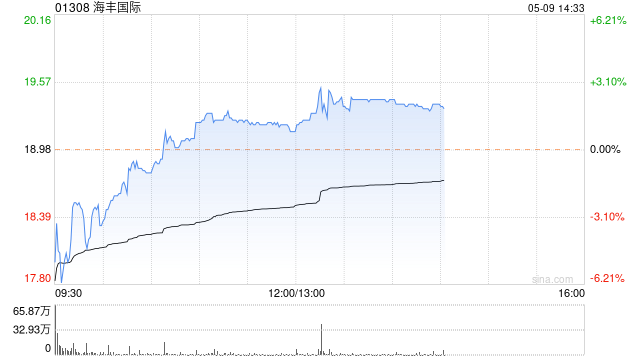

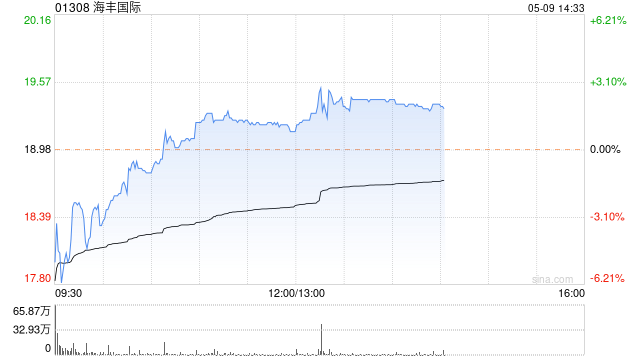

瑞银发布研报称,海丰国际(01308)强劲现金流可支撑股息,且有维持派息比率达七成的往绩,相信其股息收益率极具吸引力。该行将集团评级由“沽售”一举上调至“买入”,并改变估值计算方法,以预测企业价值对EBITDA约5.5倍计,目标价由17.3港元调升至25港元,并将该股列入瑞银亚太区关键推荐名单。该行预期,亚洲区内航线将持续供不应求,料运费今年以后持续高企,叠加海丰国际的成本控制将推动集团EBITDA在2025至29年持续增长,上调其2025至27年的每股盈测到70%至91%。

责任编辑:史丽君

瑞银发布研报称,海丰国际(01308)强劲现金流可支撑股息,且有维持派息比率达七成的往绩,相信其股息收益率极具吸引力。该行将集团评级由“沽售”一举上调至“买入”,并改变估值计算方法,以预测企业价值对EBITDA约5.5倍计,目标价由17.3港元调升至25港元,并将该股列入瑞银亚太区关键推荐名单。该行预期,亚洲区内航线将持续供不应求,料运费今年以后持续高企,叠加海丰国际的成本控制将推动集团EBITDA在2025至29年持续增长,上调其2025至27年的每股盈测到70%至91%。

责任编辑:史丽君

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.