The Smartest Market Sell-Off Stocks to Buy With $500 Right Now

-

The market has been volatile thanks to geopolitical and tariff concerns.

-

One of the hardest hit sectors has been industrial REITs.

-

Some industrial REITs today offer attractive yields of up to 5%.

There are two things going on behind the scenes on Wall Street. The first is geopolitical concerns and the second is tariff concerns, with the two issues intertwined in some ways. This complicated mess has led to a market sell-off and to one particular property niche of the real estate investment trust (REIT) sector getting hit extra hard.

Here are three industrial REITs that you may want to buy if you have $500 or more to invest right now.

1. Prologis is the industry giant

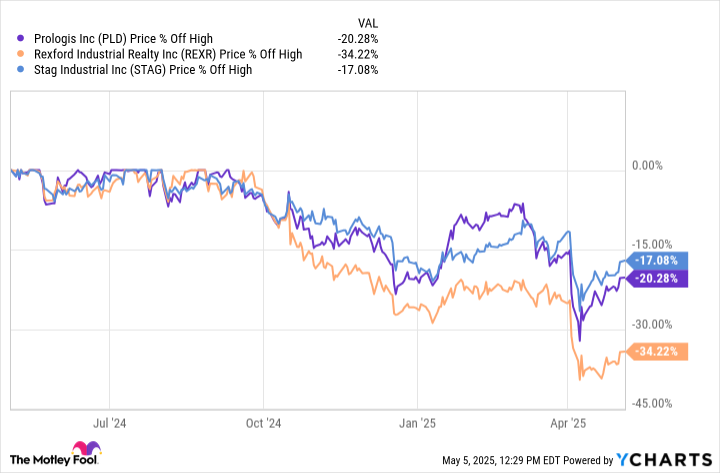

If you like to buy the biggest and best companies in a sector, well, the standout in the industrial REIT niche is Prologis (PLD 0.52%). With a market capitalization of $95 billion, it is one of the largest publicly traded REITs. It currently has a yield of 3.8%, and the stock is off about 20% from its 52-week high.

More than sheer size sets Prologis apart from its peers. It also has a global footprint, with warehouses in almost all of the most important transportation hubs in the world.

This makes it something of a one-stop shop for lessees as they seek to move products from where they are made to the end markets in which they get used. Notably, Prologis also has material built-in growth potential in the form of land that could be worth as much as $42 billion once developed.

It seems unlikely that global trade is going to grind to a halt, even though some trade lines may shift and change. Given the broad reach of Prologis' portfolio, it will probably end up doing just fine in most scenarios.

Image source: Getty Images.

2. Rexford Industrial is a sharpshooter

Rexford Industrial Realty (REXR 0.09%) has the highest dividend yield on this list at 5%. The shares have also fallen the furthest, down around 35% from their 52-week highs.

Like Prologis, Rexford is heavily focused on warehouses. Unlike Prologis, Rexford is laser focused on just one single market: Southern California. The problem with this focus right now is that one of the biggest tariff fights is with China, and Southern California is basically the gateway for Asian goods into the U.S. market.

But don't count Rexford Industrial out. Southern California is a supply-constrained market. Vacancy rates are typically below the average industrial vacancy rates for the entire country.

That gives Rexford bargaining power when it comes to rent increases. Moreover, the REIT has developed a skill in buying older properties and investing capital to upgrade them so it can charge higher rents, providing it with an internal pipeline for growth, too.

If you can handle a little extra risk, it could be the best choice for you. Assuming that international trade resumes on a more normal path, Rexford Industrial will be in prime position to benefit.

PLD data by YCharts.

3. Stag Industrial pays dividends monthly

The last industrial landlord here is Stag Industrial (STAG 0.68%). It has a dividend yield of 4.4%, and its stock is about 15% below its 52-week high-water mark.

The REIT is focused on the U.S., with a bias toward secondary markets. Management believes this gives it an edge since it often competes with small buyers that don't have the financial resources of a publicly traded REIT.

That said, it owns both warehouses and light industrial properties, so it is a bit more diversified within the industrial space than Prologis or Rexford by its end customers.

The big attraction here for most dividend investors, however, is likely to be the dividend frequency. Paying monthly, Stag Industrial ends up being more similar to a paycheck replacement than a REIT that pays a quarterly dividend.

It isn't really a better or worse approach, as investors end up getting whatever yield is on offer regardless of dividend frequency. However, being paid monthly can help the budgeting process, and some investors appreciate that.

Stag is a well-run REIT, and there's no reason to believe that it won't survive the current market environment. In fact, it is possible that reshoring efforts could end up benefiting the REIT.

Industrial REITs are a good fit for contrarian investors

If you can buy when others are selling, which is not an easy thing to do, you should take a close look at the industrial REIT niche. Tariff concerns have been a particular headwind for the group and that has resulted in a material sell-off in some of the industry's most attractive companies.

That list includes industry giant Prologis, specialist Rexford, and monthly payer Stag. Once you dig in, you might find you want to put $500, or possibly much more, to work in one of these industrial REITs today.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10