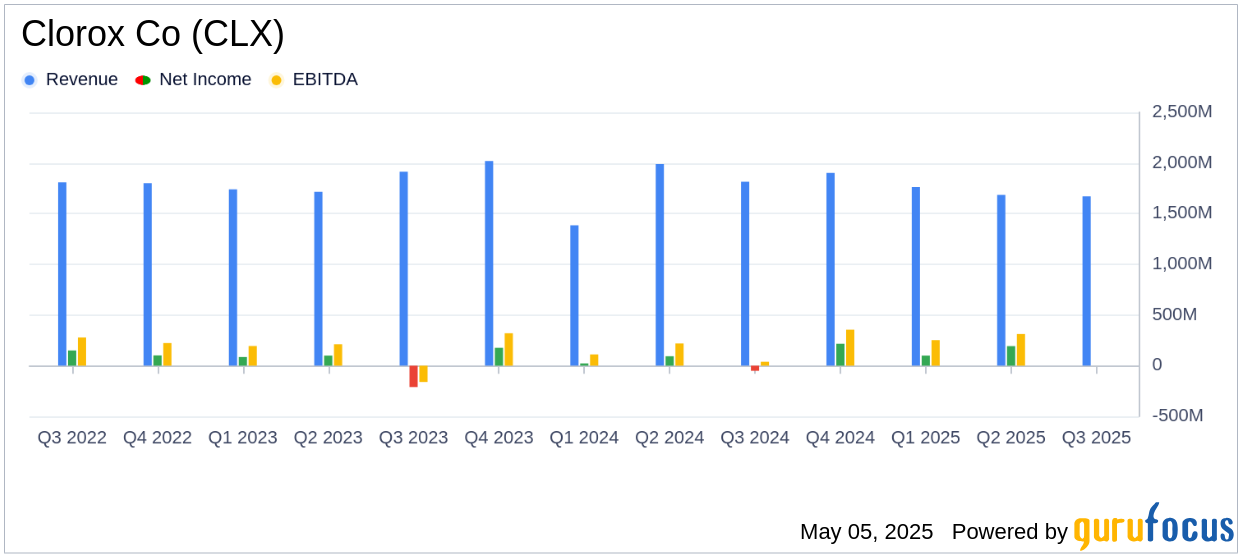

Clorox Co (CLX) Q3 Earnings: EPS Surpasses Estimates at $1.50, Revenue Falls Short at $1.67 Billion

On May 5, 2025, Clorox Co (CLX, Financial) released its 8-K filing for the third quarter of fiscal year 2025, ending March 31, 2025. The company reported a net sales decrease of 8% to $1.67 billion, missing the estimated revenue of $1,726.04 million. This decline was primarily attributed to the divestitures of the Better Health Vitamins, Minerals and Supplements (VMS) and Argentina businesses. Despite these challenges, Clorox achieved its 10th consecutive quarter of gross margin expansion.

Company Overview

Founded over a century ago, Clorox Co (CLX, Financial) has grown into a diversified company operating in various consumer product categories. Its portfolio includes well-known brands such as Clorox, Liquid-Plumr, Pine-Sol, Kingsford, Fresh Step, Glad, Hidden Valley, Brita, and Burt's Bees. The company generates more than 80% of its sales from the U.S. market.

Performance and Challenges

Clorox Co (CLX, Financial) reported a 2% decrease in organic sales, primarily due to an unfavorable price mix, while organic volume remained flat. The company faced a challenging consumer and geopolitical environment, which led to changes in shopping behaviors and temporary category slowdowns. Despite these hurdles, Clorox maintained its overall market shares.

Financial Achievements

Clorox Co (CLX, Financial) achieved a gross margin increase of 240 basis points to 44.6%, driven by cost savings and the benefits from divestitures. This margin expansion is significant for a consumer packaged goods company, as it indicates improved operational efficiency and cost management.

Key Financial Metrics

The company's diluted net earnings per share (EPS) rose to $1.50, a 466% increase from a loss of $0.41 in the same quarter last year. However, the adjusted EPS decreased by 15% to $1.45, exceeding the estimated EPS of $1.37. Year-to-date net cash provided by operations surged by 94% to $687 million, highlighting strong cash flow management.

“In the third quarter, heightened macroeconomic uncertainties drove changes in shopping behaviors, resulting in temporary category slowdowns and lower sales. We expect these slowdowns to persist in the fourth quarter, as reflected in our updated outlook,” said Chair and CEO Linda Rendle.

Segment Performance

In the Health and Wellness segment, net sales increased by 3%, driven by higher volume in Cleaning products. The Household segment saw an 11% decrease in net sales due to lower consumption and timing shifts in shipments. The Lifestyle segment experienced a 3% decline in net sales, while the International segment's net sales dropped by 15%, mainly due to the Argentina divestiture.

Analysis and Outlook

Clorox Co (CLX, Financial) continues to navigate a volatile environment with strategic divestitures and cost-saving measures. The company's ability to maintain market share and expand margins despite sales challenges is noteworthy. However, the ongoing macroeconomic uncertainties and geopolitical tensions pose risks to future performance. Clorox's updated fiscal year 2025 outlook reflects these challenges, with expectations for net sales to be down 1% to flat and adjusted EPS to range between $6.95 and $7.35.

Explore the complete 8-K earnings release (here) from Clorox Co for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10