Criteo S.A. (NASDAQ:CRTO) reported upbeat earnings for the first quarter on Friday.

The company posted quarterly earnings of $1.10 per share which beat the analyst consensus estimate of $0.77 per share. The company reported quarterly sales of $264.00 million which beat the analyst consensus estimate of $259.14 million.

“Our results this quarter demonstrate strong execution and a solid foundation to build on,” said Michael Komasinski, Chief Executive Officer of Criteo. “Criteo sits at the center of commerce and media, a powerful combination. I’m excited about our opportunities ahead and confident in our ability to deliver long-term value for our shareholders.”

Criteo said it sees second-quarter sales of $272 million to $278 million versus estimates of $276.01 million. The company also expects adjusted EBITDA of $60 million to $66 million for the quarter.

Criteo shares dipped 6.7% to trade at $27.51 on Monday.

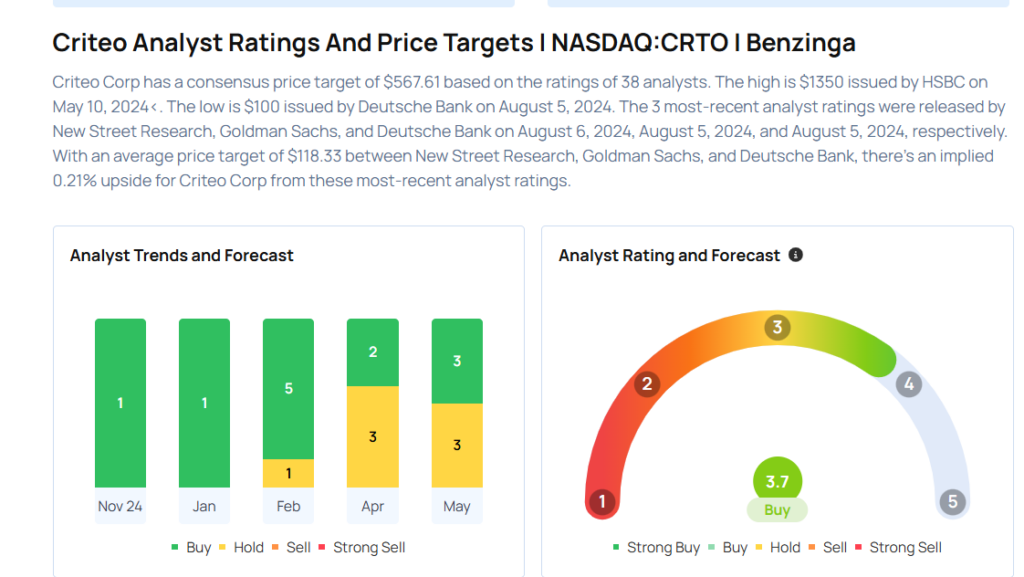

These analysts made changes to their price targets on Criteo following earnings announcement.

- Susquehanna analyst Shyam Patil maintained Criteo with a Neutral and lowered the price target from $38 to $30.

- Wells Fargo analyst Alec Brondolo maintained the stock with an Overweight rating and lowered the price target from $66 to $54.

- BMO Capital analyst Brian Pitz maintained Criteo with an Outperform rating and lowered the price target from $60 to $49.

- Morgan Stanley analyst Brian Nowak maintained the stock with an Equal-Weight rating and lowered the price target from $40 to $36.

- JP Morgan analyst Doug Anmuth maintained Criteo with a Neutral and lowered the price target from $39 to $27.

Considering buying CRTO stock? Here’s what analysts think:

Read This Next:

- Top 3 Tech And Telecom Stocks That May Jump This Quarter

Photo via Shutterstock