Binance vs Coinbase: Which Crypto Exchange is Better in 2025?

Coinbase and Binance are two of the most important crypto exchanges in the world, and this article provides an in-depth analysis of the platforms.

In our Binance vs Coinbase 2025 review, we analyze the platforms’ backgrounds, user experience, and the platforms’ interfaces, their most important products, services, features, fees, available assets, security measures, user transparency, regulatory statuses, and more.

We’ll also list the exchanges’ pros and cons to help you better decide on which crypto exchange is best for your needs.

[toc]

Binance vs Coinbase – Backgrounds and Offerings

In this Binance vs Coinbase introductory section, we’ll break down the exchanges’ backgrounds, global reach, available assets, trading volumes, and their top features.

What is Binance?

Binance is the biggest and most important centralized digital asset exchange in the world. It was built in 2017 by Changpeng Zhao aka CZ.

Digital Assets Available, Users, Reach

- Binance allows the trading of more than 350 cryptocurrencies available on its platform.

- The crypto exchange has more than 273 million registered users as of May 2025.

- Binance’s global platform is available in over 100 countries.

Trading Volume and Total Assets

Based on our Binance review, the crypto exchange’s average 24-hour trading volume in the past six months is over $20 billion, topping all other crypto exchanges we’ve analyzed.

As of May 2025, Binance has almost $136 billion in total assets.

Core Products, Services, Features

Binance’s most important products and services include the following:

- The Binance Wallet

- The Binance Pay platform

- Basic/Advanced trading services

- Simple/Advanced Earn Products

- Staking services

- Launchpool and Launchpad platforms

- Campaigns and rewards platforms, including the HODLer Airdrop portal and the Megadrop platform

- An NFT marketplace

- Education and research platforms

- Charity services

Binance’s most important features include the following:

- Boosted security with KYC regulations during the onboarding process

- Strong regulatory compliance and 21 global licenses

- A growing number of compliance teams around the world

- High user asset security via the SAFU fund valued at $1 billion

- Asset transparency via Proof-of-Reserves (PoR)

- A platform created for US users – Binance US

- Low, competitive trading fees for spot and futures trading

» SIGN UP ON BINANCE – EARN UP TO $600 «

Grab a limited $600 sign-up bonus, no trading fees and more!

What is Coinbase?

![]()

Coinbase Global, Inc. is an American technology company founded in 2012 by Brian Armstrong – it operates a centralized crypto exchange known as Coinbase.

Digital Assets Available, Users, Reach

- Coinbase allows trading of more than 240 cryptocurrencies.

- The exchange has over 105 million registered users as of early 2025.

- Coinbase operates in more than 100 countries, having over 3,700 employees.

Trading Volume and Total Assets

Coinbase has $439 billion in quarterly trading volume and $404 billion in assets on its platform. The exchange’s average 24-hour trading volume in the past six months is around $3-4 billion.

Core Products, Services, Features

Coinbase features services and products for individuals, businesses, and developers as follows:

| For Individuals | For Businesses | For Developers |

|---|---|---|

| Coinbase main platform | Institutional Solutions | Developer platform |

| Coinbase Wallet (self-hosted) | Prime brokerage platform | Staking validators and tooling |

| Coinbase One | Crypto commerce platform | Onramp (fiat-to-crypto) |

| NFT Marketplace | International exchange | Wallets + Wallet SDK |

| Advanced trading tools | Data marketplace | Commerce API |

| Earn | Listing assets on Coinbase | Exchange API |

| Card | Ventures (crypto startup funding) | Prime APIs |

| USD Coin (USDC) – Coinbase offers a “USDC Rewards” program where users can earn interest on their USDC holdings. | Cloud staking (15+ networks) | Base Node |

| Private client services (trusts, family offices, UHNWIs) | ||

| Derivatives market |

Coinbase’s best features include the following:

- High security and compliance commitment via KYC verification during the onboarding of new users

- 2FA, password protection, and multi-approval withdrawals in Coinbase Vault

- Encryption, security key enablement

- Learning guides, crypto-related tips, and tutorials

- Availability for multiple types of traders

- Transparent, verified liquidity pools

- Cold storage for assets, fund insurance

» JOIN COINBASE NOW «

As a conclusion of this Binance vs Coinbase section, we highlight that Binance has more cryptocurrencies available on its platform and more registered users. Both platforms are available in over 100 countries, highlighting high compliance with regulations.

