CDW Corp Q1 2025 Earnings: EPS of $1.69 Beats Estimates, Revenue Surges to $5.199 Billion

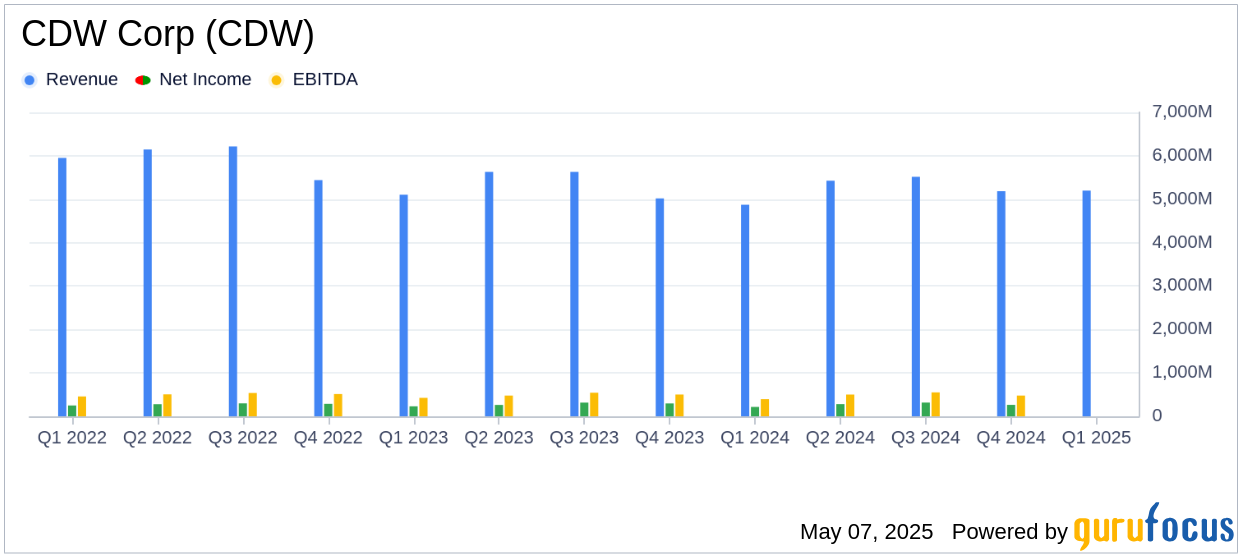

On May 7, 2025, CDW Corp (CDW, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. CDW Corp, a leading multi-brand provider of IT solutions, reported earnings per share (EPS) of $1.69, surpassing the analyst estimate of $1.67. The company's revenue for the quarter was $5,199.1 million, exceeding the estimated $4,933.86 million.

Company Overview

CDW Corp is a prominent provider of information technology solutions catering to a diverse clientele, including businesses, government entities, educational institutions, and healthcare organizations across the United States, the United Kingdom, and Canada. The company offers a comprehensive range of products and services, from hardware and software to integrated IT solutions, with a focus on hybrid infrastructure, digital experience, and security. CDW operates through five segments: Corporate, Small Business, Public, CDW UK, and CDW Canada, with the Corporate segment being the primary revenue driver.

Performance and Challenges

CDW Corp's performance in the first quarter of 2025 was marked by a 6.7% increase in net sales compared to the same period in 2024, driven by strong customer demand for notebooks, mobile devices, desktops, software, and services. However, the company faced challenges with a slight decrease in gross profit margin from 21.8% in 2024 to 21.6% in 2025, primarily due to a shift towards lower-margin products. Despite these challenges, CDW's ability to navigate dynamic market conditions and deliver mission-critical outcomes for its customers underscores its resilience and strategic positioning.

Financial Achievements

CDW Corp's financial achievements in Q1 2025 are significant for the IT solutions industry. The company's operating income rose by 10.2% to $361.4 million, while non-GAAP operating income increased by 10.0% to $444.0 million. These achievements highlight CDW's effective cost management and strategic focus on high-demand product categories, reinforcing its competitive edge in the market.

Key Financial Metrics

CDW Corp's income statement reveals a net income of $224.9 million, a 4.1% increase from the previous year. The company's non-GAAP net income per diluted share was $2.15, up 11.9% from $1.92 in 2024. These metrics are crucial as they reflect the company's profitability and efficiency in generating shareholder value.

| Metric | Q1 2025 | Q1 2024 | Percent Change |

|---|---|---|---|

| Net Sales | $5,199.1 million | $4,872.7 million | 6.7% |

| Gross Profit | $1,122.3 million | $1,063.3 million | 5.5% |

| Operating Income | $361.4 million | $328.0 million | 10.2% |

| Net Income | $224.9 million | $216.1 million | 4.1% |

| EPS (Diluted) | $1.69 | $1.59 | 6.1% |

Analysis and Commentary

CDW Corp's robust performance in Q1 2025 is a testament to its strategic focus on customer-centric solutions and its ability to adapt to changing market demands. The company's diverse product portfolio and strong presence in key markets have enabled it to capitalize on growth opportunities, despite economic uncertainties. As noted by Christine A. Leahy, CEO of CDW,

The team delivered an excellent start to 2025, as they once again helped customers navigate dynamic market conditions and accomplish mission-critical outcomes."This statement underscores the company's commitment to maintaining its leadership position in the IT solutions industry.

Overall, CDW Corp's Q1 2025 earnings report reflects a positive trajectory, with strong sales growth and improved profitability metrics. The company's strategic initiatives and focus on high-demand product categories position it well for continued success in the evolving IT landscape.

Explore the complete 8-K earnings release (here) from CDW Corp for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10