Federal Realty Investment Trust Surpasses Q1 Expectations with EPS of $0.72 and Revenue of $309.15 Million

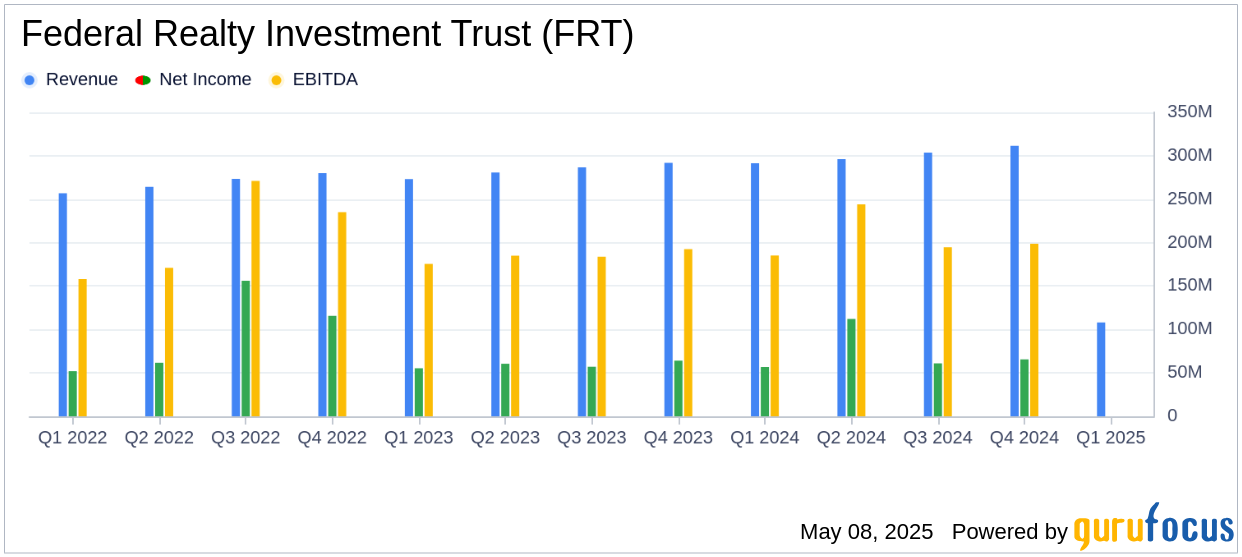

On May 8, 2025, Federal Realty Investment Trust (FRT, Financial) released its 8-K filing for the first quarter ended March 31, 2025. The company reported earnings per diluted share of $0.72, surpassing the analyst estimate of $0.69. Revenue for the quarter reached $309.15 million, exceeding the estimated $306.40 million. Federal Realty Investment Trust is a shopping center-focused retail real estate investment trust that owns high-quality properties in eight of the largest metropolitan markets, with a portfolio that includes 102 properties, 26.8 million square feet of retail space, and over 3,100 multifamily units.

Performance Highlights and Challenges

Federal Realty Investment Trust reported a net income available for common shareholders of $61.8 million for the first quarter of 2025, compared to $54.7 million in the same period of 2024. The company generated funds from operations (FFO) per diluted share of $1.70, up from $1.64 in the first quarter of 2024. This performance is crucial as FFO is a key metric for REITs, reflecting their ability to generate cash from operations.

Despite the positive results, Federal Realty faces challenges such as potential tenant defaults, lease expirations, and the need for capital to fund growth. These challenges could impact future performance if not managed effectively.

Financial Achievements and Strategic Moves

Federal Realty's financial achievements include a comparable property operating income growth of 2.8% and a comparable portfolio occupancy rate of 93.6%. The company also extended its $600 million unsecured term loan maturity date to March 2028 and increased its potential size to $750 million, ending the quarter with nearly $1.5 billion in total liquidity. Additionally, Federal Realty announced a new common share repurchase program of up to $300 million.

These achievements are significant as they demonstrate Federal Realty's ability to maintain strong financial health and liquidity, which are critical for sustaining growth and stability in the competitive REIT industry.

Key Financial Metrics and Analysis

Federal Realty's consolidated income statement shows total revenue of $309.15 million, with rental income contributing $302.29 million. Operating income for the quarter was $108.13 million, up from $100.19 million in the previous year. The balance sheet reflects total assets of $8.62 billion, with liabilities amounting to $5.18 billion and shareholders' equity of $3.26 billion.

Important metrics such as the FFO per diluted share and occupancy rates are crucial for assessing the company's operational efficiency and market position. The increase in FFO indicates improved cash flow, while high occupancy rates suggest strong demand for Federal Realty's properties.

Commentary and Future Outlook

“We started the year with strong operating results and are encouraged to see continuing elevated foot traffic across our properties,” said Donald C. Wood, Federal Realty’s Chief Executive Officer. “Decades of experience have taught us how to insulate our portfolio against economic cycles and disruptive forces. With irreplaceable real estate and a high-quality, diverse tenant base in affluent markets, we are well positioned for continued growth and stability.”

Federal Realty's strategic focus on high-quality properties in affluent markets positions it well for future growth. The company's ability to navigate economic cycles and maintain a strong tenant base will be key to its continued success.

Explore the complete 8-K earnings release (here) from Federal Realty Investment Trust for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10