The average 24-hour trading volume of Binance surpasses the one of Coinbase, showing increased activity on the platform.

Both platforms cater to the needs of beginners and more experienced traders with a vast palette of products and services for everyone.

Binance vs Coinbase: UX and UI

During our analysis of Binance vs Coinbase, we noticed that both platforms work smoothly while offering users valuable data about their products and services.

However, Binance is more straightforward about its product offerings in the sense that they’re easier to access, even for less experienced users.

Coinbase also has a vast palette of products and offerings for beginners and more advanced users, but the website’s layout might be more confusing for some users, with complex products/services more hidden.

For users who simply want to buy/sell crypto, Coinbase is easier to use compared to Binance.

But, overall, both platforms performed well in terms of UX. Regarding security, both Coinbase and Binance require strict KYC verification during the onboarding process.

Binance vs Coinbase: Trading Features

Both platforms offer products and service options for beginners and advanced traders.

Coinbase Products/Trading Options

As revealed above in our Binance vs Coinbase guide, Coinbase provides multiple products for individuals, businesses, and developers.

Binance Products/Trading Options

Binance provides options for basic trading and advanced trading.

Binance’s basic options include the following:

- Spot Trading

- Margin Trading

- P2P Trading

- Convert and Block Trade

Binance’s advanced options include the following:

- The Binance Alpha platform, showcasing projects with potential to grow in Web3

- Trading Bots

- Copy Trading

- APIs

Binance also features a developer center featuring the following:

- Financial trading options

- VIP and Institutional tools

- Investment and various services

- Dev tools including: Mini Program, Binance Oauth, Binance Open API, Binance Fiat Widget, Binance Pay Merchant

Spot Trading on Binance vs Coinbase

Coinbase’s spot markets provide deep liquidity, real-time order books, and high security, and they’re available in Coinbase Advanced mode.

Binance Spot allows you to trade crypto, providing real-time data on asset prices, technical indicators, charts, analysis, and more options.

Futures Trading on Binance vs Coinbase

Below, you can see a comparison between Coinbase and Binance futures trading:

Coinbase Futures Trading

Coinbase allows crypto futures trading with flexibility via 24/7 market access and nano-sized futures contracts via the platform’s Derivatives section on Coinbase Advanced.

For limited periods of time, Coinbase offers you the chance to enjoy USDC rewards on your Perpetuals Portfolio, 0% maker/taker fees when you trade perpetual futures in eligible markets.

Binance Futures Trading

Binance Futures includes contracts settled in USDT, USDC, and other crypto, providing USDT options with limited downside and affordable entry.

Binance also features Inverse Perpetuals available as COIN-margined contracts. Coinbase doesn’t offer Inverse Perpetuals, being more focused on spot trading and linear (USDT and USD-margined) perpetual futures via Coinbase Advanced and Coinbase International Exchange.

Inverse Perpetuals are typically BTC or crypto-margined contracts where you can post crypto as collateral and settle in crypto. If you’re specifically looking for Inverse Perpetuals, Binance is a better option.

Margin Trading on Binance vs Coinbase

Details of Margin Trading availability and types on both Coinbase and Binance:

Coinbase Margin Trading

As of 2020, Margin Trading became available on Coinbase Pro. The exchange offers two types of margin, cross and isolated.

Binance Margin Trading

Binance also provides Margin Trading, offering both cross-margin and isolated margin.

» SIGN UP ON BINANCE – EARN UP TO $600 «

Advanced Features on Binance vs Coinbase: Copy Trading and Trading Bots

This section of the Binance vs Coinbase review addresses advanced features on both exchanges.

