Chinese e-commerce company, JD.com Inc. (NASDAQ:JD) is shaking up China’s food delivery market with its bold zero-commission model, while taking aim at the global meal delivery scene as well.

What Happened: During its first quarter earnings call on Tuesday, JD.com’s CEO, Sandy Xu said that the company has rapidly scaled its food delivery operation, now approaching 20 million daily orders just months after launch.

The business, she stressed, is not a standalone service but deeply integrated into JD's broader retail ecosystem, allowing the company to pursue sustainable scale without charging high commissions and fees.

See Also: Robert Kennedy Jr. Cheers FDA Plan To Ban Fluoride Supplements For Children, Calls Move ‘Long Overdue’

JD's pricing strategy is rooted in what Xu called the company's long-standing “$0.35 principle,” a philosophy set by its founder, Liu Qiangdong, which prioritizes modest margins over aggressive markups.

We insist on “taking only reasonable profit,” Xu says, adding that the company’s decision to lower commission rates and boost traffic for high-quality merchants is designed to help sellers focus on food quality over platform costs. “This is a positive cycle,” she says.

Why It Matters: This approach stands in stark contrast with DoorDash Inc. (NASDAQ:DASH), Uber Technologies Inc. (NYSE:UBER), and GrubHub, which have come under scrutiny for the high commissions they charge restaurants, resulting in them being sued over the years.

Uber recently filed a lawsuit against DoorDash, accusing the rival delivery platform of engaging in underhanded tactics and anti-competitive practices that it claims have driven up costs for both restaurants and consumers.

During its first quarter, JD reported $41.5 billion in revenue, up 15.8% year-over-year, and beating consensus estimates at $40.2 billion. It posted a profit of $1.16 per share, compared to estimates at $1.05.

Price Action: The stock was up 3.33% on Tuesday, trading at $37.25 per share on the Nasdaq, but is down 2.42% after hours, following its first quarter results.

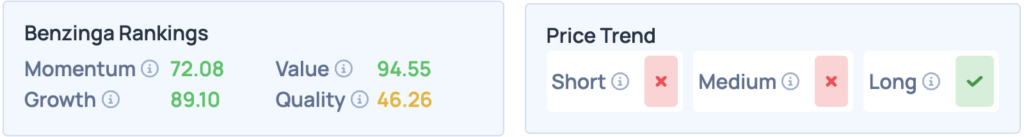

For more insights on JD.com’s stock score and price trends, sign up for Benzinga Edge.

Read More:

- Alphabet’s Value Could Skyrocket To $3.7 Trillion With Google’s ‘Big Bang Breakup’ Over ‘Isolated Spin-Offs,’ Says Analyst

Image Via Shutterstock