CoreWeave Inc (NASDAQ:CRWV) reported better-than-expected sales for the first quarter after the market close on Wednesday.

CoreWeave reported first-quarter revenue of $981.63 million, beating analyst estimates of $859.77 million, according to Benzinga Pro. The company reported a first-quarter adjusted loss of $1.49 per share. Total revenue was up 420% on a year-over-year basis. The company said it ended the quarter with a revenue backlog of $25.9 billion.

"We've delivered an outstanding start to 2025 on multiple fronts. Our strong first quarter financial performance caps a string of milestones including our IPO, our major strategic deal with OpenAI as well as other customer wins, our acquisition of Weights & Biases and many technical achievements," said Michael Intrator, co-founder and CEO of CoreWeave.

CoreWeave shares fell 2.1% to trade at $66.02 on Thursday.

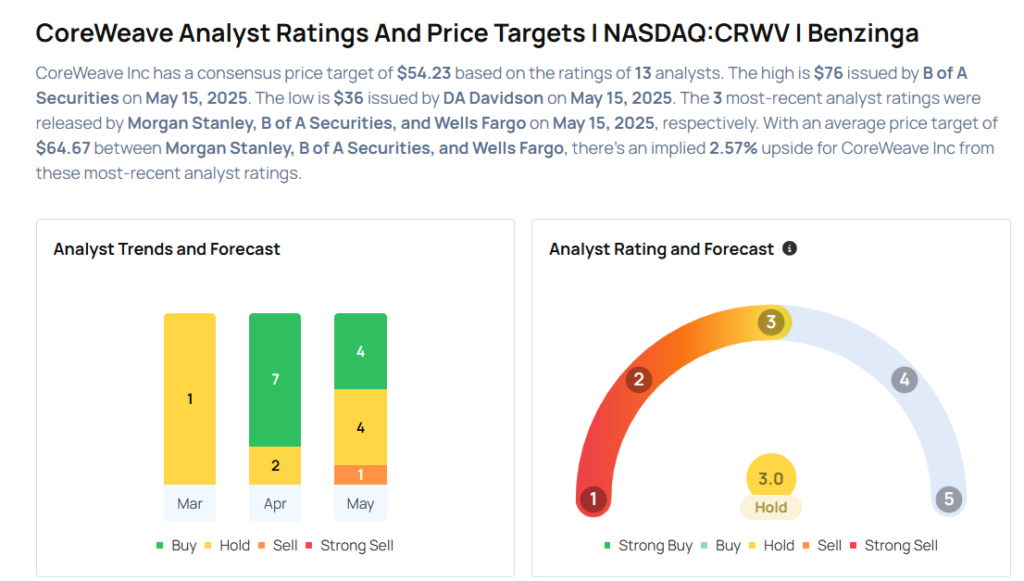

These analysts made changes to their price targets on CoreWeave following earnings announcement.

- Barclays analyst Raimo Lenschow maintained CoreWeave with an Overweight rating and raised the price target from $60 to $70.

- Macquarie analyst Paul Golding maintained the stock with a Neutral and raised the price target from $56 to $65.

- Wells Fargo analyst Michael Turrin maintained CoreWeave with an Equal-Weight rating and raised the price target from $50 to $60.

- B of A Securities analyst Brad Sills maintained the stock with a Buy and boosted the price target from $42 to $76.

- Morgan Stanley analyst Keith Weiss maintained CoreWeave with an Equal-Weight rating and raised the price target from $46 to $58.

Considering buying CRWV stock? Here’s what analysts think:

Read This Next:

- Jim Cramer: SoFi Goes To ‘New Highs,’ Recommends Not Buying This Health Care Stock

Photo via Shutterstock