Binance vs Coinbase: Copy Trading

While Coinbase doesn’t offer a native Copy Trading feature, it allows integration of third parties that offer such a feature. On the other hand, Binance’s Copy Trading feature includes Futures and Spot sections, together with information on how you can copy trade and follow other traders’ strategies.

Binance vs Coinbase: Trading Bots

Coinbase lacks a Trading Bot, but Binance’s Trading Bots section allows creating bots. When the price of an asset drops and hits a buy order, the bot will place a sell order, and when the price of the asset rises and hits a sell order, the bot will place a buy order.

Binance’s Trading Bots section includes a rebalancing bot, Spot DCA, and Spot algo orders.

Overall, if you’re interested in using Copy Trading and Trading Bots, Binance is the best choice for you.

Binance vs Coinbase: Fee Comparison

In this Binance vs Coinbase section, we’ll analyze the exchanges’ fees for spot and futures, while also addressing withdrawal and potential hidden fees.

Spot Trading Fees for Binance vs Coinbase

A deep dive into Coinbase and Binance spot trading fees:

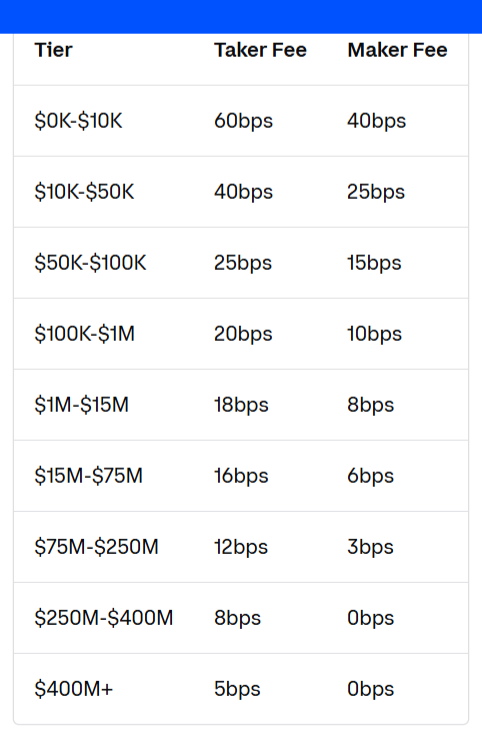

Coinbase Spot Trading Fees

Coinbase’s fees are calculated based on the current pricing tier you are in when the order is placed, and not on the tier you would be in after the trade is completed.

The fee tier is based on total USD trading volume over a 30-day period.

When you place an order at the market price that gets filled immediately, you are considered a taker and will pay a fee between 0.05% and 0.6%.

When you place an order that is not immediately matched by an existing order, the order is placed on the order book. If another customer places an order that matches yours, you are considered the maker and will pay a fee between 0% and 0.4%.

For instance, for a tier between $0 and $10,000, the maker/taker fee is 0.6%/0.4% (or, in Coinbase’s notes, 60bps/40bps). For a tier between $10,000 and $50,000, the maker/taker fee is 0.4%/0.25%. For a tier between $50,000 and $100,000, the maker/taker fee is 0.25%/0.15%.

For over $400 million, the maker/taker fee is 0.05%/0%.

Binance Spot Trading Fees

Binance settles Spot and Margin fees for regular users and multiple VIP levels with BNB holdings discounts.

Regular users who have a 30-day trading volume below $1 million get a maker/taker fee of 0.1% without a BNB discount and 0.75%/0.75% with a BNB discount.

The VIP 1 level users who have a 30-day volume above $1 million and a minimum of 25 BNB get:

- A maker/taker fee is 0.09%/0.1% without a BNB discount

- A maker/taker fee of 0.0675%/0.075% with a BNB discount

The exchange’s fees continue to decrease as the VIP level surges, and the BNB holdings rise. The VIP level goes up to 9 – the highest VIP level provided by Binance.

