Coterra Energy Inc (CTRA) Q1 2025 Earnings: EPS of $0.80 Beats Estimate, Revenue Performance Strong

On May 5, 2025, Coterra Energy Inc (CTRA, Financial) released its 8-K filing detailing its first-quarter 2025 financial results. The company, an independent oil and gas entity, focuses on the development, exploration, and production of oil, natural gas, and natural gas liquids (NGLs) across key regions such as the Permian Basin, Marcellus Shale, and Anadarko Basin.

Performance Overview and Strategic Adjustments

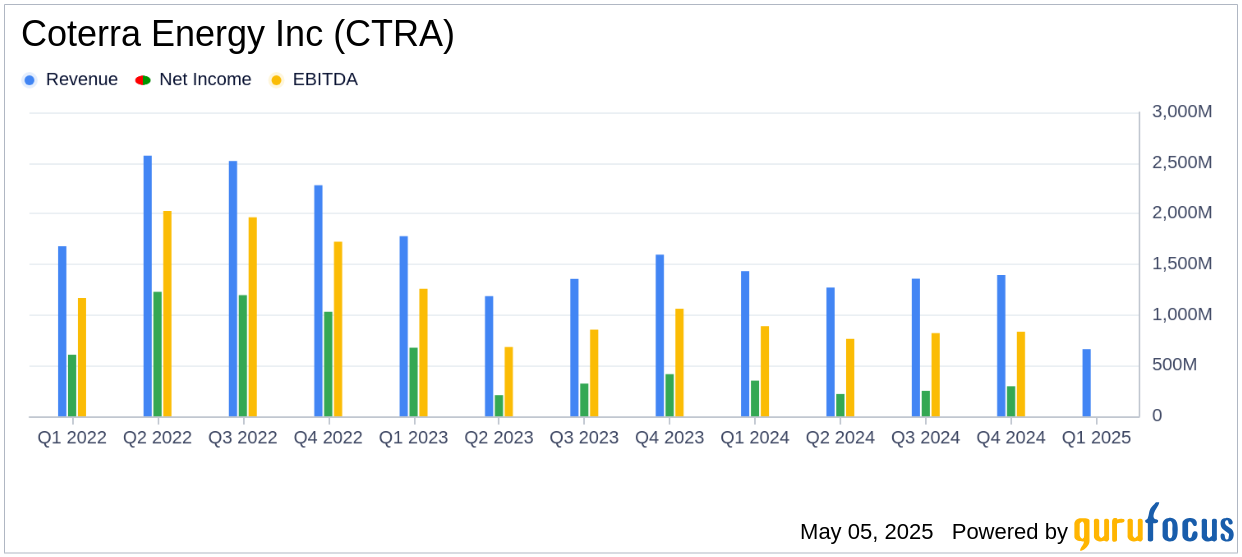

Coterra Energy Inc (CTRA, Financial) reported a net income of $516 million, or $0.68 per share, for the first quarter of 2025. The adjusted net income, a non-GAAP measure, was $608 million, or $0.80 per share, surpassing the analyst estimate of $0.76 per share. This performance highlights the company's ability to navigate the challenging macroeconomic environment and oil price headwinds.

In response to these challenges, Coterra has strategically reduced its oil-directed activities, particularly in the Permian Basin, while increasing its focus on natural gas production in the Marcellus Shale. This shift is expected to bolster free cash flow and maintain production guidance, reflecting the company's adaptability in a volatile market.

Financial Achievements and Industry Implications

Coterra's financial achievements in the first quarter are significant for the oil and gas industry, emphasizing the importance of a diversified portfolio and strategic capital allocation. The company reported cash flow from operating activities of $1,144 million and discretionary cash flow of $1,135 million. Free cash flow totaled $663 million, underscoring the company's strong cash generation capabilities.

Capital expenditures for drilling, completion, and other fixed asset additions amounted to $472 million, with incurred capital expenditures totaling $552 million, both within the lower half of the guidance range. This disciplined capital management is crucial for sustaining operations and ensuring long-term profitability in the oil and gas sector.

Key Financial Metrics and Operational Highlights

For the first quarter of 2025, Coterra's total equivalent production reached 747 MBoepd, near the high end of the guidance range. Oil production averaged 141.2 MBopd, while natural gas production exceeded expectations at 3,044 MMcfpd. The company's realized average prices were $69.73 per barrel for oil and $3.28 per Mcf for natural gas, excluding the effect of commodity derivatives.

The company's unit operating cost was $9.97 per Boe, reflecting efficient operational management. Additionally, Coterra's net debt to trailing twelve-month adjusted pro forma EBITDAX ratio stood at 0.9x, indicating a strong financial position and commitment to debt reduction.

Shareholder Returns and Future Outlook

Coterra declared a quarterly dividend of $0.22 per share, representing a 3.4% annualized yield. The company also repurchased 0.9 million shares for $24 million, with total shareholder returns amounting to approximately $192 million for the quarter. Coterra remains committed to returning 50% or more of its annual free cash flow to shareholders through dividends and share repurchases.

Looking ahead, Coterra has lowered its 2025 capital expenditures range to $2.0 to $2.3 billion, reflecting a strategic shift towards natural gas production. The company expects to generate approximately $2.1 billion in free cash flow for the year, which will be used to fund dividends, reduce debt, and execute share repurchases.

Tom Jorden, Chairman, CEO, and President of Coterra, stated, "The company's top-tier balance sheet, diversified portfolio of high-quality oil and natural gas-focused assets, and low reinvestment rate position Coterra to prosper throughout cyclical commodity price environments."

Overall, Coterra Energy Inc (CTRA, Financial) has demonstrated resilience and strategic foresight in its first-quarter 2025 performance, positioning itself for continued success in the evolving energy landscape. For more detailed insights, visit the 8-K filing.

Explore the complete 8-K earnings release (here) from Coterra Energy Inc for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10