Zimmer Biomet Holdings Inc Q1 2025 Earnings: Revenue Surpasses Estimates at $1.909 Billion, EPS Falls Short at $0.91

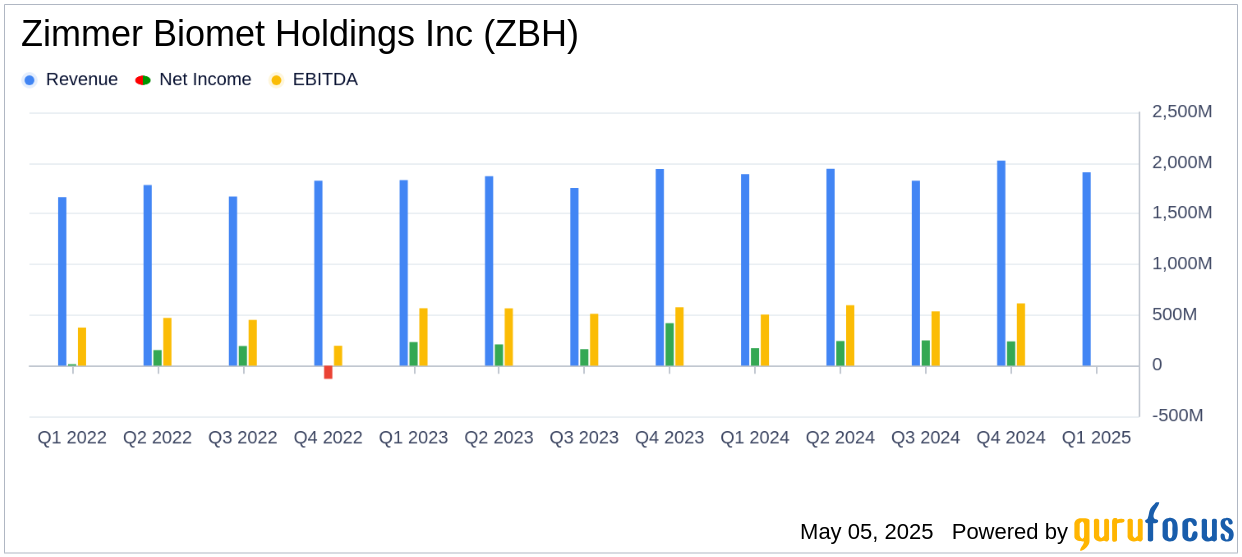

On May 5, 2025, Zimmer Biomet Holdings Inc (ZBH, Financial) released its 8-K filing detailing the financial results for the first quarter of 2025. The company, a leader in orthopedic reconstructive implants and surgical equipment, reported net sales of $1.909 billion, surpassing the analyst estimate of $1,895.32 million. However, the diluted earnings per share (EPS) of $0.91 fell short of the estimated $1.05.

Company Overview

Zimmer Biomet designs, manufactures, and markets orthopedic reconstructive implants and surgical equipment. With significant acquisitions such as Centerpulse in 2003 and Biomet in 2015, Zimmer Biomet holds a leading market share in the United States, Europe, and Japan. The company generates approximately two-thirds of its revenue from large joint sales, with the remainder coming from extremities, trauma, sports medicine, and related surgical products. In 2022, Zimmer Biomet spun out its dental and spine businesses.

Performance and Challenges

Zimmer Biomet's Q1 2025 net sales increased by 1.1% year-over-year, with a 2.3% rise on a constant currency basis. Despite the revenue growth, the company's EPS of $0.91 was below the analyst estimate of $1.05, indicating challenges in cost management or operational efficiency. The adjusted EPS, however, was $1.81, reflecting the company's efforts to manage non-recurring expenses and operational adjustments.

Financial Achievements

The company's financial achievements include a 1.3% increase in U.S. sales and a 3.7% rise in international sales on a constant currency basis. The acquisition of Paragon 28, a company focused on the foot and ankle orthopedic segment, is expected to bolster Zimmer Biomet's position in this high-growth area. The company also showcased innovations at the 2025 American Academy of Orthopaedic Surgeons annual meeting, highlighting its commitment to advancing orthopedic solutions.

Income Statement Highlights

Zimmer Biomet reported an operating profit of $292.3 million, up from $265.9 million in the same period last year. The net earnings attributable to Zimmer Biomet Holdings Inc were $182.0 million, compared to $172.4 million in Q1 2024. The company's cost of products sold increased to $549.8 million from $512.3 million, reflecting higher production costs or changes in product mix.

Geographic and Product Category Sales

| Category | Net Sales (in millions) | % Change | Constant Currency % Change |

|---|---|---|---|

| United States | $1,113.6 | 1.3% | 1.3% |

| International | $795.5 | 0.7% | 3.7% |

| Knees | $792.9 | 0.6% | 1.9% |

| Hips | $495.8 | 0.9% | 2.4% |

| S.E.T. | $470.5 | 3.9% | 4.9% |

Analysis and Strategic Outlook

Zimmer Biomet's strategic initiatives, including the acquisition of Paragon 28 and the introduction of new products, are poised to drive future growth. The company's focus on innovation and diversification is evident in its recent product launches and FDA clearances. However, the lower-than-expected EPS highlights the need for continued focus on cost management and operational efficiency.

“We are proud of our team’s continued execution and performance to start the year, as we delivered solid first quarter results and advanced our bold innovation agenda,” said Ivan Tornos, Zimmer Biomet’s President and Chief Executive Officer.

Overall, Zimmer Biomet's Q1 2025 results reflect a company in transition, balancing growth initiatives with the challenges of maintaining profitability in a competitive market. The company's updated guidance for 2025, including the impact of the Paragon 28 acquisition, suggests a positive outlook for the remainder of the year.

Explore the complete 8-K earnings release (here) from Zimmer Biomet Holdings Inc for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10