Binance’s VIP 9 level users who have a 30-day trading volume above $4 billion and BNB holdings of at least 5,500 BNB get:

- A maker/taker fee of 0.01%/0.023% without a BNB discount

- A maker/taker fee of 0.00825%/0.01725% with a BNB discount

Overall, Binance’s fees are significantly lower than Coinbase’s.

Futures Trading Fees for Binance vs Coinbase

An in-depth analysis of Coinbase and Binance’s futures trading fees:

Coinbase Futures Trading Fees

Coinbase allows you to trade futures with 0%/0.03% maker/taker fees and up to 5.1% USDC rewards on your trading balance.

For a limited time, Coinbase offers 12% USDC on your Perpetuals portfolio and 0% maker and taker fees when you trade perpetual futures in eligible markets.

According to Coinbase, perpetual futures traders will receive 0% maker/taker fees up to a certain volume threshold. If your trailing 30-day perpetuals volume exceeds $50M, your fees will update to 0.00% maker and 0.003% taker.

Binance Futures Trading Fees

Binance’s fees for USDT are settled for regular users and various VIP levels. ETH/BTC futures contracts use the same fee schedule as USDT.

Regular users who have a 30-day trading volume lower than $15 million, and hold a minimum of 1 BNB, get:

- A maker/taker fee of 0.02%/0.05% without a BNB discount

- A 0.018%/0.045% with a BNB 10% discount

VIP 1 users who have a 30-day trade volume above $15 million and BNB holdings of at least 25 BNB get:

- A maker/taker fee structure of 0.016%/0.04% without a BNB discount

- A maker/taker fee of 0.0144%/0.036% fee with a BNB discount

VIP 9 users, representing the highest VIP level on Binance, who have a 30-day trade volume of at least $25 billion and a minimum of 5,500 BNB, will have:

- A maker/taker fee of 0%/0.017% without a BNB discount

- A maker/taker fee of 0%/0.0153% with a BNB discount

Binance vs Coinbase: Withdrawal Fees and Potential Hidden Fees

Coinbase’s fiat deposit and withdrawal fees depend on the method you use to deposit and withdraw funds.

- When using the ACH (Automated Clearing House network) for US only, the deposit and withdrawal fees are $0.

- When using WIRE (USD), the deposit fee is $10 and the withdrawal fee is $25.

- When using SEPA (EUR), the deposit fee is 0.15 EUR, and the withdrawal fee is zero.

- When using SWIFT (GBP), the deposit fee is zero, and the withdrawal fee is 1 GBP.

Coinbase’s instant card withdrawal fee is up to 1.5% of the amount, with a minimum fee of $0.55.

Binance does not charge deposit fees, and its withdrawal fees cover the transaction costs of moving crypto.

Based on our Binance vs Coinbase review, Binance’s withdrawal fees are lower compared to those of Coinbase.

The exchanges should not have hidden fees, considering that both are regulated.

» SIGN UP ON COINBASE «

Binance vs Coinbase: Security and Trust

Both crypto exchanges emphasize the importance of user trust via various security measures/PoR, and advanced KYC measures when onboarding new users.

Coinbase Security and Transparency

Coinbase employs the following security measures for its users:

- Advanced KYC verification when onboarding new users

- Auto-enrolled 2FA with security key support

- Password protection

- Multi-approval withdrawals in Coinbase Vault

- Holding customer assets 1:1

- PoR for cbBTC

- High encryption technology

- Crime insurance coverage

- Cold storage for assets

- Institutional custody insurance

» JOIN COINBASE TO START TRADING NOW «

Binance Security and Transparency

Binance also features a multitude of security measures for keeping its users safe:

- Advanced KYC verification when onboarding new users

- 2FA

- Biometrics

- Device management

- Whitelisting

- Regulation compliance

- Keeping user assets in cold storage

- Securing user assets via the SAFU fund valued at $1 billion

- PoR, showing that user assets are backed by at least 1:1

Although Coinbase lacks a SAFU fund, like Binance has, the exchange provides high security for users. Both crypto exchanges are safe and secure for users.

