Ethereum’s stablecoin market cap jumps 1m-fold since the first time ETH reached $1,4k 5 seconds ago

The total stablecoin market cap in the Ethereum ecosystem has jumped approximately 1 million-fold since the token reached $1,400 for the first time in January 2018.

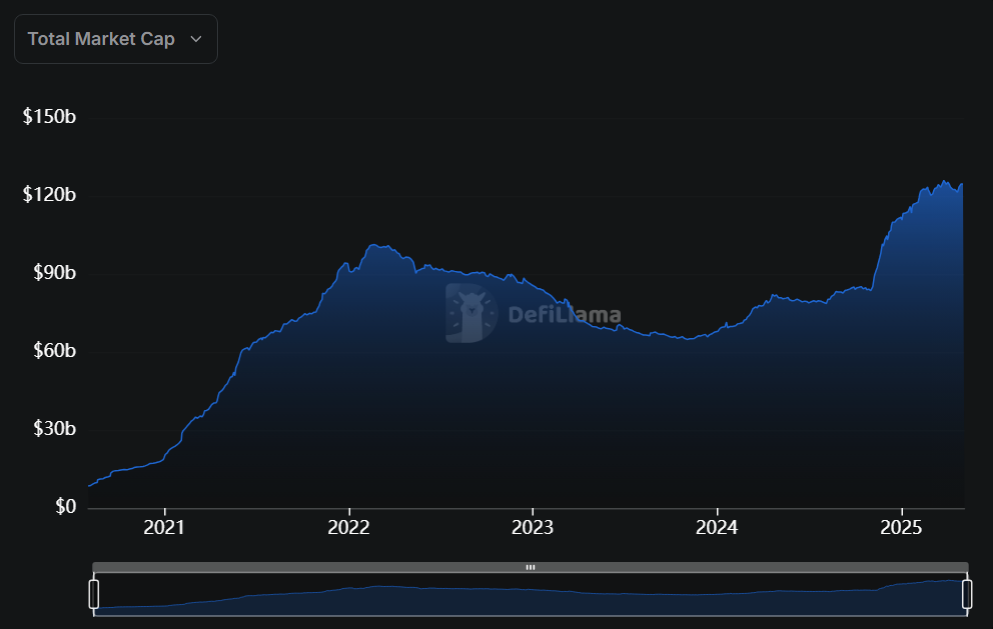

According to data on DeFi Llama, the ETH (ETH) stablecoin market cap has gone up to around $124.5 billion on May 6. However, it has declined by 0.08% or around $100 million in the past week.

In January 2018, when ETH hit $1,400 for the first time in history, its stablecoin market cap sat at a measly $124,500. Despite its meager beginnings compared to its current state, it was enough to cement Ethereum’s place as the second-largest cryptocurrency by market cap, falling behind only to Bitcoin (BTC).

At press time, Tether (USDT) continues to contribute the majority of ETH’s stablecoin market cap, making up around 52% of the ecosystem’s total stablecoin market cap or equal to around $64.7 billion from the $124.5 billion total.

On the other hand, USD Coin (USDC) injects $37 billion in market cap to the ETH ecosystem, followed by Ethena’s USDe (USDE) which makes up $4.5 billion of the total stablecoin market cap. Fourth and fifth place are occupied by Sky Dollar’s USDS and Dai’s DAI (DAI), contributing around $3.8 billion and $3.6 billion in stablecoin market cap respectively.

At press time, ETH itself has dipped slightly by 0.89% in the past 24 hours. It is currently trading hands at $1,804, having jumped more than 10.9% in the past two weeks. ETH’s market cap stands at more than $216 billion, with a daily trading volume reaching $9.2 billion. This marks a slight 4.10% increase in trading volume compared to the previous day of trading, indicating a rise in market activity.

As preciously reported by crypto.news, Ethereum is preparing to launch is next major upgrade this month. The upgrade is set to introduce a number of changes aimed at boosting on-chain scalability, improving user experience, and enhancing validator efficiency through EIP-7251’s maximum stake adjustment from from 32 ETH to 2,048 ETH.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10