, exceeding the estimated EPS of $1.59.

Company Overview

Verisk Analytics Inc (VRSK, Financial) is a prominent player in the data analytics and technology sector, primarily serving the property and casualty insurance industry in the United States. The company leverages extensive databases and proprietary data assets to develop analytical tools that assist insurance providers in risk assessment, operational efficiency, and claims settlement optimization. Verisk is also expanding its reach into life insurance, marketing, and international markets.

Performance Highlights and Challenges

Verisk's performance in the first quarter of 2025 underscores its ability to deliver consistent growth and profitability. The company's revenue growth of 7.9% on an organic constant currency (OCC) basis highlights its resilience in an uncertain risk environment. However, challenges such as fluctuating foreign exchange rates and the need for continuous innovation to stay ahead in the competitive analytics market remain pertinent.

Financial Achievements and Industry Significance

Verisk's financial achievements are significant for the business services industry, as they demonstrate the company's capability to generate substantial returns while investing in innovation. The adjusted EBITDA, a non-GAAP measure, increased by 9.5% to $417 million, reflecting strong operational efficiency. This growth is crucial for maintaining Verisk's competitive edge and supporting its strategic initiatives.

Key Financial Metrics

The income statement reveals a notable increase in diluted adjusted EPS, a non-GAAP measure, which rose by 6.1% to $1.73. This metric is important as it provides a clearer picture of the company's profitability by excluding non-recurring items. Additionally, Verisk's net cash provided by operating activities surged by 19.5% to $445 million, and free cash flow increased by 23.3% to $391 million, underscoring the company's strong cash generation capabilities.

Lee Shavel, President and CEO of Verisk, stated, "I am pleased to share that 2025 is off to a solid start at Verisk as we delivered broad-based top line growth across underwriting and claims and healthy profit growth."

Analysis and Outlook

Verisk's strong start to 2025, characterized by revenue and profit growth, positions the company well for continued success. The strategic focus on supporting clients with insights and solutions that enhance efficiency and automation is likely to drive further growth. The company's commitment to returning over $250 million to shareholders through dividends and repurchases reflects confidence in its business model and financial strength.

Overall, Verisk Analytics Inc (VRSK, Financial) has demonstrated a robust financial performance in the first quarter of 2025, surpassing analyst estimates and reinforcing its position as a leader in the data analytics and technology sector. For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Verisk Analytics Inc for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10