Past Incidents of Binance vs Coinbase

Binance’s most important security incident took place on May 7, 2019, when hackers stole 7,000 BTC in a single transaction. Coinbase has never experienced a major platform hack, but it did have security incidents.

The most notable incident was in 2021 when at least 6,000 Coinbase users were affected by a security vulnerability involving the SMS-based account recovery process.

In May 2025, Coinbase’s CEO, Brian Armstrong, revealed that some attackers threatened to release customer data and asked for $20 million in Bitcoin in return. Armstrong said that the exchange will not pay the ransom and has other protective measures in mind.

Binance vs Coinbase: Earn and Passive Income Products

Both crypto exchanges feature passive income products that we’ll detail below.

Coinbase Earn, Staking, Loans

Earn

Coinbase Learn and Earn allows users to learn about crypto and earn rewards.

Staking

Coinbase Staking allows users to earn APY by buying and staking eligible assets to earn rewards.

Loans

Coinbase Prime offers institutional lending to qualified customers, providing crypto lending services and yield products.

Binance Earn, Staking, Loans

Earn

Binance Earn offers Simple and Advanced Earn options for its users as follows:

- Simple Earn – Allowing you to earn passive income from Savings and Staking

- Advanced Earn – Offering Dual Investment and On-Chain Yields

Staking

Staking services are available for ETH and SOL.

Loans

Binance provides you with three loan types:

- Flexible Rate Loan – Allows you to borrow for Spot/Margin/Futures

- VIP Loan – If you’re an institutional investor

- Fixed Rate Loan – Allows you to borrow and supply at chosen fixed interest rates

As detailed above, both Coinbase and Binance offer you Earn, Staking, and Loan services.

Binance vs Coinbase: Launchpool and Launchpad Availability

Coinbase does not have Launchpool or Launchpad platforms.

On the other hand, Binance offers users both Launchpool and Launchpad platforms to help you launch your projects and advise on how to best issue and launch tokens. So far, Launchpool has over 60 projects on the platform, and most provide 4% of the supply.

Regulatory Status and Jurisdictions – Binance vs Coinbase

Coinbase is available in over 100 countries, but it’s not supported in Russia, Iran, and North Korea.

Binance is also available in more than 100 countries and regions in which the crypto exchange is currently not available include Canada, the Netherlands, Cuba, the Democratic People’s Republic of North Korea (“DPRK”), Iran, Syria, the Crimea region, and any non-government-controlled areas of Ukraine.

Both crypto exchanges are fully regulated, following strict legislation in the regions in which they are available. Coinbase and Binance are both available for US users.

» JOIN BINANCE & CLAIM UP TO $600 BONUS «

Final Verdict – Pros and Cons for Binance vs Coinbase

After carefully analyzing both crypto exchanges in our Binance vs Coinbase guide, we reveal their most important pros and cons.

Coinbase Pros and Cons

| Section | Pros | Cons |

|---|---|---|

| Platform Background | US-based, publicly traded company with strong institutional presence. | Smaller global market share compared to Binance. |

| Asset Availability | 240+ digital assets, high-quality listings. | Fewer assets than Binance. |

| UX & UI | Easy for beginners to buy/sell crypto; clean mobile app design. | Some services are buried in menus; less intuitive for advanced users. |

| Trading Features | Strong security and liquidity for spot trading; USDC rewards for Perpetuals. | No Inverse Perpetuals; lacks Copy Trading and automated trading bots. |

| Fees (Spot & Futures) | Transparent tiered structure; 0% futures fees during promotions. | Higher spot fees (up to 0.6%); charges for instant withdrawals. |

| Earn & Passive Income | Offers Learn & Earn, basic staking, and institutional lending (Coinbase Prime). | No advanced Earn tools (e.g., Dual Investment); limited staking selection. |

| Security & Transparency | No major hacks; strong 2FA, cold storage, and insurance; 1:1 reserves verified. | Past SMS-based recovery vulnerability affected 6,000 users. |

