Sarepta Therapeutics, Inc. (NASDAQ:SRPT) posted a loss for the first quarter on Tuesday.

Sarepta Therapeutics reported quarterly losses of $3.42 per share, which missed the analyst consensus estimate of losses of 95 cents. Quarterly revenue came in at $744.86 million, which beat the consensus estimate of $683.36 million.

"In the first quarter, we achieved net product revenue of $611.5 million, a 70% increase over the same quarter prior year; our PMO franchise performed well at $236.5 million; and ELEVIDYS achieved $375 million, growing at 180% over the same quarter prior year. However, we also faced headwinds in the quarter. While we are taking a variety of actions to address and resolve these challenges, we have adjusted our guidance for 2025 to $2.3 billion to $2.6 billion," said Doug Ingram, CEO of Sarepta Therapeutics.

Sarepta Therapeutics lowered its fiscal 2025 revenue to a new range of $2.3 billion to $2.6 billion

Sarepta Therapeutics shares dipped 26.6% to close at $46.75 on Tuesday.

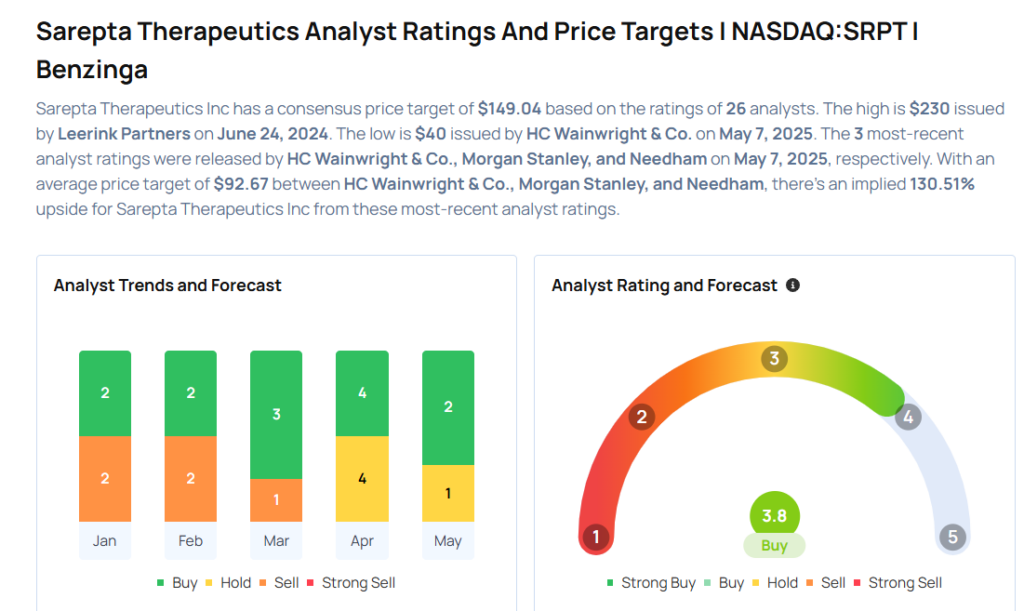

These analysts made changes to their price targets on Sarepta Therapeutics following earnings announcement.

- Needham analyst Gil Blum maintained Sarepta Therapeutics with a Buy and lowered the price target from $183 to $125.

- Morgan Stanley analyst Matthew Harrison maintained the stock with an Overweight rating and lowered the price target from $182 to $113.

- HC Wainwright & Co. analyst Mitchell Kapoor maintained Sarepta Therapeutics with a Neutral and cut the price target from $75 to $40.

Considering buying SRPT stock? Here’s what analysts think:

Read This Next:

- Top 2 Energy Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock