Astera Labs, Inc. (NASDAQ:ALAB) reported better-than-expected earnings for the first quarter on Tuesday.

The company posted quarterly earnings of 33 cents per share which beat the analyst consensus estimate of 28 cents per share. The company reported quarterly sales of $159.44 million which beat the analyst consensus estimate of $153.13 million.

“Astera Labs started the year strong, with Q1 revenue growing 13% sequentially and 144% year-over-year, and exceeding our first quarter guidance for gross margin and earnings per share,” said Jitendra Mohan, Astera Labs’ Chief Executive Officer. “Our design wins across AI platforms, expanding portfolio with increasing value for customers, and significant traction with Scorpio fabric solutions strategically position us as a critical connectivity supplier for the entire AI rack. During the quarter, we saw strong demand for PCIe scale-up and Ethernet scale-out connectivity solutions in custom ASIC platforms, along with initial shipments for Scorpio P-Series and Aries 6 Retimers for merchant GPU-based platforms. These factors and new opportunities for scale-up interconnects boost our confidence in accelerating R&D development to further strengthen our connectivity platform and to deliver results that outpace industry growth.”

Astera Labs said it sees second-quarter adjusted earnings of 32 cents to 33 cents per share, versus market estimates of 30 cents per share. The company expects sales of $170.000 million-$175.000 million versus estimates of $160.29 million.

Astera Labs shares dipped 5.4% to trade at $67.52 on Wednesday.

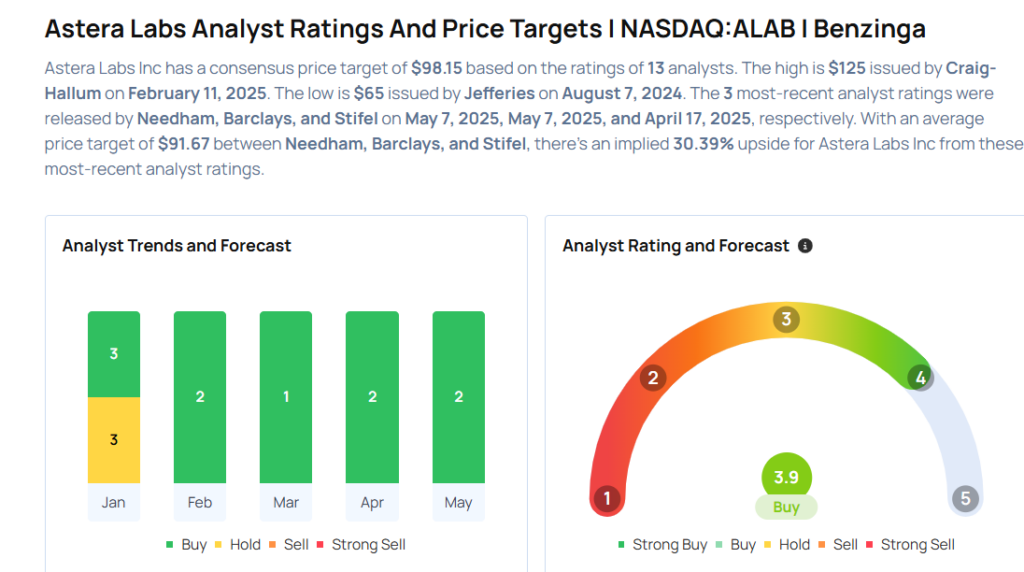

These analysts made changes to their price targets on Astera Labs following earnings announcement.

- Barclays analyst Tom O’Malley maintained Astera Labs with an Overweight rating and raised the price target from $70 to $75.

- Needham analyst Quinn Bolton maintained the stock with a Buy and lowered the price target from $140 to $100.

Considering buying ALAB stock? Here’s what analysts think:

Read This Next:

- Top 2 Energy Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock