Electronic Arts, Inc. (NASDAQ:EA) posted better-than-expected earnings for the fourth quarter on Tuesday.

Electronic Arts reported quarterly earnings of $1.58 per share, which beat the analyst consensus estimate of $1.09. Quarterly revenue clocked in at $1.8 billion, beating the consensus estimate of $1.56 billion.

"The incredible success of College Football and the enduring strength of FC drove another record year for EA SPORTS, while The Sims capped FY25 with a historic Q4," said Andrew Wilson, CEO of Electronic Arts.

The company expects fiscal year 2026 net bookings to be approximately $7.6 billion to $8 billion and net revenue to be approximately $7.1 billion to $7.5 billion.

Electronic Arts shares gained 0.3% to trade at $155.02 on Wednesday.

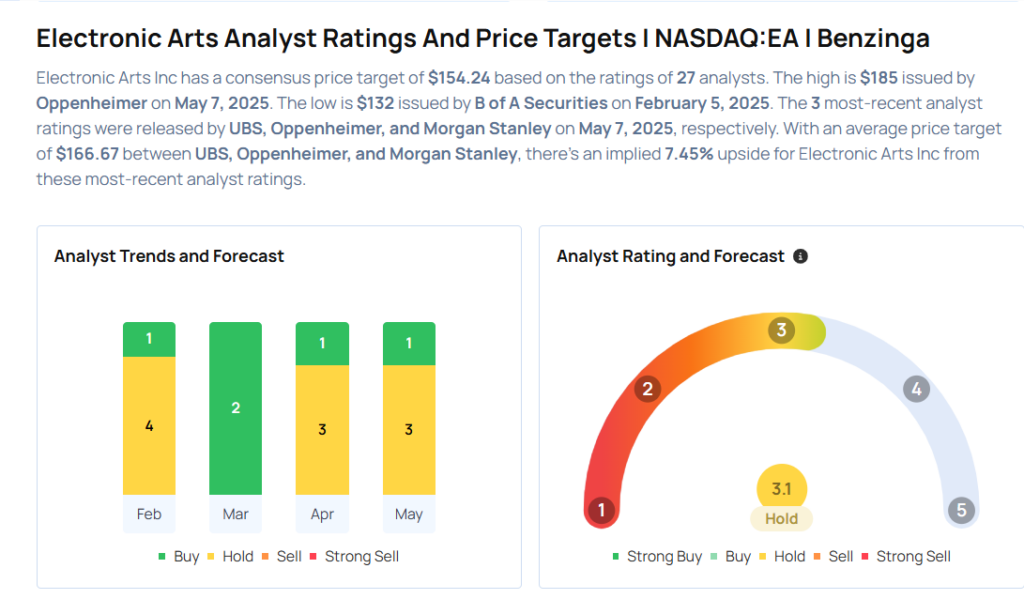

These analysts made changes to their price targets on Electronic Arts following earnings announcement.

- JP Morgan analyst David Karnovsky maintained Electronic Arts with a Neutral and raised the price target from $135 to $160.

- Morgan Stanley analyst Brian Nowak maintained the stock with an Equal-Weight rating and raised the price target from $135 to $148.

- Oppenheimer analyst Martin Yang maintained Electronic Arts with an Outperform rating and increased the price target from $170 to $185.

- UBS analyst Eric Sheridan maintained the stock with a Neutral and raised the price target from $152 to $167.

Considering buying EA stock? Here’s what analysts think:

Read This Next:

- Top 3 Financial Stocks That May Plunge In May

Photo via Shutterstock