| Developer & Institutional Tools | Full developer suite: SDK, APIs, Base Node, Coinbase Cloud, Prime services. | Less integrated ecosystem compared to Binance. |

| Launchpad / Token Incubation | None – no Launchpad or Launchpool equivalent and no direct support for early-stage token projects or farming initiatives. | |

| Regulatory Compliance | US-licensed, listed on NASDAQ; operates with full compliance in supported countries. | Restricted in certain jurisdictions (e.g., Iran, Russia, North Korea). |

| Withdrawal & Funding Fees | ACH free; detailed fiat fee breakdown; transparent card withdrawal process. | Instant card withdrawals up to 1.5%; higher fees for WIRE and some fiat methods. |

| Transparency & PoR | Verified cold storage, PoR for cbBTC, and 1:1 asset backing. | No SAFU-style emergency fund in place. |

Binance Pros and Cons

| Section | Pros | Cons |

|---|---|---|

| Platform Background | Largest exchange by trading volume; strong global presence. | Regulatory issues in multiple regions; founder CZ stepped down amid legal cases. |

| Asset Availability | 350+ cryptos, including early-stage and trending tokens. | Some tokens may be less-vetted or highly volatile. |

| UX & UI | Feature-rich dashboard with clearer access to advanced tools. | May be overwhelming for beginners; complex interface. |

| Trading Features | Offers Spot, Margin, Futures, Inverse Perpetuals, Copy Trading, and Bots. | Complex options may confuse casual or non-professional users. |

| Fees (Spot & Futures) | Lowest fees industry-wide; big discounts with BNB. | Requires BNB holdings for maximum savings; tiered structure can seem complex. |

| Earn & Passive Income | Offers Dual Investment, Simple/Advanced Earn, and flexible/fixed loans. | Higher risk products; advanced terms may be unclear for beginners. |

| Security & Transparency | SAFU fund ($1B), 2FA, biometrics, PoR, cold wallets. | 2019 hack (7,000 BTC); ongoing regulatory scrutiny in some jurisdictions. |

| Developer & Institutional Tools | Extensive toolset: API, Oauth, Fiat On-Ramp, VIP access, Web3 integrations. | May prioritize institutional scale over independent developer usability. |

| Launchpad / Token Incubation | Launchpad and Launchpool with over 60 projects launched. | New tokens can be high-risk and untested. |

| Regulatory Compliance | Holds 21+ licenses; operates in 100+ countries. | Banned in countries like Canada and the Netherlands; compliance record mixed. |

| Withdrawal & Funding Fees | No deposit fees; broad fiat and crypto support; low crypto withdrawal fees. | Crypto withdrawal fees vary by network; fiat options depend on region. |

| Transparency & PoR | PoR system, SAFU, and real-time reserve insights. | Lack of third-party audits causes trust issues for some users. |

After analyzing Binance vs Coinbase, we conclude that both of them provide a vast palette of products and services for beginners and more experienced traders.

While the exchanges cater to the needs of these groups, Binance might have a more explicit platform, with clearer detailing of its products. Its SAFU fund also makes it safer for users in case of disaster, and the exchange also provides lower overall fees compared to Coinbase.

FAQ

Binance vs Coinbase – Which Crypto Exchange is Better for Me in 2025?

Choosing the best exchange depends on your needs as a trader. If you’re interested in more complex features, you might want to go with Binance, and if you’re only curious to debut your trading journey as a novice, Coinbase is also a good start. Both platforms provide products for beginners and professional users, and developers as well.

Which Crypto Exchange Has Lower Fees – Coinbase or Binance?

Based on our Binance vs Coinbase review, Binance has lower overall fees for spot/futures trading and fiat withdrawal.

Are Both Coinbase and Binance Available in the US?

Coinbase and Binance are both available in the US.

Do Both Coinbase and Binance Offer Futures Trading?

Both crypto exchanges provide futures trading, but Binance also offers Inverse Perpetuals.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10