On Holding AG (NYSE:ONON) reported better-than-expected first-quarter financial results on Tuesday.

On Holding reported quarterly earnings of 23 cents per share which beat the analyst consensus estimate of 16 cents per share. The company reported quarterly sales of $807.70 million which beat the analyst consensus estimate of $570.78 million.

Caspar Coppetti, Co-Founder and Executive Co-Chairman of On, said: “Building on our vision to be the most premium global sportswear brand, our first quarter results have exceeded our expectations and reflect the strong momentum of our brand across all channels, regions and product categories. Looking into the second quarter and beyond, we are energized by the global traction and cultural resonance of On as a head-to-toe sportswear brand. As we solidify our premium positioning in the marketplace, we will continue to focus on what differentiates us — combining performance and design with a constant thirst for innovations big and small.”

On Holding shares gained 11.8% to close at $57.38 on Tuesday.

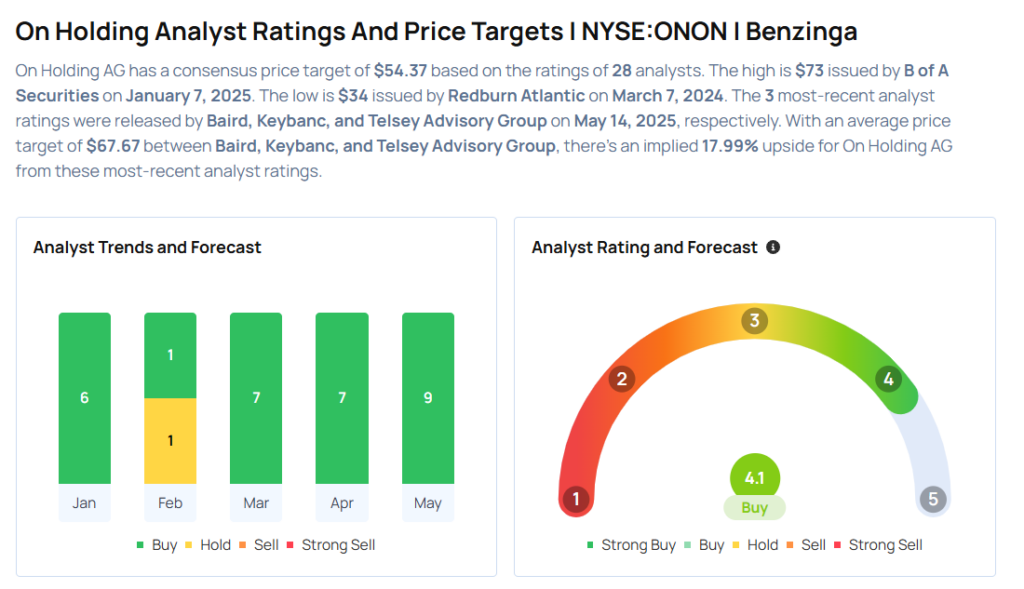

These analysts made changes to their price targets on On Holding following earnings announcement.

- Needham analyst Tom Nikic maintained On Holding with a Buy and raised the price target from $55 to $62.

- Keybanc analyst Ashley Owens maintained the stock with an Overweight rating and raised the price target from $60 to $68.

- Baird analyst Jonathan Komp maintained On Holding with an Outperform rating and raised the price target from $63 to $70.

Considering buying ONON stock? Here’s what analysts think:

Read This Next:

- Top 3 Materials Stocks That Could Blast Off This Month