Lucid Group Inc. (NASDAQ:LCID) shared a comprehensive list of updates as well as forecasts at the Q1 2025 earnings call with investors.

What Happened: The EV maker announced $235 million in revenue, which, despite being a 36% YoY increase when compared to Q1 2024, was lower than the estimated $246 million. Lucid also announced -$0.20 Earnings Per Share (EPS), beating Wall Street estimates, the company reported at the earnings call on Tuesday evening.

"We delivered 3,109 vehicles, up more than 58% year over year and our fifth consecutive quarter of record deliveries," CEO Marc Winterhoff said. Winterhoff also highlighted a 28% YoY increase in production as the company produced 2,212 vehicles.

Lucid also experienced an increase in gross margins for the quarter. "On a GAAP basis, Q1 gross margin was negative 97.2%, up from negative 134.3% in the prior year quarter," Lucid's CFO, Tafiq Boussaid, shared with investors.

He also outlined an 8-15% impact on margins due to the uncertainties raised by U.S. President Donald Trump's tariffs. The company has also set a target of producing 20,000 units in 2025.

The company also shared its plans to develop a mid-size platform slated to enter production in 2026. "We are working right now with a very strong focus on midsize," Winterhoff said in the call.

Why It Matters: The updates outline what was a successful quarter for the company, which also recently acquired some assets from EV Trucking company Nikola Corp, as well as hiring over 300 employees of the company.

Lucid, which is owned by Saudi Arabia's Sovereign Wealth Fund PIF, had also raised over $1 billion via convertible senior notes earlier this year.

Lucid also partnered up with KAUST, or King Abdullah University of Science and Technology, to develop advanced autonomous driving capabilities as well as AI hardware.

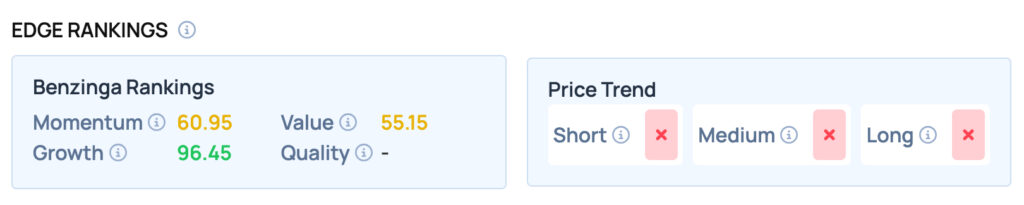

LCID scores well on the Growth metric and has satisfactory scores on the Momentum and Value metrics. For more such insights, sign up for Benzinga Edge today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

- Rivian Holds Firm On $45K Price For Upcoming R2 Despite Tariff Pressures: CEO RJ Scaringe Says It’s ‘Important For Us’ As EV Maker Tops Q1 Estimates

Photo courtesy: Ian Dewar Photography / Shutterstock.com