Eaton Corporation (NYSE:ETN) reported better-than-expected first-quarter 2025 results on Friday.

Revenue rose 7% year-over-year (Y/Y) to $6.38 billion, beating the consensus of $6.26 billion. Organic sales growth grew 9% Y/Y. Adjusted EPS rose 13% Y/Y to $2.72, beating the consensus of $2.71.

Paulo Ruiz, Eaton president and chief operating officer, said, "Demand in our end markets continues to drive strong organic growth. As we look ahead, we're confident, even amid broader macroeconomic volatility, we're prepared to meet that demand with a proven strategy to invest in our businesses, drive operational excellence and continue our path of growth."

For 2025, Eaton reiterated adjusted EPS of $11.80 – $12.20 vs. $11.97 consensus estimate. The company revised its organic growth outlook to 7.5%-9.5% from 7% – 9% in the prior year quarter.

For the second quarter, the company expects organic growth of 6%-8% and adjusted EPS of $2.85-$2.95, compared to the street view of $2.98.

Eaton shares gained 0.4% to trade at $299.95 on Monday.

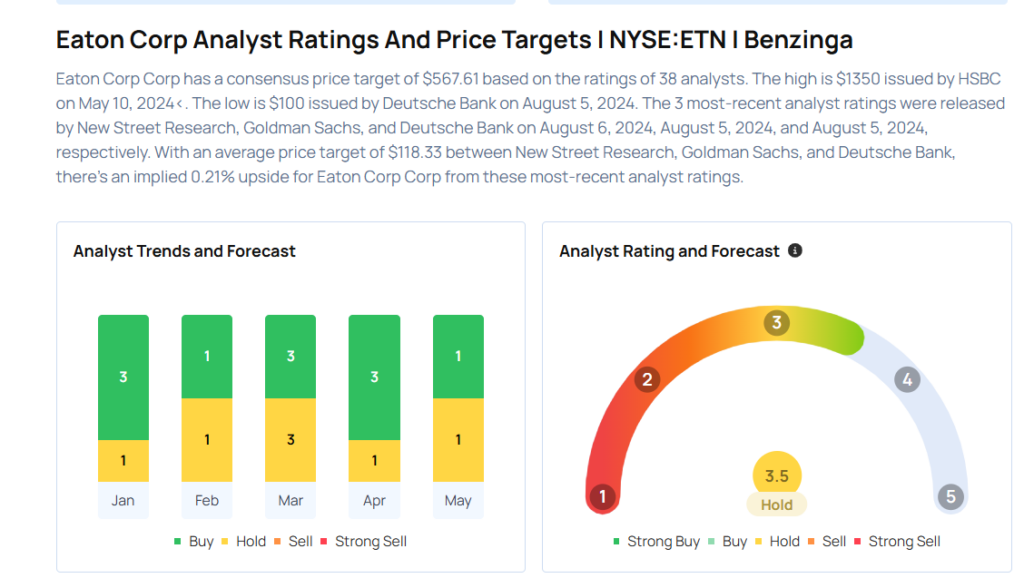

These analysts made changes to their price targets on Eaton following earnings announcement.

- Wells Fargo analyst Joseph O’Dea maintained Eaton with an Equal-Weight rating and raised the price target from $270 to $310.

- Keybanc analyst Jefferson Harralson maintained the stock with an Overweight rating and raised the price target from $325 to $355.

Considering buying ETN stock? Here’s what analysts think:

Read This Next:

- Top 3 Tech And Telecom Stocks That May Jump This Quarter

Photo via Shutterstock