Arthur Hayes Emphasizes Treasury Over Fed for Bitcoin's Future

- Investors should focus on the US Treasury's actions over the Federal Reserve.

- Treasury uses repurchase agreements and auctions to manage US debt.

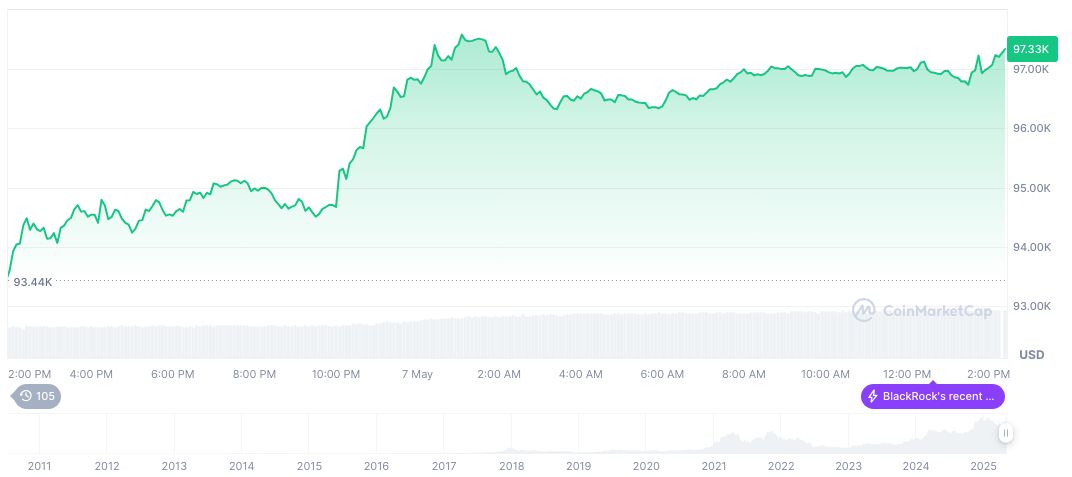

- Bitcoin approaches a significant milestone of $100,000.

Investors are advised to concentrate on the US Treasury's actions rather than the Federal Reserve's frequent announcements. Hayes emphasizes Yellen's techniques in managing liquidity through repurchase agreements and auctions to handle expanding US debt.

Following Hayes's remarks, several key market participants emphasized how the Treasury's maneuvers could lead to substantial changes in liquidity, impacting global finance. Numerous industry experts are considering Hayes's views as Bitcoin approaches the $100,000 mark.

US Treasury's Role in Bitcoin's Path to $1 Million

Arthur Hayes of BitMEX recently drew attention to the US Treasury's evolving role in global monetary policy, suggesting a shift away from the Federal Reserve. He argues that the Treasury's strategies, under Secretary Yellen, shape global liquidity significantly.

In past financial climates, such as the 2008 crisis, the Treasury's financial policies significantly influenced global liquidity, impacting multiple asset classes, including cryptocurrencies.

Bitcoin could break $1 million USD by the close of the decade. - Arthur Hayes

Market Data and Insights

Did you know? The US Treasury's actions have historically influenced various asset classes, including cryptocurrencies, during financial crises.

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $99,679.79, with a market cap of $1.98 trillion, reflecting its dominant role in the crypto market at 64.12%. The 24-hour trading volume surged by 67.10%, reaching $53.80 billion. Recent price changes include a 2.76% increase over 24 hours and a 25.94% rise over 30 days.

Insights from the Coincu research team highlight that the active financial strategies and partnerships between the US and China could bolster Bitcoin's trajectory, supporting Hayes's predictions. Market trends, combined with easing global tensions, may propel Bitcoin to new heights.

Read original article on coincu.comDisclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10